Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

650 |

| MoneyManMatt |

490 |

| Jon Bon |

400 |

| Still Looking |

399 |

| samcruz |

399 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| Starscream66 |

282 |

| You&Me |

281 |

| George Spelvin |

270 |

| sharkman29 |

256 |

|

Top Posters

Top Posters |

| DallasRain | 70831 | | biomed1 | 63764 | | Yssup Rider | 61317 | | gman44 | 53378 | | LexusLover | 51038 | | offshoredrilling | 48842 | | WTF | 48267 | | pyramider | 46370 | | bambino | 43221 | | The_Waco_Kid | 37431 | | CryptKicker | 37231 | | Mokoa | 36497 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

02-07-2023, 01:56 PM

02-07-2023, 01:56 PM

|

#1606

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by lustylad

Don't bother. We already know the numbers. They demonstrate the opposite of what you think. This is one of the best threads in the PF. You've already hijacked it more than once with your anti-Reagan diatribes. If you try to do it again, I will hit the RTM button, something I almost never do.

Again, don't do it. Tiny already started a thread on inequality. Go back and post your hateful, inflammatory class-warfare gibberish there. Don't make me report you for veering off topic.

|

Report away school monitor.

I was on topic btw.

You're one of those economic guru's from the Reagan era  ..you do not see the parallel between Biden and Reagan's inflation numbers and the huge budget deficits? I'm pointing out to all the Chicken Littles that seem to think the end of the world is upon us  that everything is gonna be alright.

Biden is fighting the Russians by proxy in Ukraine much like Reagan did in Afghanistan.

We have a Fed raising rates to fight inflation much like the early 1980s.

And Tiny is crying about debt and deficits much like I was in the early 80's.

So I am on topic , with a twist of historical context.

But if your vagina is twitching so bad that you need a Mod to scratch it, by all means do your thing. Would not be the first time you've done it when folks talk bad about your Hero , Ronnie.

|

|

Quote

| 1 user liked this post |

02-07-2023, 01:59 PM

02-07-2023, 01:59 PM

|

#1607

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by Tiny

OK, The COVID relief bill just passed will cost 1.9 trillion. Biden has just proposed another 2.2 trillion for Democratic priorities and infrastructure, and reportedly will propose another 2 trillion spending bill in April for more Democratic Party priorities. That adds up to about 6 trillion in round numbers.

Alexandria Ocasio Cortez and Joe Manchin believe the $2.2 trillion just announced is too low. AOC wants it upped to $10 trillion and Manchin wants $4 trillion.

And then there's the Green New Deal, beloved by all the progressive Democratic Politicians. The American Action Forum estimates that would take $51 trillion to $93 trillion over the next ten years.

So most of this money is supposed to come from people who make more than $1 million a year, and all of it from those who make over $400,000 per year. President Biden has promised people making less than $400,000 per year will not have their tax rates increased.

Here's a link to the IRS tax statistics:

https://www.irs.gov/statistics/soi-t...d-gross-income

The latest year available is 2018. In that year, the total taxable income of people making over $1 million per year was $1.6 trillion. If you add the amount of taxable income of people making from $500,000 to a million a year, that goes up to $2.3 trillion.

However, these people are already paying a large % of their income in federal and state income taxes to help pay for existing programs. Let's say 30% of their income to be conservative -- I'm pretty sure it's more than that. That means if you take every dime they make, that they're not already paying in taxes, you end up with $1.1 trillion ($1 million cutoff) or $1.6 trillion ($500,000 cutoff) to pay for all this shit the Democratic Party politicians are proposing.

There's a snowball's chance in hell these politicians can do what they want to do by just taxing the rich. |

Did Manchin up it to 4 trillion? No

Did AOC get her way with the green new deal. Not really

So should we break down into what the reported sky falling was vs actuality?

|

|

Quote

| 1 user liked this post |

02-11-2024, 11:02 AM

02-11-2024, 11:02 AM

|

#1608

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,001

|

Quote:

Originally Posted by eyecu2

Spending does need to stop, or at least slow way the fuck down. We're never going to spend ourselves into a better economy.

