Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

646 |

| MoneyManMatt |

490 |

| Still Looking |

399 |

| samcruz |

399 |

| Jon Bon |

396 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| Starscream66 |

280 |

| George Spelvin |

265 |

| sharkman29 |

255 |

|

Top Posters

Top Posters |

| DallasRain | 70796 | | biomed1 | 63334 | | Yssup Rider | 61040 | | gman44 | 53297 | | LexusLover | 51038 | | offshoredrilling | 48679 | | WTF | 48267 | | pyramider | 46370 | | bambino | 42779 | | CryptKicker | 37222 | | The_Waco_Kid | 37138 | | Mokoa | 36496 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

03-26-2010, 06:13 AM

03-26-2010, 06:13 AM

|

#1

|

|

Ambassador

Join Date: Dec 25, 2009

Location: The Interhemispheric Fissure

Posts: 6,565

My ECCIE Reviews

|

Another help for those mortgages underwater.

Another help for those mortgages underwater.

I've looked at homes for sale in this part of my state to see where the prices are at. To my surprise there are no deals or bargains to be had. I say this because my state is one of the hardest hit in the economy. Even through the past decade when the country was doing well we continued to suffer here.

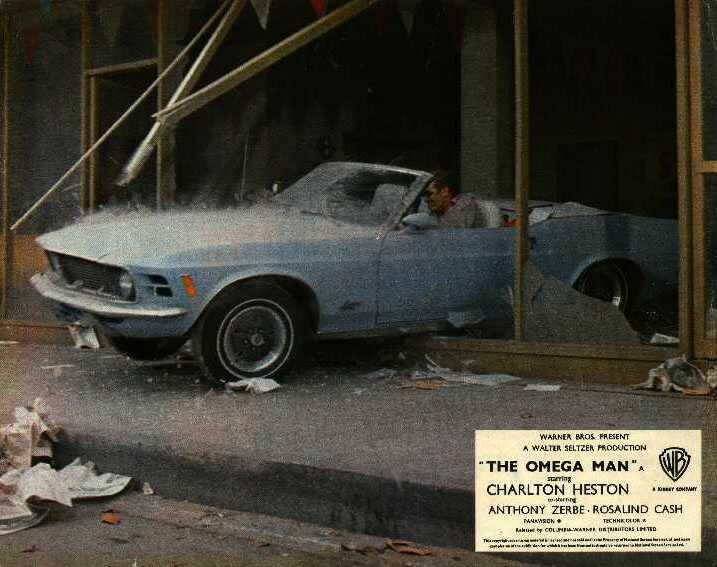

Any bargains to be had here are all in the cities. However no one wants to live like the Omega Man.

Well our nanny government has just announced that they have another "help" for those with mortgages underwater.

If you can prove hardship, you can have your rate reduced (up to) 2% for 4 years AND your loan can be stretched to 40 years. YAY!

|

|

Quote

| 1 user liked this post |

03-26-2010, 09:21 AM

03-26-2010, 09:21 AM

|

#2

|

|

Valued Poster

Join Date: Apr 5, 2009

Location: Eatin' Peaches

Posts: 2,645

|

Real life implications of the housing market on jobs

Real life implications of the housing market on jobs

Take this with a grain of salt* as I'm just relaying this story as it was relayed to me.

A drinking buddy friend of mine is a product manager for a large company here in ATL. He was approached by a headhunter about a job with a rival that would require a move to the Midwest. It would have been in effect a "promotion" for him. He went down the typical interviewing path including 2 visits out to their offices. He had a verbal offer subject to certain terms being ironed out.

One of those terms was a relocation package. The problem is (call him) "Joe" bought his "dream condo" at the market's peak in 2006 or 07. Since Joe hadn't been looking to sell, he hadn't fully appreciated what had happened to local home values. He was at least $100K underwater, maybe more depending on how quickly he needed sell, on his mortgage plus would lose whatever little equity he'd put into the place.

Not that it would help Joe if he needed to sell quickly, but of course he wouldn't be eligible for any of these bailout plans/programs. He got a favorable interest rate and makes good money so he is able to comfortably make his payments.

