Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

650 |

| MoneyManMatt |

490 |

| Jon Bon |

408 |

| Still Looking |

399 |

| samcruz |

399 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| Starscream66 |

286 |

| nicemusic |

285 |

| You&Me |

281 |

| George Spelvin |

278 |

| sharkman29 |

258 |

|

Top Posters

Top Posters |

| DallasRain | 70994 | | biomed1 | 64748 | | Yssup Rider | 61777 | | gman44 | 53756 | | LexusLover | 51038 | | offshoredrilling | 49095 | | WTF | 48267 | | pyramider | 46388 | | bambino | 43244 | | The_Waco_Kid | 38039 | | CryptKicker | 37310 | | Mokoa | 36497 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

01-10-2025, 10:34 PM

01-10-2025, 10:34 PM

|

#1

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,042

|

Why Americans perceived Bidenflation to be higher than CPI inflation

Why Americans perceived Bidenflation to be higher than CPI inflation

An NBER paper earlier this year written by economists at the IMF and Harvard, including Democrat Larry Summers, goes a long way towards explaining why Americans thought inflation was worse than the headline number. You can download the paper here.

https://www.nber.org/papers/w32163

Or read a summary here.

https://www.forbes.com/sites/theapot...vious-formula/

If you look at the official numbers, the median American wage earner saw prices increase about 1/2 of 1% more than wages during the Biden administration. Compare to the Trump administration, when wages rose by almost 7% more than prices. Those are wages before tax. After income tax, median real wages were up more than 7%, because of the Trump/Ryan/McConnell tax cuts for the middle class.

But the official numbers don't take into account the increase in interest payments borne by Americans, manifested in higher house, car and credit card payments and the like. The consumer price index, the way it was calculated prior to 1983, did take that into account. What Summers and the rest did in the NBER study was go back and calculate CPI using the pre-1983 method. And then they compared it to consumer sentiment.

Using the old methodology, which includes interest expense borne by consumers, inflation peaked at 18% in November, 2022! And if you look at consumer sentiment, it tracks the Summers et al CPI a lot better than the current CPI.

In other words, the workingman was way behind the eight ball. When you include higher interest costs he had to bear, he lost purchasing power. And that's a good part of the reason Biden got poor numbers for economic policy in surveys.

|

|

Quote

| 1 user liked this post |

01-11-2025, 12:09 AM

01-11-2025, 12:09 AM

|

#2

|

|

Lifetime Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 19,156

|

Thanks, tiny.

Hard to believe that under the old CPI, Biden's inflation would have been TWICE as high, peaking in 2022 at 18% rather than 9%. Wtf - that's even higher than Jimmy Carter's peak of 14-15% back in 1980, when we were still calculating inflation using the old methodology.

I think another reason it took so long for Biden's inflation shock to dissipate is because of the lag for wages to catch up. Workers lost a lot of purchasing power in Biden's first 2 years, and have been clawing it back very slowly since then.

|

|

Quote

| 1 user liked this post |

01-11-2025, 01:49 PM

01-11-2025, 01:49 PM

|

#3

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,042

|

Quote:

Originally Posted by lustylad

Thanks, tiny.

Hard to believe that under the old CPI, Biden's inflation would have been TWICE as high, peaking in 2022 at 18% rather than 9%. Wtf - that's even higher than Jimmy Carter's peak of 14-15% back in 1980, when we were still calculating inflation using the old methodology.

I think another reason it took so long for Biden's inflation shock to dissipate is because of the lag for wages to catch up. Workers lost a lot of purchasing power in Biden's first 2 years, and have been clawing it back very slowly since then.

|

That makes a lot of sense LustyLad, the bold text. In the shorter term, the Fed kept interest rates too low for too long. Like Biden, they should have paid attention to Larry Summers back in 2021.

|

|

Quote

| 1 user liked this post |

01-11-2025, 07:56 PM

01-11-2025, 07:56 PM

|

#4

|

|

Valued Poster

Join Date: Apr 22, 2011

Location: Omaha, NE nearby

Posts: 3,343

|

Quote:

Originally Posted by lustylad

Thanks, tiny.

Hard to believe that under the old CPI, Biden's inflation would have been TWICE as high, peaking in 2022 at 18% rather than 9%. Wtf - that's even higher than Jimmy Carter's peak of 14-15% back in 1980, when we were still calculating inflation using the old methodology.

I think another reason it took so long for Biden's inflation shock to dissipate is because of the lag for wages to catch up. Workers lost a lot of purchasing power in Biden's first 2 years, and have been clawing it back very slowly since then.

|

It ain't hard to believe, as anyone that paid bills and compared it to last year has seen it.