We just need to figure out how to get this ship turned around before it's too late without a bunch of knee-jerk reactions.

What programs would be first changed in your opinions?

|

I agree 100% Eyecu2. This is the biggest problem facing America.

Transitioning from social security/Medicare/Medicaid/Obamacare to something like Singapore's Central Provident Fund may go against my Libertarian instincts, but it would help solve the looming debt crisis, increase retirement income, increase the level of competition and thus lower prices for medical care, stop the vicious circle of higher student loans and higher tuition prices, and increase the savings rate. In Singapore, employer contributions to individuals' CPF accounts are funded by 20% payroll contributions from the employer and 17% from employees. So you might have to transition over a number of years to keep from throwing the country into a big recession. And you'd probably want to leave older Americans in the existing system.

Moving more expenditures and taxing from the federal government to local and state governments would be another great step. When the power of the purse is closest to the people, government is more efficient. Infrastructure is a good example. Much of it costs multiples more in the USA than Europe, and I can't help but think part of that is the way our federal government throws around the pork.

Cutting defense expenditures and spending money on defense more efficiently would make a lot of sense IMHO. We spend more on defense that the next 10 countries combined. And #10 is Ukraine, which is receiving a lot of defense funding from us.

https://www.pgpf.org/chart-archive/0...nse-comparison

Cutting down on corporate pork is a good idea. Biden's infrastructure, CHIPS and Inflation Reduction Act spending were overdone. I bet the multiplier for programs like the preceding is less than 1, meaning you hand out $1.00 of government money for, say, renewable energy projects and you get back less than $1.00 in increased GDP. Actually the corporate income tax reduction probably did a lot more to increase jobs and improve the competitivity of American business than all those Acts combined. Along the same lines, we're too generous with the farm subsidies.

We could probably do with some welfare reform. I think greatly alleviating childhood poverty should be one of our goals. Our politicians have made a lot of headway in this. But from what I understand the way the system works it's encouraging some people not to work. Some people can stay at home and, after taxes and handouts, make as much as they can by working. I don't begrudge doing that though for, say, a single Mom with 4 young kids.

Looking at the longer term, improvements in education would help increase GDP and thus lower the debt/GDP ratio. I don't know how much the federal government can do, as it's more a local and state matter. But if kids were getting good educations in fields like accounting, engineering, the sciences, plumbing, auto mechanics, etc., it would help. More parent involvement in education, charter schools, vouchers, less power in the hands of the teachers' unions, and channeling kids towards fields where they can make a living instead of liberal arts degrees would help.

|

|

Quote

| 1 user liked this post |

02-11-2024, 11:20 AM

02-11-2024, 11:20 AM

|

#1609

|

|

Premium Access

Join Date: Feb 27, 2010

Location: houston

Posts: 10,574

|

Noticed your academic study post on the Kudlow thread.

Everyone loves academic studies.....right ?

They give 20 years for corrective action.

How many decades has Social Security been ready to collapse....despite academic studies.

|

|

Quote

| 1 user liked this post |

02-11-2024, 11:25 AM

02-11-2024, 11:25 AM

|

#1610

|

|

Valued Poster

Join Date: Nov 2, 2010

Location: Dallas, TX

Posts: 160

|

Eventually, one of three things, or a combination of them, will HAVE to happen, and all three of them are very bad.

1. Print money to pay them (leading to massive inflation, ala Wehrmacht Republic).

2. MASSIVE MASSIVE spending cuts (like...half of current expenditures)

3. Reneg on the debt.

We ALL know #2 ain't gonna happen. So, its 1 and/or 3. I think likely a combination. Why? Because who is the largest holder of US Debt? China. Trillions worth. They would bear much of the damage done.

Debt ratings companies see this too...that's why they have been downgrading US Debt.