Now as much as this company liked Joe, they couldn't justify "bailing out" Joe. Joe wouldn't/couldn't afford to take the hit. Bottom line: Joe has come to the realization that he's "stuck" in ATL for the foreseeable future.

*I say grain of salt because I'm surprised the headhunter let this go as far as it did without identifying this issue earlier. Poor work on his/her part but it doesn't change the fact that there are thousands of "Joes" out there that can't move because they are so underwater on their homes.

|

|

Quote

| 1 user liked this post |

03-26-2010, 10:55 AM

03-26-2010, 10:55 AM

|

#3

|

|

Valued Poster

Join Date: Dec 31, 2009

Location: Even with a gorgeous avatar: Happiness is ephemeral

Posts: 2,003

|

MA, I would guess you live in a state where there was not much of a run up in prices.

|

|

Quote

| 1 user liked this post |

03-26-2010, 12:40 PM

03-26-2010, 12:40 PM

|

#4

|

|

Ambassador

Join Date: Dec 25, 2009

Location: The Interhemispheric Fissure

Posts: 6,565

My ECCIE Reviews

|

Quote:

Originally Posted by discreetgent

MA, I would guess you live in a state where there was not much of a run up in prices.

|

15% max

|

|

Quote

| 1 user liked this post |

03-26-2010, 08:25 PM

03-26-2010, 08:25 PM

|

#5

|

|

Your favorite secret

User ID: 5481

Join Date: Jan 4, 2010

Location: Houston

Posts: 194

My ECCIE Reviews

|

what constitutes "underwater"?

what constitutes "underwater"?

I had this discussion today - an old friend insists she isn't underwater. That since the apraisal district says her house is worth xxx, she thinks it is worth xxxx. However, she can't SELL it for xxx and given the number given by real estate professionals, she would be considered underwater.

I tried to explain its the same as my crappy diamond I bought at auction in November: its a $23,000 diamond, per the paperwork. I got it for $8,000. Can't sell it for a dime over $12,000. I'm taking it, but still - its no longer a $23,000 diamond - its now a 12 thousand dollar diamond.

Does the same hold for homes? How is the underwater name established?

ps - my understanding is that being underwater is not a requirement to the new program, but one of many independent of the others; yes?

|

|

Quote

| 1 user liked this post |

03-26-2010, 08:45 PM

03-26-2010, 08:45 PM

|

#6

|

|

Valued Poster

Join Date: Dec 23, 2009

Location: gone

Posts: 3,401

|

Conceptually, how do we justify helping homeowners who "lost money" by over leveraging their property. Consider two people, with the same incomes, that bought a house for $400K. A put 40% down and has a mortgage of 240K. B took a 95% loan and has a mortgage of $380K. lets assume that the market value of both homes are now $300K.

Both homeowners have suffered a 100K hit to their net worth. One lost 100K of equity, the other lost 20K of equity and has 80K of mortgage in excess of their value. Same $100K hit. How is it fair to help B and not A? Suppose further that A&B each had $160 to put down, but while A but it all in his home, B left $140 in a money market account. What now?

When you start down this slippery slope, where do you stop? I'm dying to hear TTH's take on this question.

|

|

Quote

| 1 user liked this post |

03-26-2010, 09:01 PM

03-26-2010, 09:01 PM

|

#7

|

|

Valued Poster

Join Date: Apr 5, 2009

Location: Eatin' Peaches

Posts: 2,645

|

Quote:

Originally Posted by pjorourke

Conceptually, how do we justify helping homeowners who "lost money" by over leveraging their property. Consider two people, with the same incomes, that bought a house for $400K. A put 40% down and has a mortgage of 240K. B took a 95% loan and has a mortgage of $380K. lets assume that the market value of both homes are now $300K.

Both homeowners have suffered a 100K hit to their net worth. One lost 100K of equity, the other lost 20K of equity and has 80K of mortgage in excess of their value. Same $100K hit. How is it fair to help B and not A? Suppose further that A&B each had $160 to put down, but while A but it all in his home, B left $140 in a money market account. What now?

