speaking of Trump's taxes and what they "show" ...

After Democrats release Trump’s tax returns, CPAs have questions: ‘In order to generate these kinds of losses, you need to be super rich. It’s not a poor man’s game.’

https://finance.yahoo.com/m/50320a0d...s-release.html

By

Quentin Fottrell

comments

‘The personal tax return is just the tip of the iceberg’

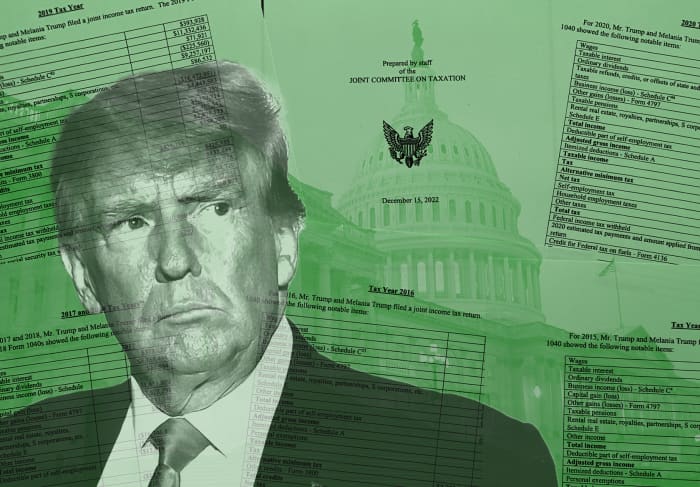

The Democrat-led House Ways and Means Committee released six years of Donald Trump’s income-tax returns on Friday.

The Democrat-led House Ways and Means Committee released six years of Donald Trump’s income-tax returns on Friday.

MarketWatch photo illustration/Getty Images, AP

Democrats released six years of Donald Trump’s income-tax returns on Friday, providing further

insight into the former president’s tax situation. Trump and his wife, Melania, paid $0 in income taxes for 2020, according to a report released late Tuesday by the congressional Joint Committee on Taxation.

The nonpartisan committee’s findings also

raised several red flags related to the filings, namely Trump’s carryover losses, loans to his children that may or may not also be considered taxable gifts, and deduction-related tax write-offs.

In 2020, as the COVID pandemic hit,

the Trumps reported a loss of $4.8 million. For 2018 and 2019, the then-president’s reported income increased and they paid approximately $1.1 million in federal taxes each year.

The Internal Revenue Service only started to audit Trump’s 2015 tax filings on April 3, 2019, more than two years into his presidency, which some commentators say is a sign of the strained resources at the IRS.

“Just like every other American, the President of the United States is obligated to pay taxes owed,” reads an internal IRS memo from earlier this month. “This is a core responsibility of our common citizenship: without tax revenue, our government would cease to exist.”

In a statement released Friday by the Trump campaign, the former president said his returns show “how proudly successful I have been.”

The U.S. tax code, experts say, cuts both ways. “The government intentionally makes laws that have two objectives,” said Charles Renwick, a CPA and author of the forthcoming book “

All the Presidents’ Taxes.” “One is to raise money and the other objective is to incentivize behavior. Real-estate investing is clearly incentivized by the tax code.”

People who lose money and therefore have no income pay no taxes, Renwick noted. “There is another scenario where [Trump] lost money on paper but made money on the underlying economics. If that’s the case, then it’s the result of the incentives in the tax code and not necessarily a result of any impropriety. The chances are that he did it right,” he said.

“Trump is engaging in an activity that is very, very incentivized by our current tax code,” he said.

One disclosure includes Trump’s foreign bank accounts in Ireland, the U.K., China, and Saint Martin. “We already knew he owned large buildings with Chinese partners (555 California Street in San Francisco),” Renwick told MarketWatch.

“Disclosures like these are black and white,” he said. “Remember, his former campaign Chairman,

Paul Manafort, was convicted of tax fraud for not disclosing foreign bank accounts. This is clearly an important disclosure from the standpoint of providing transparency.”

Jonathan Medows, managing member of Medows CPA PLLC, based in New York, agrees that — based on what has been revealed about Trump’s 2020 income taxes — the former president’s tax returns highlight ways Americans can use the tax code to minimize their tax burden.