Why no one is waking up to this is the real question. It is validating the thesis around democracy (originally put forward by a Scottish philosopher in like the 1600's), that democracies ultimately fail when the people realize they can just vote themselves money. Worse, it is now used as a tool to get those votes (like the student loan bailout, whose sole purpose was to shore up support for Democrats amongst the younger generations, where support was waning).

|

|

Quote

| 2 users liked this post |

02-11-2024, 11:27 AM

02-11-2024, 11:27 AM

|

#1611

|

|

Valued Poster

Join Date: Nov 2, 2010

Location: Dallas, TX

Posts: 160

|

Quote:

Originally Posted by VitaMan

Noticed your academic study post on the Kudlow thread.

Everyone loves academic studies.....right ?

They give 20 years for corrective action.

How many decades has Social Security been ready to collapse....despite academic studies.

|

Worse, they identified this problem under Ford, passed legislation to correct it (additional SS tax), then promptly and consistently just continued to spend it each year.

So, we've already paid to fix the problem...only it never got fixed. Plus, it is now a lot worse than it was then.

It's really hard to see this in action and not come to the conclusion that we're all just really really stupid.

|

|

Quote

| 2 users liked this post |

02-11-2024, 11:43 AM

02-11-2024, 11:43 AM

|

#1612

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,001

|

Quote:

Originally Posted by VitaMan

Noticed your academic study post on the Kudlow thread.

Everyone loves academic studies.....right ?

They give 20 years for corrective action.

How many decades has Social Security been ready to collapse....despite academic studies.

|

Damn the academic studies and actuarial science, full speed ahead! You're starting to sound like some of the anti-vaxxers VitaMan.

The only reason social security hasn't collapsed was because of bipartisan legislation during the Reagan administration to increase employer and employee contributions. At the time, it was expected to keep the system solvent until 2030. There may have been other, minor changes since Reagan to shore up social security. According to the Social Security Administration, we actually won't run out of money until 2037.

You don't see politicians from either party lining up to boost payroll contributions or cut benefits.

|

|

Quote

| 1 user liked this post |

02-11-2024, 11:49 AM

02-11-2024, 11:49 AM

|

#1613

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,001

|

Quote:

Originally Posted by BigDog63

Eventually, one of three things, or a combination of them, will HAVE to happen, and all three of them are very bad.

1. Print money to pay them (leading to massive inflation, ala Wehrmacht Republic).

2. MASSIVE MASSIVE spending cuts (like...half of current expenditures)

3. Reneg on the debt.

We ALL know #2 ain't gonna happen. So, its 1 and/or 3. I think likely a combination. Why? Because who is the largest holder of US Debt? China. Trillions worth. They would bear much of the damage done.

Debt ratings companies see this too...that's why they have been downgrading US Debt.

Why no one is waking up to this is the real question. It is validating the thesis around democracy (originally put forward by a Scottish philosopher in like the 1600's), that democracies ultimately fail when the people realize they can just vote themselves money. Worse, it is now used as a tool to get those votes (like the student loan bailout, whose sole purpose was to shore up support for Democrats amongst the younger generations, where support was waning).

|

Excellent post Big Dog. One minor disagreement, Japan is now our largest foreign creditor, and China is #2. And I bet China's holdings of our debt will continue to decrease, given what's happening with Russian reserves and assets frozen by the USA and other western countries because of Ukraine.

|

|

Quote

| 1 user liked this post |

02-11-2024, 12:32 PM

02-11-2024, 12:32 PM

|

#1614

|

|

Premium Access

Join Date: Feb 27, 2010

Location: houston

Posts: 10,574

|

Send me a message when the USA defaults on its debts.

|

|

Quote

| 1 user liked this post |

02-13-2024, 11:38 AM

02-13-2024, 11:38 AM

|

#1615

|

|

Valued Poster

Join Date: Apr 29, 2013

Location: Milky Way

Posts: 10,954

|

Interesting: "We have failed."

|

|

Quote

| 1 user liked this post |

02-13-2024, 04:18 PM

02-13-2024, 04:18 PM

|

#1616

|

|

Valued Poster

Join Date: Apr 4, 2011

Location: sacremento

Posts: 3,669

|

Quote:

Originally Posted by Tiny

I agree 100% Eyecu2. This is the biggest problem facing America.