When you start down this slippery slope, where do you stop? I'm dying to hear TTH's take on this question.

|

I'm still waiting for Obama to make me whole on my ill-advised purchase of Webvan stock back in the late 90's

|

|

Quote

| 1 user liked this post |

03-26-2010, 09:04 PM

03-26-2010, 09:04 PM

|

#8

|

|

Miss America

User ID: 3339

Join Date: Dec 30, 2009

Posts: 461

|

Quote:

Originally Posted by pjorourke

Conceptually, how do we justify helping homeowners who "lost money" by over leveraging their property. Consider two people, with the same incomes, that bought a house for $400K. A put 40% down and has a mortgage of 240K. B took a 95% loan and has a mortgage of $380K. lets assume that the market value of both homes are now $300K.

Both homeowners have suffered a 100K hit to their net worth. One lost 100K of equity, the other lost 20K of equity and has 80K of mortgage in excess of their value. Same $100K hit. How is it fair to help B and not A? Suppose further that A&B each had $160 to put down, but while A but it all in his home, B left $140 in a money market account. What now?

When you start down this slippery slope, where do you stop? I'm dying to hear TTH's take on this question.

|

Well PJ, I'm heading to Washington DC tomorrow thur Wed. (Ms. Bordeauxva goes to Washington - sorry Mr. Smith) While I'm there, I'll be sure to stop by the White House and find out what Obama thinks of this scenario.

|

|

Quote

| 1 user liked this post |

03-26-2010, 09:05 PM

03-26-2010, 09:05 PM

|

#9

|

|

Valued Poster

Join Date: Dec 31, 2009

Location: In hopes of having a good time

Posts: 6,942

|

Quote:

Originally Posted by atlcomedy

I'm still waiting for Obama to make me whole on my ill-advised purchase of Webvan stock back in the late 90's  |

I'm still waiting for my worthless GM stock to recover.

|

|

Quote

| 1 user liked this post |

03-26-2010, 09:15 PM

03-26-2010, 09:15 PM

|

#10

|

|

Valued Poster

Join Date: Apr 5, 2009

Location: Eatin' Peaches

Posts: 2,645

|

Quote:

Originally Posted by Sydneyb

I had this discussion today - an old friend insists she isn't underwater. That since the apraisal district says her house is worth xxx, she thinks it is worth xxxx. However, she can't SELL it for xxx and given the number given by real estate professionals, she would be considered underwater.

I tried to explain its the same as my crappy diamond I bought at auction in November: its a $23,000 diamond, per the paperwork. I got it for $8,000. Can't sell it for a dime over $12,000. I'm taking it, but still - its no longer a $23,000 diamond - its now a 12 thousand dollar diamond.

Does the same hold for homes? How is the underwater name established?

ps - my understanding is that being underwater is not a requirement to the new program, but one of many independent of the others; yes?

|

Yeah, you are right relative to your friend. It is about fair market value or what you could actually sell for.

But when you see in the news the term "underwater" they are referring to mortgages not just being underwater on an asset.

That is, if you put down a substantial down payment or have lived in your home for awhile (assuming you didn't take out a 2nd/3rd mortgage) and benefited from some appreciation you likely aren't underwater on your mortgage, even if your home value has taken a recent hit.

The cleanest definition of an underwater mortgage is if you sold your house...had your HUD settlement statement that summarized who owed who what...and all costs in (including realtor commission), and at closing you have to write a check instead of getting a check, you are underwater.

The origin of the term comes from the notion of "drowning" or "in danger of drowning"

|

|

Quote

| 1 user liked this post |

03-26-2010, 09:48 PM

03-26-2010, 09:48 PM

|

#11

|

|

Ambassador

Join Date: Dec 25, 2009

Location: The Interhemispheric Fissure

Posts: 6,565

My ECCIE Reviews

|

The only thing Washington cares about is the number of foreclosures.