My House and car insurance costs have almost doubled in the last 2 years because of inflation.

|

|

Quote

| 1 user liked this post |

01-11-2025, 09:06 PM

01-11-2025, 09:06 PM

|

#5

|

|

BANNED

Join Date: Feb 17, 2018

Location: Ok

Posts: 4,436

|

CPI lies.

|

|

Quote

| 1 user liked this post |

01-16-2025, 02:24 PM

01-16-2025, 02:24 PM

|

#6

|

|

Lifetime Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 19,156

|

Tiny - Here's a WSJ column mentioning the problem.

The headline CPI understates what most American consumers are experiencing, based on their own personal "basket of goods and services".

Biden’s Fitting Goodbye

The unpopular president tells his favorite falsehoods one last time.

By James Freeman

Jan. 15, 2025 4:22 pm ET

President Joe Biden is leaving office the way he arrived —telling the same economic fairy tale that justified a historic increase in federal spending and destroyed his presidency. Today the White House released a “Letter from President Biden.” Here’s how it begins:

"Four years ago, we stood in a winter of peril and a winter of possibilities. We were in the grip of the worst pandemic in a century, the worst economic crisis since the Great Depression, and the worst attack on our democracy since the Civil War. But we came together as Americans, and we braved through it. We emerged stronger, more prosperous, and more secure."

In truth, America had largely reopened the previous summer after the spring Covid panic of 2020. The economy had roared back to life. GDP growth rates were high and inflation rates were low. By the time Mr. Biden took office, the United States was enjoying its third straight quarter of robust economic growth—the opposite of a crisis, and in no way comparable to the Great Depression. The tragedy is that if Mr. Biden had simply done nothing, there’s every reason to believe that prosperity would have continued. That first year of the Biden presidency, 2021, would turn out to be by far the best in terms of economic expansion.

But Mr. Biden—or whoever makes decisions in the Biden White House—insisted on a surge in government spending to address the make-believe crisis, ignoring warnings even from prominent Democratic economists. The results included inflation at a 40-year-high, ravaged consumers, and angry voters. Washington’s total public debt has increased by more than $8 trillion during his presidency.

Don’t expect a mea culpa from Mr. Biden. “Inflation continues to come down,” says the president’s letter today, striking a triumphal note about a rate that is still double what it was when he took office.

For people of modest means, the 2.9% annual rise in the Consumer Price Index reported by the Labor Department today may be even worse than it appears. Jason Trennert at Strategas has been calculating the year-over-year rise in a particularly important basket of goods and services. Today he writes:

Strategas’ Common Man CPI rose 3.3% y/y in December. The measure is comprised of items Americans must buy – Food, Energy, Shelter, Clothing, Utilities, and Insurance and has exceeded the headline CPI in 42 of the last 47 months (89% of the time). In the last four years, prices have increased by 20.8% while wages have increased only 16.1%. This is a new all-time high for the index. The items we deem to be discretionary are seeing deflation while those we deem as essential – Common Man CPI – continue to see inflation.

Consumers only wish they could celebrate today’s prices the way that Mr. Biden does.

https://www.wsj.com/opinion/bidens-f...odbye-520b07d3

|

|

Quote

| 2 users liked this post |

01-16-2025, 03:32 PM

01-16-2025, 03:32 PM

|

#7

|

|

Valued Poster

Join Date: Sep 2, 2024

Location: Houston texas

Posts: 335

|

With all respect to all of the hard data and analysis, what it came down to is the average working American at the grocery store, or paying their light bill, or trying to get a mortgage, or filling their car up, or a multitude of other things that have at times doubled in price.

It’s that simple.

|

|

Quote

| 1 user liked this post |

01-16-2025, 03:52 PM

01-16-2025, 03:52 PM

|

#8

|

|

Valued Poster

Join Date: Sep 26, 2021

Location: down under Pittsburgh

Posts: 10,800

|

....  ... "Let's Go Brandon!" ...

#### Salty

|

|

Quote

| 1 user liked this post |

01-16-2025, 04:05 PM

01-16-2025, 04:05 PM

|

#9

|

|

Lifetime Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 19,156

|

Quote:

Originally Posted by Jacky S

With all respect to all of the hard data and analysis, what it came down to is the average working American at the grocery store, or paying their light bill, or trying to get a mortgage, or filling their car up.

It’s that simple.

|

I agree, Jacky. But you can't fault economists for seeking to quantify and measure these things. Otherwise how would we substantiate the fact that inflation soared to a 40-year high under Biden?

Thank God for the folks who track all this stuff down at the BLS.