Business owners and investors can accelerate certain deductions, he said. “Usually, that’s in real estate, by the way,” he said. “You can lose a lot of money on paper and return capital to investors but still have cash flow. Bottom line: In order to generate these kinds of losses, you need to be super rich. It’s not a poor man’s game.”

Karla Dennis, founder of Karla Dennis and Associates, Inc. in La Palma, Calif., an enrolled tax agent and business consultant, said there is a broader takeaway for Americans: “Affluent people are more aware of the options open to them.”

“Most tax players are focused on tax compliance, and fewer taxpayers are looking at what year-long tax strategy can be employed to reduce their tax bill,” she added. “If you study for a test, you get an A+.”

Inequities in the U.S. tax system

How progressive is the progressive tax system? Medows said the U.S. middle class ends up bearing the brunt of the tax burden, while wealthy people have more avenues to minimize what they owe the IRS.

He cites the 6.2% Social Security tax as an example. The maximum amount of earnings subject to the Social Security tax (the taxable maximum) will

increase to $160,200 from $147,000 in January. People who earn more than that maximum will pay the same as someone making $160,200.

“If you’re self-employed, if you’re a middle-class person, you’re paying this tax [on all your earnings], but if you’re super rich and earn $3 million, you’re only paying it on the first $160,200 of your earnings,” Medows told MarketWatch. “You have your biggest earners not paying it. You have middle-class people paying it. That’s a hidden tax,” he said.

“I don’t know how progressive the U.S. tax system is,” he concluded.

And Donald Trump? “For all I know, he may simply have been a very unsuccessful businessman whose genuine losses reduced his net worth over the past couple of decades,” Gary Burtless, a senior fellow at the the centrist Brookings Institution, told MarketWatch.

Burtless, who does not profess to be an expert on Trump’s taxes, does see inequities in the U.S. tax system, however. “If we define the ‘very rich’ as Americans with extremely high pretax incomes in the current tax year, I agree with most of my fellow citizens in thinking it disgraceful when ‘very rich’ people pay zero dollars in current income taxes. The theory of our progressive income tax system is that each U.S. resident’s tax liability should represent a rising share of their pretax income as their pretax income increases,” he said.

“On the other hand,” he continued, “if we define the ‘very rich’ as Americans with extremely high net worth, then it is easy for me to imagine that some of these ‘very rich’ will quite properly owe no income taxes in a given year — for example, in a year when their pretax income in the current tax year is very low or negative.”

Wealth tax vs. income tax

Consider, Burtless said, farmers who own farms worth $2 million or more. “If they reap a terrible harvest, their gross incomes might be very low or even negative, despite the fact that they remain very wealthy under the ‘net worth’ definition. Our progressive income tax is not a wealth tax; it is an income tax.”

Keep in mind, he added, that some states and many localities impose property taxes on land, property improvements and certain categories of real property. In that case, wealthy farmers may still be liable for sizable property taxes, even in years when their federal income-tax liability is very low or zero.

“In my view, if voters want to impose taxes on everyone with high net worth, they should consider establishing a comprehensive wealth tax,” Burtless added. “A progressive income tax is not the most sensible way to achieve that goal.”

This year, some

72.5 million U.S. households, or 40%, will pay no federal income tax, down from the pandemic high of 100 million households, or 60%, two years ago, according to estimates from the Tax Policy Center. In 2021, nearly 56% of households, or 99 million, paid no federal income tax, the nonpartisan think tank said in a report released earlier this year.

“I don’t wish being poor on anyone,” Medows said. “I’d rather pay my taxes. My wife works in a public hospital. My father, bless his memory, was a public defender. He got health insurance. Unless you work for a big company, many middle-class people can’t afford medical insurance. The system is rigged against the middle class.”

As for presidential tax returns, Renwick said full transparency should also require former presidents to release their tax returns after they leave office to show what, if any, foreign business deals they make that could have been influenced by their policies and other dealings while in power.

“Do we get to see all his informational returns, like his partnership and trust returns?” Renwick added. “All of these things are sources of value that create potential conflicts of interest. If the goal is increased transparency, if the goal is to identify conflicts of interest, if the goal is to see they are paying their fair share, if the goal is to see if they have foreign business dealers — there is more information that should be released.”

“The personal tax return is just the tip of the iceberg,” he said.