More foreclosures = housing values continue to decline = rescession continues to spiral. Even if people can afford their mortgage they are more likely to send the keys back if they have to wait 10 + years to recoup the loss.

|

|

Quote

| 1 user liked this post |

03-26-2010, 09:59 PM

03-26-2010, 09:59 PM

|

#12

|

|

El Hombre de la Mancha

Join Date: Dec 30, 2009

Location: State of Confusion

Posts: 46,370

|

Quote:

Originally Posted by charlestudor2005

I'm still waiting for my worthless GM stock to recover.  |

I will never buy another GM product. They just keep pissing me off.

|

|

Quote

| 1 user liked this post |

03-26-2010, 11:12 PM

03-26-2010, 11:12 PM

|

#13

|

|

Your favorite secret

User ID: 5481

Join Date: Jan 4, 2010

Location: Houston

Posts: 194

My ECCIE Reviews

|

Quote:

Originally Posted by atlcomedy

Yeah, you are right relative to your friend. It is about fair market value or what you could actually sell for.

......That is, if you put down a substantial down payment or have lived in your home for awhile (assuming you didn't take out a 2nd/3rd mortgage) and benefited from some appreciation you likely aren't underwater on your mortgage, even if your home value has taken a recent hit.

The cleanest definition of an underwater mortgage is if you sold your house...had your HUD settlement statement that summarized who owed who what...and all costs in (including realtor commission), and at closing you have to write a check instead of getting a check, you are underwater.

|

Got it. Thanks for the answer

|

|

Quote

| 1 user liked this post |

03-26-2010, 11:18 PM

03-26-2010, 11:18 PM

|

#14

|

|

Valued Poster

Join Date: Dec 31, 2009

Location: Even with a gorgeous avatar: Happiness is ephemeral

Posts: 2,003

|

Quote:

Originally Posted by pjorourke

Conceptually, how do we justify helping homeowners who "lost money" by over leveraging their property. Consider two people, with the same incomes, that bought a house for $400K. A put 40% down and has a mortgage of 240K. B took a 95% loan and has a mortgage of $380K. lets assume that the market value of both homes are now $300K.

Both homeowners have suffered a 100K hit to their net worth. One lost 100K of equity, the other lost 20K of equity and has 80K of mortgage in excess of their value. Same $100K hit. How is it fair to help B and not A? Suppose further that A&B each had $160 to put down, but while A but it all in his home, B left $140 in a money market account. What now?

When you start down this slippery slope, where do you stop? I'm dying to hear TTH's take on this question.

|

In theory then B should simply make a business decision and hand in the keys to the mortgage holder. Of course the mortgage holder will scream about the morality of reneging on an obligation but if its all about money then I can't see what they are complaining about. Make sense PJ?

|

|

Quote

| 1 user liked this post |

03-26-2010, 11:19 PM

03-26-2010, 11:19 PM

|

#15

|

|

Your favorite secret

User ID: 5481

Join Date: Jan 4, 2010

Location: Houston

Posts: 194

My ECCIE Reviews

|

Quote:

Originally Posted by pjorourke

Conceptually, how do we justify helping homeowners who "lost money" by over leveraging their property. Consider two people, with the same incomes, that bought a house for $400K. A put 40% down and has a mortgage of 240K. B took a 95% loan and has a mortgage of $380K. lets assume that the market value of both homes are now $300K.

Both homeowners have suffered a 100K hit to their net worth. One lost 100K of equity, the other lost 20K of equity and has 80K of mortgage in excess of their value. Same $100K hit. How is it fair to help B and not A? Suppose further that A&B each had $160 to put down, but while A but it all in his home, B left $140 a money market account. What now?

|

While if I was person A, I agree that would be a tough nut to swallow.

The only way that I see that it can benefit the homeowner who put 40% down is that the homes in his neighborhood aren't in foreclosure thereby increasing the value of his home and neighborhood. My understanding that in Florida and AZ there are neighborhoods that are literally rotting; that can't help the folks that are still there due to their fiscal responsiblity either, can it?

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|