Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

649 |

| MoneyManMatt |

490 |

| Still Looking |

399 |

| samcruz |

399 |

| Jon Bon |

397 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| Starscream66 |

280 |

| George Spelvin |

267 |

| sharkman29 |

256 |

|

Top Posters

Top Posters |

| DallasRain | 70799 | | biomed1 | 63389 | | Yssup Rider | 61090 | | gman44 | 53297 | | LexusLover | 51038 | | offshoredrilling | 48713 | | WTF | 48267 | | pyramider | 46370 | | bambino | 42893 | | The_Waco_Kid | 37233 | | CryptKicker | 37224 | | Mokoa | 36496 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

06-15-2016, 09:04 AM

06-15-2016, 09:04 AM

|

#16

|

|

Valued Poster

Join Date: Nov 21, 2011

Location: DFW

Posts: 486

|

Quote:

Originally Posted by DarkeyKong

Oh, is "that" what they do with "our" tax money? I was so mistaken, my apologies children and roads. I was unaware that the government used taxpayer dollars only for the purpose of critical and pertinent reasons. I was unaware the they in absolutely no way waste a single penny of our money in misappropriation, how could I have ever missed that?

|

Thats a lot of words you just put in my mouth. Didn't say even half that...

Your response seems like you have a problem with how they are spent, not that they are collected. But that's not what your original post was...just fuck taxes, this is ridiculous.

Of course the politicians are wasteful. Worse than that. Liars and crooks. I love America but fuck the govt. Now that I can get behind.

|

|

Quote

| 1 user liked this post |

06-15-2016, 09:20 AM

06-15-2016, 09:20 AM

|

#17

|

|

Valued Poster

Join Date: Sep 15, 2014

Location: dallas

Posts: 1,219

|

Unless you own your company, the U.S. tax code will basically prevent you from being super wealthy.

I get pissed off too. After maxing out 401k, paying healthcare premiums, and being in the upper tier of the federal income tax rate bracket, literally over half my paycheck is gone. Then I still have to pay sales tax, property tax, capital gains tax on any investments I liquidate... It is maddening.

|

|

Quote

| 1 user liked this post |

06-15-2016, 09:39 AM

06-15-2016, 09:39 AM

|

#18

|

|

Pending Age Verification

User ID: 45258

Join Date: Sep 16, 2010

Location: Dallas

Posts: 1,515

My ECCIE Reviews

|

The more money you make, the more tax you pay. If you pay a lot in taxes, that means you're in the money. Woohooo!!! :-)

Yes, I am tired of taxes. We get taxed on everything. Taxes on income, inheritance, cell phone, purchases, we die and we get taxed! Ugh

|

|

Quote

| 1 user liked this post |

06-15-2016, 11:19 AM

06-15-2016, 11:19 AM

|

#19

|

|

Valued Poster

Join Date: Feb 7, 2012

Location: DFW

Posts: 668

|

With the way home values are skyrocketing around the metroplex, I think quite a few of us are in for a shock on our next personal property tax bill. I didn't know it was so out of hand until I decided to look around to upgrade, and not only are the prices flying north, there is nothing available and you can't even hope to buy a home around here unless you are prepared to go 15K over the asking price. Someone tell all those people to stop moving here. We are full up!

|

|

Quote

| 1 user liked this post |

06-15-2016, 11:32 AM

06-15-2016, 11:32 AM

|

#20

|

|

BANNED

Join Date: May 5, 2013

Location: Phnom Penh, Cambodia

Posts: 36,100

|

Quote:

Originally Posted by Zee Man

The bottom quarter in this country pay no income tax

|

bottom HALF pays no Federal income tax..

a consumption tax is more give away to the wealthy.. their large savings, retirement, and stock accounts would be tax free, the 1% would have a larger wealth disparity than ever.

|

|

Quote

| 2 users liked this post |

06-15-2016, 01:09 PM

06-15-2016, 01:09 PM

|

#21

|

|

Account Disabled

Join Date: Oct 20, 2011

Location: Promo Code MY600

Posts: 4,389

|

Quote:

Originally Posted by Super Sonic

With the way home values are skyrocketing around the metroplex, I think quite a few of us are in for a shock on our next personal property tax bill.

|

Mine showed up in the mail a few weeks ago.....and YE$....the value$ and amount$ due are UP considerably. $hocking pretty much $um$ it up for me.....

|

|

Quote

| 1 user liked this post |

06-15-2016, 01:34 PM

06-15-2016, 01:34 PM

|

#22

|

|

Valued Poster

Join Date: Jul 20, 2012

Location: DFW

Posts: 1,649

|

On the property tax piece... were you not able to protest? The jump started 2 years ago and yes its a pain but the savings is worth the 15 mins per property. Your argument doesn't have to be strong either just show up on time.

But yes, F taxes and F school bonds!

|

|

Quote

| 1 user liked this post |

06-15-2016, 02:42 PM

06-15-2016, 02:42 PM

|

#23

|

|

Account Disabled

Join Date: Feb 15, 2012

Location: .

Posts: 3,870

|

Quote:

Originally Posted by DFWhobbyguy

Thats a lot of words you just put in my mouth. Didn't say even half that...

Your response seems like you have a problem with how they are spent, not that they are collected. But that's not what your original post was...just fuck taxes, this is ridiculous.

Of course the politicians are wasteful. Worse than that. Liars and crooks. I love America but fuck the govt. Now that I can get behind.

|

My friend, I absolutely agree, horrible title! It was just an emotional outburst, but I think we see eye to eye here

|

|

Quote

| 1 user liked this post |

06-15-2016, 02:45 PM

06-15-2016, 02:45 PM

|

#24

|

|

Account Disabled

Join Date: Feb 15, 2012

Location: .

Posts: 3,870

|

Quote:

Originally Posted by Super Sonic

With the way home values are skyrocketing around the metroplex, I think quite a few of us are in for a shock on our next personal property tax bill. I didn't know it was so out of hand until I decided to look around to upgrade, and not only are the prices flying north, there is nothing available and you can't even hope to buy a home around here unless you are prepared to go 15K over the asking price. Someone tell all those people to stop moving here. We are full up!

|

This post just made my heart sink, that's one think I wasn't even considering yet. Shit shit shit shit shit shit shit!!!!

|

|

Quote

| 1 user liked this post |

06-15-2016, 02:48 PM

06-15-2016, 02:48 PM

|

#25

|

|

Lifetime Premium Access

Join Date: May 28, 2009

Location: DFW

Posts: 152

|

Before we all get too excited about a national sales or consumption tax consider this - how would those providers of services on this site collect and report the tax?

And unless the 16th amendment is repealed we would simply end up with both a sales and an income tax.

And no one has ever been able to tell me why a sales or consumption tax is constitutional and the income tax was not until said 16th amendment. Yes, I do realize that the constitution has been rendered obsolete by those in power but some of us still think it is important.

And finally, there are very powerful forces within and outside of government working to eliminate cash altogether and convince us that money is nothing more than a series of electronic entries at your bank. I don't see how it would ever work, but we all know those bastards can make Wednesdays out of Fridays with the stroke of a pen. And let's face it, except for hobbying and ammo why do we need cash anyway? This has nothing to do with taxation other than the government knowing how you spend every dime and sending you a bill for your tax instead of you telling the government the correct tax amount according to your records.

Speaking of tax - I have to get back to preparing the "rendering unto Caesar" for clients so enough of a rant here.

|

|

Quote

| 1 user liked this post |

06-15-2016, 03:06 PM

06-15-2016, 03:06 PM

|

#26

|

|

Professional Tush Hog.

Join Date: Mar 27, 2009

Location: Here and there.