Plus the GDP data is what allows people like James Freeman (the columnist above) to call out Biden's lie that we were in the "worst economic crisis since the Great Depression" when he took office.

|

|

Quote

| 3 users liked this post |

01-16-2025, 09:31 PM

01-16-2025, 09:31 PM

|

#10

|

|

Lifetime Premium Access

Join Date: Nov 16, 2013

Location: Baton Rouge

Posts: 6,177

|

The answer to your original question Tiny is that Fox told people it was bad every day. Right wing folks said every day no one could afford eggs and gas. It was repeated daily as a mantra.

Now oddly, every day Fox has stop complaining that people can’t afford anything as has right wing folks.

|

|

Quote

| 1 user liked this post |

01-17-2025, 04:07 AM

01-17-2025, 04:07 AM

|

#11

|

|

Valued Poster

Join Date: Apr 22, 2011

Location: Omaha, NE nearby

Posts: 3,343

|

Quote:

Originally Posted by 1blackman1

The answer to your original question Tiny is that Fox told people it was bad every day. Right wing folks said every day no one could afford eggs and gas. It was repeated daily as a mantra.

Now oddly, every day Fox has stop complaining that people can’t afford anything as has right wing folks.

|

WRONG, some people actually pay attention to dollars going out of their checkbook.

I pay car insurance in 6 month increments and House Insurance annually. Housing insurance almost doubled the last two years. Doesn't matter what news I listen too.

|

|

Quote

| 1 user liked this post |

01-17-2025, 10:56 AM

01-17-2025, 10:56 AM

|

#12

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,042

|

Quote:

Originally Posted by 1blackman1

The answer to your original question Tiny is that Fox told people it was bad every day. Right wing folks said every day no one could afford eggs and gas. It was repeated daily as a mantra.

Now oddly, every day Fox has stop complaining that people can’t afford anything as has right wing folks.

|

That actually was a statement, not a question Blackman. Yes, people on Fox may have complained. But they were outweighed by the Pollyanna's on MSNBC, CNN, and to a lesser extent CBS, ABC and NBC, who were so confused why Americans were unhappy with the economy.

Well, Larry Summers, who was Secretary of the Treasury under Clinton and director of the National Economic Council under Obama, and his co-authors have a good explanation as to part of it -- see the OP. Too bad Joe Biden was listening to his progressive handlers, instead of people like Larry Summers and Jason Furman. The academic background of the Chairman of his Council of Economic Advisors was in social work, for goodness sake.

The end result was not as pretty as MSNBC would have you believe:

Quote:

Originally Posted by lustylad

But Mr. Biden—or whoever makes decisions in the Biden White House—insisted on a surge in government spending to address the make-believe crisis, ignoring warnings even from prominent Democratic economists. (Tiny's note: those economists included Larry Summers.) The results included inflation at a 40-year-high, ravaged consumers, and angry voters. Washington’s total public debt has increased by more than $8 trillion during his presidency.

