Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

649 |

| MoneyManMatt |

490 |

| Still Looking |

399 |

| samcruz |

399 |

| Jon Bon |

397 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| Starscream66 |

281 |

| You&Me |

281 |

| George Spelvin |

270 |

| sharkman29 |

256 |

|

Top Posters

Top Posters |

| DallasRain | 70812 | | biomed1 | 63462 | | Yssup Rider | 61114 | | gman44 | 53307 | | LexusLover | 51038 | | offshoredrilling | 48750 | | WTF | 48267 | | pyramider | 46370 | | bambino | 42977 | | The_Waco_Kid | 37283 | | CryptKicker | 37225 | | Mokoa | 36497 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

02-14-2020, 02:52 PM

02-14-2020, 02:52 PM

|

#16

|

|

Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 18,702

|

Quote:

Originally Posted by Chung Tran

Obama's economic record was stronger for his first 4 years, than Trump's has been.

|

What the fuck are you even talking about?

Here's the metric wtf claims to care about the most - the budget deficit! Ask him to explain it to you and then compare odumbo's first 4 years to trump.

Quote:

Originally Posted by lustylad

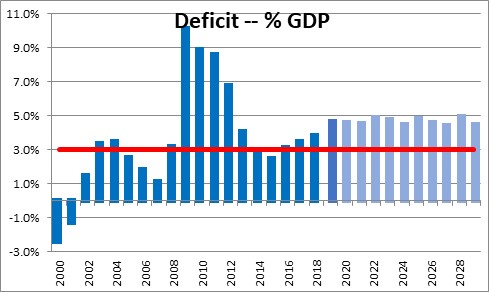

Federal Deficit As % of GDP (Fiscal Years ending 9/30):

Odumbo 1st Term (2009-2012 Avg) - 8.5%

Trump To Date (2017-2019 Avg) - 4.1%

Here's a bar graph showing the results on a year-by-year basis, along with projections going forward:

|

|

|

Quote

| 1 user liked this post |

02-14-2020, 03:33 PM

02-14-2020, 03:33 PM

|

#17

|

|

Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 18,702

|

Quote:

Originally Posted by Chung Tran

...the tax cuts temporarily drove up profits, couple that with absurdly low interest rates, and you'll get a good stock market for a time.. yield chasers. but it has an expiration date looming.

|

Hey chungy, those tax cuts don't expire until 2025. And if that's too "temporary" for you, you can always make 'em permanent!

And don't forget what Lord Keynes said - in the long run we're all dead!

|

|

Quote

| 4 users liked this post |

02-14-2020, 10:44 PM

02-14-2020, 10:44 PM

|

#18

|

|

BANNED

Join Date: May 5, 2013

Location: Phnom Penh, Cambodia

Posts: 36,100

|

Quote:

Originally Posted by lustylad

Looks like you and wtf need to get your stories straight.

He thinks lower rates stimulate a weak economy while you claim they "destroy" it...

Please confer with wtf and make up your fucking minds which argument you want to run with, ok?

|

I speak for myself.. lower rates ARE stimulative, when the economy is in the shitter. Obama, the guy you love to hate, rescued the economy from the Republicans, back in 2008-2009, utilizing low interest rates.

but after an economy has been on solid footing for years (like the US), lowering rates further (i.e., through Fed policy) leads to destruction.. it creates bubbles, we are now in the 3rd bubble since 2000, by any empirical metric. your Boy Trump knows that absurdly low rates are what is fueling the stock market.. NOT economic metrics.

Quote:

Originally Posted by lustylad

What the fuck are you even talking about?

Here's the metric wtf claims to care about the most - the budget deficit! Ask him to explain it to you and then compare odumbo's first 4 years to trump.

|

why do you bring up wtf? what the fuck are YOU talking about?

go back and read.. and remember. I'm the guy who says deficits don't matter.. one other guy on this forum agrees with me on that, a "Republican".. I have explained why many times. Obama's first 4 years were more economically powerful than Trump's.. you'll never admit it, because you hate Obama.

|

|

Quote

| 1 user liked this post |

02-15-2020, 07:14 AM

02-15-2020, 07:14 AM

|

#19

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by lustylad

Wrong again! Higher rates mean fatter net interest margins for banks. Why do you think bank stocks usually outperform other sectors in high-rate environments?

|

Ask the Savings and Loan how great those high intrest were for their bottom line.

|

|

Quote

| 1 user liked this post |

02-15-2020, 07:23 AM

02-15-2020, 07:23 AM

|

#20

|

|

Valued Poster

Join Date: Jan 16, 2010

Location: Texas

Posts: 51,038

|

Quote:

Originally Posted by WTF

Ask the Savings and Loan how great those high intrest were for their bottom line.

|

Were you even born when "savings and loans" were around?