Posts: 8,959

|

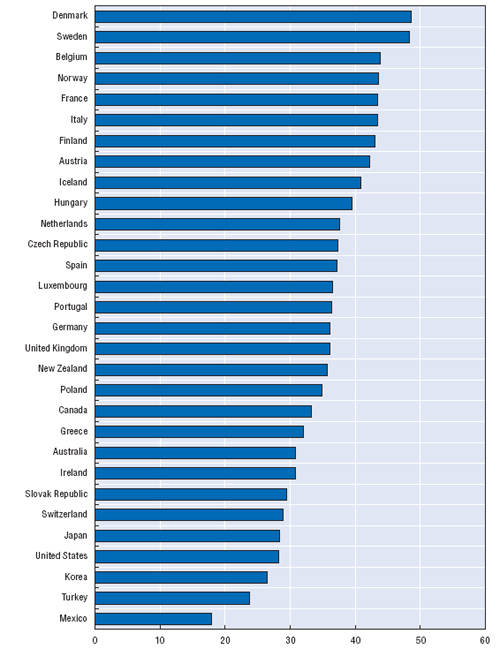

Mostly you're being unreasonable. The US has the lowest total tax burden of any major industrialized country. It is also lower the most smaller industrialized countries. Only Mexico, S. Korea, and Turkey have a lower total tax burden (and yes, that state, local, Federal, sales, income, etc. all of them).

And no, your income taxes aren't really higher.m Our marginal income rates are at historically low levels.

What has changed to some degree is the percent of the tax burden payed by the wealthy and very wealthy.. It has declined. Especially for the very wealthy. I'm currently engaged in some estate planning, but I can now pass the first $5 million on to my two kids tax free. That makes it a good bit easier to plan for the remainder.

If you travel to Europe a lot like I do, you can also see that we are paying the price for being a low tax country. Their roads and public infrastructure are demonstrably better than ours almost everywhere in Western Europe now. Meanwhile, our roads are falling apart. Our aurports are old and crowded. And our mass transportation is nearly non-existent or falling apart.

|

|

Quote

| 2 users liked this post |

06-15-2016, 04:13 PM

06-15-2016, 04:13 PM

|

#27

|

|

Valued Poster

Join Date: Dec 15, 2015

Location: Earth

Posts: 223

|

Looking only at marginal tax rates is misleading. Our marginal rates are much lower now than in the 50's, but back in the 50's there were many many more deductions available. When we lowered our marginal rate, we also eliminated many of the common deduction ( for example, consumer interest). Comparing our current taxes rates to the rates of another era is like comparing an apple to an orange. I suspect the same is true when comparing one country to another. A fair comparison requires a deeper look.

|

|

Quote

| 1 user liked this post |

06-15-2016, 06:38 PM

06-15-2016, 06:38 PM

|

#28

|

|

Professional Tush Hog.

Join Date: Mar 27, 2009

Location: Here and there.

Posts: 8,959

|

Quote:

Originally Posted by howsilly

Looking only at marginal tax rates is misleading. Our marginal rates are much lower now than in the 50's, but back in the 50's there were many many more deductions available. When we lowered our marginal rate, we also eliminated many of the common deduction ( for example, consumer interest). Comparing our current taxes rates to the rates of another era is like comparing an apple to an orange. I suspect the same is true when comparing one country to another. A fair comparison requires a deeper look.

|

I agree with your post inso far as marginal rates don't tell the entire story. However, if you look at the OECD website you will see that this is total tax burden which is essentially effective total tax rate -- all taxes collected by all government entities/GDP. So I stand on my assertion that we are not just a low tax country, but a very low tax country.

|

|

Quote

| 1 user liked this post |

06-16-2016, 09:32 AM

06-16-2016, 09:32 AM

|

#29

|

|

Hiatus Nov20-Dec25

User ID: 205713

Join Date: Sep 14, 2013

Location: Palm Springs Ca-Hiatus Nov20-Dec25

Posts: 6,517

My ECCIE Reviews

|

be glad you all don't live in Cal... <<<<<

|

|

Quote

| 1 user liked this post |

06-16-2016, 11:53 AM

06-16-2016, 11:53 AM

|

#30

|

|

Account Disabled

Join Date: Feb 15, 2012

Location: .

Posts: 3,870

|

Quote:

Originally Posted by LustyBustyGina38FF

be glad you all don't live in Cal... <<<<<

|

Ironically, I acquired a small business in Cali, that kind of led to this thread, lol!

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|