|

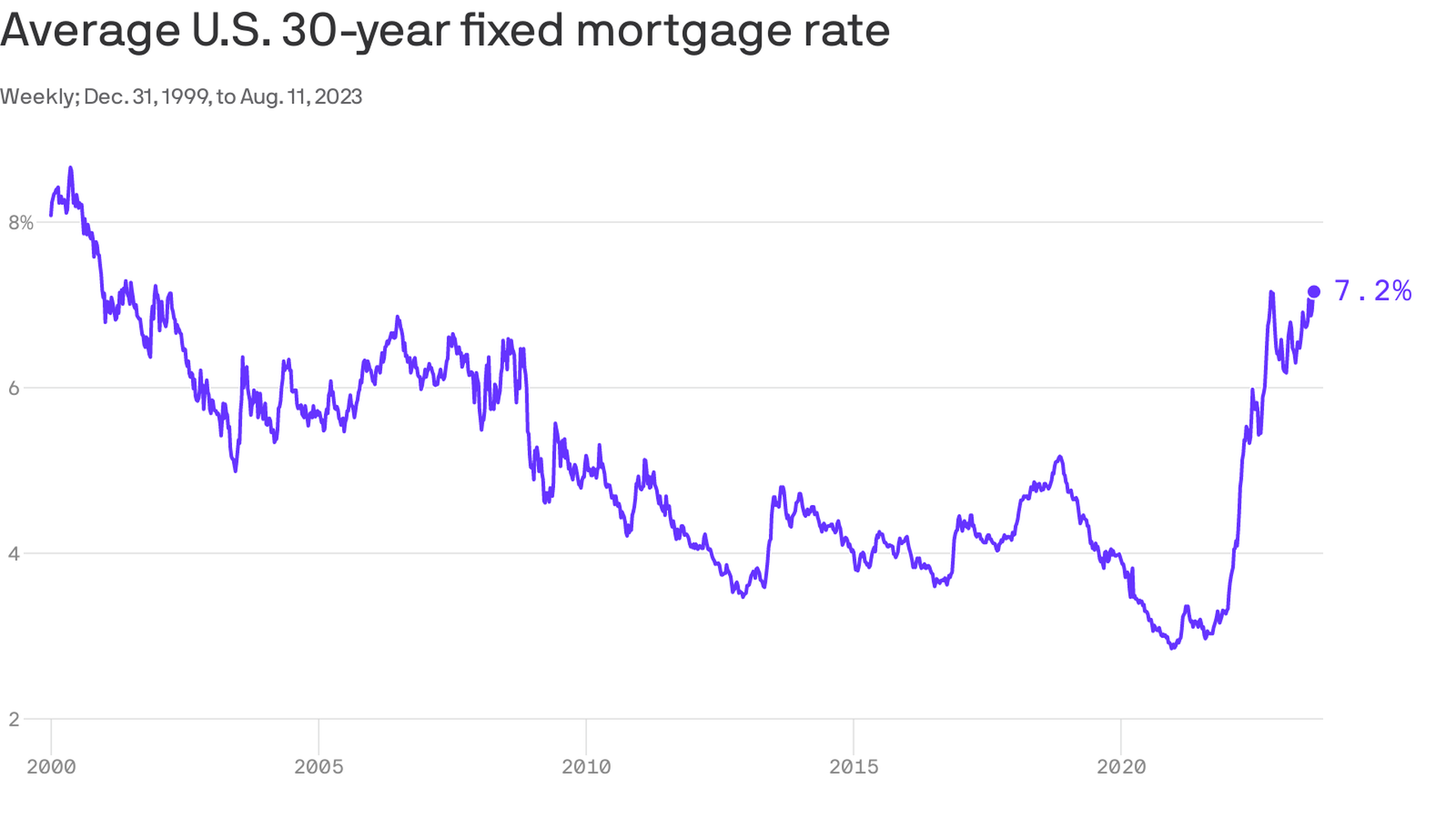

FYI, when the 30 year mortgage rate goes from 3% to 7%, the mortgage payment on a $450,000 house goes from $1900 to $2900. That hurts if you're buying a home. Same with cars and credit card debt.

|

|

Quote

| 1 user liked this post |

01-21-2025, 02:49 PM

01-21-2025, 02:49 PM

|

#13

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,343

|

If anyone wants to find reasons that so many Americans might "feel worse" about the recent years' inflation narratives than might seem warranted by the actual CPI data, this might be another good place to look.

The bulk of shelter inflation is calculated not from simply surveying apartment rents, etc., but by attempting to determine changes in what is called "owners' equivalent rent" (referred to as OER).

This methodology has been used for about 40 years now, and depends on surveys of what owners would pay in rent for their homes if they leased or rented them instead of owning them outright. Although the whole idea may seem ridiculous, the rationale is that over a long period of time it might serve to "smooth out" sharp ups and downs in mortgage interest rates.

The problem is that when mortgage rates rise sharply from very low levels, as was the case over the last three years, home affordability indexes crater much more quickly than most people's comfort level with the price of food, gasoline, etc.

Compounding the discontent is the fact that the supply of resale homes has been tightened by the simple fact that most people with a very low (2.75-4.0%) fixed-rate mortgage aren't likely to sell unless virtually forced, keeping prices significantly higher than they would normally be in a rising mortgage interest rate market.

Given all this, it's easy to see why millions of millennial and Gen Z Americans who dream of purchasing their first home are not happy campers.

|

|

Quote

| 2 users liked this post |

01-21-2025, 04:34 PM

01-21-2025, 04:34 PM

|

#14

|

|

Lifetime Premium Access

Join Date: Nov 16, 2013

Location: Baton Rouge

Posts: 6,177

|

How long were mortgage rates 3%? Surely it must have been at least a couple decades and was accepted as the norm for mortgage interest rates. That surely explains why millennials and GenZs were expecting to purchase homes at that rate.

|

|

Quote

| 1 user liked this post |

01-21-2025, 05:18 PM

01-21-2025, 05:18 PM

|

#15

|

|

Lifetime Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 19,156

|

Quote:

Originally Posted by 1blackman1

How long were mortgage rates 3%? Surely it must have been at least a couple decades and was accepted as the norm for mortgage interest rates. That surely explains why millennials and GenZs were expecting to purchase homes at that rate.

|

Why don't you look this stuff up instead of asking? Here's a chart showing average 30-year fixed mortgage rates by year. The average rate dropped to 3% during the 2020-21 pandemic, but that was never the "norm". In the decade prior, it mostly ranged around 4-5%. Going from 3% to 5% or higher results in a huge spike in the monthly mortgage payment.

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|