The "savings and loan" debacle didn't have anything to do with "higher interest rates" .... it was primarily due to over-inflated appraisals to justify a 100% loan for the actual sales price so that a borrower was not required to make an initial downpayment because one was "only" making a 60-70% loan on the appraised value. The Feds came in and started "auditing" the S&L portfolios as to "real value" on the collateral ...

and discovered alleged 120-150% loans rather than 60-70% loans. In many instances the Feds saw that properties were "underappraised" so they could require the borrower to refi the note or pay it off .... vs. foreclosure .... which drove the RE market even lower thereby aggravating an already disastrous situation ... those were all government subsidized loans when made!!!!

Most of those loans had fixed rates and were assumable without the necessity of approval by the lender. To "wash" those loans out and have the replaced with "due on" clauses in loans the Feds basically destroyed a lot of people personally and lenders business wise. The bureaucrats didn't care. There was evidence that they and their friends gobbled up some good investment properties in the fire sales that were orchestrated by the government to dump the "other real estate" (ORE) of the books in the liquidation of the S&L assets.

During the Reagan years Congress amended the tax code to do the same thing with multi-family housing.

|

|

Quote

| 1 user liked this post |

02-15-2020, 07:32 AM

02-15-2020, 07:32 AM

|

#21

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by LexusLover

Were you even born when "savings and loans" were around?

The .

|

Were you even born when the Constitution was conceived??? Yet you talk about it numbnuts....Jesus.

You might want to dig a little deeper than wiki to understand the start of the S&L crisis in the 1980s. It started with high rates....

|

|

Quote

| 1 user liked this post |

02-15-2020, 07:35 AM

02-15-2020, 07:35 AM

|

#22

|

|

Valued Poster

Join Date: Jan 16, 2010

Location: Texas

Posts: 51,038

|

Quote:

Originally Posted by WTF

Were you even born when the Constitution was conceived???

|

The Constitution still exists. The S&L's DON'T .... numbnuts!

You keep digging deeper into the cesspool you create for yourself!

Keep reading down at Barnes & Nobles ... you don't impress anyone!

And you don't know what the fuck you're talking about....just regurgitating bullshit.

Tell me how a 5%-10% is "high"?

|

|

Quote

| 1 user liked this post |

02-15-2020, 07:47 AM

02-15-2020, 07:47 AM

|

#23

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by LexusLover

The Constitution still exists. The S&L's DON'T .... numbnuts!

|

So if something no longer exists....you have to have been alive when it existed to discuss it?

Is that your logic Einstein?

How about the dinosaurs or Jesus? Off limits...except for your old ass, well you and Austin Ellen. You two are the only ones qualified to discuss ancient history?

Nope, can't discuss it....weren't around. How about you change your handle to something more appropriate...LexusLyingLoser

Oh and here , this might help you understand exactly how high intrest rates helped kill the S&L industry. What you described were reactions after the high rates.

https://www.econlib.org/library/Enc/...oanCrisis.html

|

|

Quote

| 1 user liked this post |

02-15-2020, 09:06 AM

02-15-2020, 09:06 AM

|

#24

|

|

Valued Poster

Join Date: Jan 16, 2010

Location: Texas

Posts: 51,038

|

Quote:

Originally Posted by WTF

So if something no longer exists....you have to have been alive when it existed to discuss it?

|

No, you just have to know what the fuck you're jabbering about ...

... and you don't with regard to the failed S&Ls ... as well as the Texas state banking system .... Henry B. Gonzalez, who was on the House banking committee oversaw the following investigation of the "Rent a Bank" scandal primarily in South Texas. The entire investigation was published for the public to read. Too bad you elected not to read the FACTS ... SINCE you aren't old enough to have been involved with it on the ground as it was happening.

But that's what you do, along with a bunch of other LOONS on here and in the LameStreamMedia ...

... you catch a quote out of some pundit's bullshit and take a snippit out of it and pretend it's the "gospel" and FACTUALLY ACCURATE even though it's some asshole's opinion.

You've been doing that since you got on Eccie .... that's why you get your ass torn off every time you venture into shit you know nothing about .... like criminal law and criminal trials. You need to pull up a lawn chair with JackOff on the local station driveway and suck beer with him!

You have "good" company though! Just pick one!!!

The HasBeen Predator

The Socialist

The Fake Indian

The BoyScout Mayor

The OldWhiteTrader Billionaire

Or the FatOldHagLoser Predator-Facilitator as a "Compromise"!!!!

AKA The Blue Turds!

|

|

Quote

| 1 user liked this post |

02-15-2020, 10:07 AM

02-15-2020, 10:07 AM

|

#25

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by LexusLover

No, you just have to know what the fuck you're jabbering about ...

... and you don't with regard to the failed S&Ls ... !

|

Quote:

Originally Posted by LexusLover

Were you even born when "savings and loans" were around?

The "savings and loan" debacle didn't have anything to do with "higher interest rates" .... .

|

Interest rate restrictions locked S&Ls into below-market rates on many mortgages whenever interest rates rose. State-imposed usury laws limited the rate lenders could charge on home mortgages until Congress banned states from imposing this ceiling in 1980. In addition to interest rate ceilings on mortgages, the due-on-sale clause in mortgage contracts was not uniformly enforceable until 1982. Before, borrowers could transfer their lower-interest-rate mortgages to new homeowners when property was sold.