Transitioning from social security/Medicare/Medicaid/Obamacare to something like Singapore's Central Provident Fund may go against my Libertarian instincts, but it would help solve the looming debt crisis, increase retirement income, increase the level of competition and thus lower prices for medical care, stop the vicious circle of higher student loans and higher tuition prices, and increase the savings rate. In Singapore, employer contributions to individuals' CPF accounts are funded by 20% payroll contributions from the employer and 17% from employees. So you might have to transition over a number of years to keep from throwing the country into a big recession. And you'd probably want to leave older Americans in the existing system.

Moving more expenditures and taxing from the federal government to local and state governments would be another great step. When the power of the purse is closest to the people, government is more efficient. Infrastructure is a good example. Much of it costs multiples more in the USA than Europe, and I can't help but think part of that is the way our federal government throws around the pork.

Cutting defense expenditures and spending money on defense more efficiently would make a lot of sense IMHO. We spend more on defense that the next 10 countries combined. And #10 is Ukraine, which is receiving a lot of defense funding from us.

https://www.pgpf.org/chart-archive/0...nse-comparison

Cutting down on corporate pork is a good idea. Biden's infrastructure, CHIPS and Inflation Reduction Act spending were overdone. I bet the multiplier for programs like the preceding is less than 1, meaning you hand out $1.00 of government money for, say, renewable energy projects and you get back less than $1.00 in increased GDP. Actually the corporate income tax reduction probably did a lot more to increase jobs and improve the competitivity of American business than all those Acts combined. Along the same lines, we're too generous with the farm subsidies.

We could probably do with some welfare reform. I think greatly alleviating childhood poverty should be one of our goals. Our politicians have made a lot of headway in this. But from what I understand the way the system works it's encouraging some people not to work. Some people can stay at home and, after taxes and handouts, make as much as they can by working. I don't begrudge doing that though for, say, a single Mom with 4 young kids.

Looking at the longer term, improvements in education would help increase GDP and thus lower the debt/GDP ratio. I don't know how much the federal government can do, as it's more a local and state matter. But if kids were getting good educations in fields like accounting, engineering, the sciences, plumbing, auto mechanics, etc., it would help. More parent involvement in education, charter schools, vouchers, less power in the hands of the teachers' unions, and channeling kids towards fields where they can make a living instead of liberal arts degrees would help. |