A federal ban on adjustable-rate mortgages until 1981 further magnified the problem of S&L maturity mismatching by not allowing S&Ls to issue mortgages on which interest rates could be adjusted during times of rising interest rates. As mentioned above, during periods of high interest rates, S&Ls, limited to making long-term, fixed-rate mortgages, earned less interest on their loans than they paid on their deposits.

Interest rate restrictions locked S&Ls into below-market rates on many mortgages whenever interest rates rose. State-imposed usury laws limited the rate lenders could charge on home mortgages until Congress banned states from imposing this ceiling in 1980. In addition to interest rate ceilings on mortgages, the due-on-sale clause in mortgage contracts was not uniformly enforceable until 1982. Before, borrowers could transfer their lower-interest-rate mortgages to new homeowners when property was sold.

A federal ban on adjustable-rate mortgages until 1981 further magnified the problem of S&L maturity mismatching by not allowing S&Ls to issue mortgages on which interest rates could be adjusted during times of rising interest rates. As mentioned above, during periods of high interest rates, S&Ls, limited to making long-term, fixed-rate mortgages, earned less interest on their loans than they paid on their deposits.

|

|

Quote

| 1 user liked this post |

02-15-2020, 10:23 AM

02-15-2020, 10:23 AM

|

#26

|

|

Valued Poster

Join Date: Dec 31, 2009

Location: dallas

Posts: 23,345

|

Methinks the ftw doth protest too much!

It is ok - Bernie will put it all right for you, FTW

|

|

Quote

| 1 user liked this post |

02-15-2020, 11:21 AM

02-15-2020, 11:21 AM

|

#27

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by oeb11

Methinks the ftw doth protest too much!

It is ok - Bernie will put it all right for you, FTW

|

A federal ban on adjustable-rate mortgages until 1981 further magnified the problem of S&L maturity mismatching by not allowing S&Ls to issue mortgages on which interest rates could be adjusted during times of rising interest rates. As mentioned above, during periods of high interest rates, S&Ls, limited to making long-term, fixed-rate mortgages, earned less interest on their loans than they paid on their deposits.

A federal ban on adjustable-rate mortgages until 1981 further magnified the problem of S&L maturity mismatching by not allowing S&Ls to issue mortgages on which interest rates could be adjusted during times of rising interest rates. As mentioned above, during periods of high interest rates, S&Ls, limited to making long-term, fixed-rate mortgages, earned less interest on their loans than they paid on their deposits.

|

|

Quote

| 1 user liked this post |

02-15-2020, 11:28 AM

02-15-2020, 11:28 AM

|

#28

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by lustylad

What the fuck are you even talking about?

Here's the metric wtf claims to care about the most - the budget deficit! Ask him to explain it to you and then compare odumbo's first 4 years to trump.

|

Numb nuts...for apple to apple , you compare the nearest years. Which is Obama's last admin vs Trumps 1rst.

Only a dumbass void of economics would go to a recession started in another administration and want to compare it to present day.

|

|

Quote

| 1 user liked this post |

02-15-2020, 11:30 AM

02-15-2020, 11:30 AM

|

#29

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by lustylad

Who's lystylaffer and where did he cheer for lower Fed rates?

P.S. Lustylad wasn't a fan of odumbo's QE. He cheered when it ended in 2014.

|

Donald has started up QE again . just calling it something different.

https://www.bloomberg.com/news/artic...d-the-fed-lost

|

|

Quote

| 1 user liked this post |

02-15-2020, 11:32 AM

02-15-2020, 11:32 AM

|

#30

|

|

Valued Poster

Join Date: Jan 16, 2010

Location: Texas

Posts: 51,038

|

Quote:

Originally Posted by oeb11

Methinks the ftw doth protest too much!

It is ok -

|

WTF actually believes his large letters and pics are convincing!

A single objection of "not relevant" would toss his ridiculous attempt to appear "all knowing" ... he doesn't know shit about what his copying and pasting, which only shows the depths of his ignorance ... plagiarizing as though it were his "original" thoughts! It wasn't there and didn't know shit from shinola what was actually happening.

#1: there was no Federal law prohibiting "variable rates" on state loans for real estate ... and "variable rates" had nothing to do with the crash ... it was loaning money to high risk debtors with no down payment (risk in the investment) and bribed appraisers who overinflated the values of properties to secure loans.

In the past few years it's been happening in the Houston area and many realtors who have a vested interest in turning residential properties (flipping) have participated in a similar scheme with the collusion of their "favorite" appraisers .... they take the "closing" numbers on the purchase to augment the value of the property for future appraisals in the area ... in other words ... their RE commissions and associated closing fees are factored in as part of the property value for future comparisons. The local taxing authority has no problem with that ... because it increases their base value. It's too bad WTF gets in over his head so often by posting bullshit.

Like I said: He needs to stay on the station driveway with JackOff!

And his little "economic" POST has NOTHING TO DO WITH THE ECONOMY.

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|