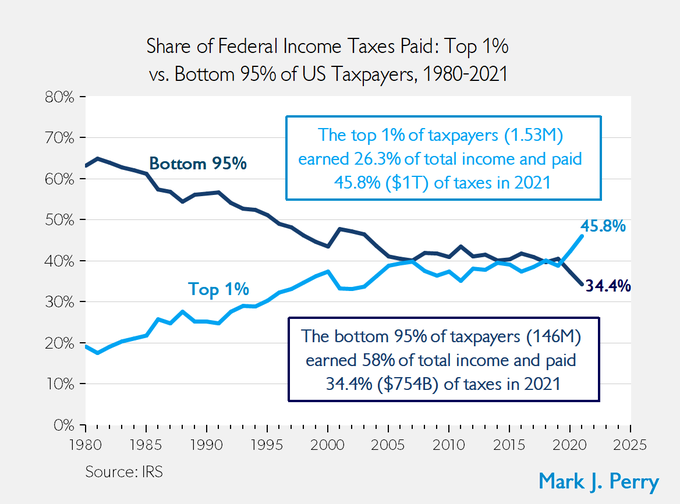

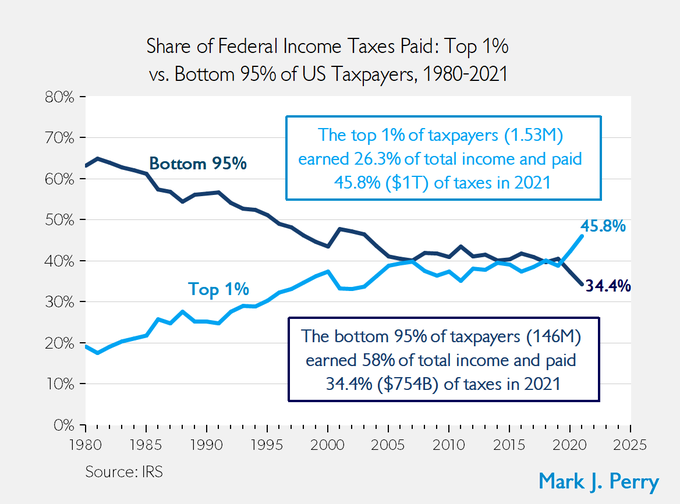

I agree the USA is never going to spend it's way into a better economy or into trillion dollar Federal Gov Budget Surpluses. Before I would transition to what the Philipines does, I would fix the tax code. The one percent simply do NOT pay enough in Tax. In the tax tables their tax rate percentage is between 35 - 39%. What they are actually paying (Effective tax rate is no where near this), due to loopholes.

For example the effective tax rate for Mitt Romney is 15% in any given year( he said this in public). I would lower to the tax rate percentage to between 30 - 34% and eliminate all or most loopholes. I would change the Corporate tax rate to go back to 25%. It was too high before the Trump tax cuts. However, it's too low now. Most of the money saved went to stock buybacks instead of investment expand the business.

You knock social security and Obamacare. Social security would pay for itself if they would change the formula. You don't have as many people in the working now a days ( birth rate has decreased). People are still having sex, they just aren't having as many kids. The formulas for Social Security has not changed since the program was implemented.

As for Obamacare only 10 million people are on it. Over 285 million people get group health insurance thru their employer. BTW( A group health insurance policy from the employer is the cheapest health insurance one can get).

We spend way to much on Military Spending. There is just no need to have troops stationed all over the world any more.

I say look at these things before adopting that what they do in the Philipines.

|

|

Quote

| 1 user liked this post |

02-13-2024, 04:36 PM

02-13-2024, 04:36 PM

|

#1617

|

|

Valued Poster

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 18,787

|

Quote:

Originally Posted by adav8s28

The one percent simply do NOT pay enough in Tax.

|

Huh? You think 45.8% of all income taxes isn't enough? Back in 1980, they paid less than 20%.

They now pay more than the bottom 95% do. And you want to squeeze them for more?

Ask any of our esteemed far-left class-warfare demagogues (Bernie, Fauxcahontas, AOC, etc.) to define exactly what they mean by "fair share". They won't do it.

|

|

Quote

| 3 users liked this post |

02-13-2024, 05:25 PM

02-13-2024, 05:25 PM

|

#1618

|

|

Valued Poster

Join Date: Apr 29, 2013

Location: Milky Way

Posts: 10,954

|

Quote:

Originally Posted by lustylad

Huh? You think 45.8% of all income taxes isn't enough? Back in 1980, they paid less than 20%.

They now pay more than the bottom 95% do. And you want to squeeze them for more?

Ask any of our esteemed far-left class-warfare demagogues (Bernie, Fauxcahontas, AOC, etc.) to define exactly what they mean by "fair share". They won't do it.

|

Nice closing to the post, sir. Very nice.

The highest form of flattery?

|

|

Quote

| 1 user liked this post |

02-13-2024, 05:44 PM

02-13-2024, 05:44 PM

|

#1619

|

|

Valued Poster

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 18,787

|

Quote:

Originally Posted by eccieuser9500

The highest form of flattery?

|

Glad you can identify with the beleaguered taxpayer!

|

|

Quote

| 1 user liked this post |

02-13-2024, 08:44 PM

02-13-2024, 08:44 PM

|

#1620

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 9,001

|

Quote:

Originally Posted by eccieuser9500

Nice closing to the post, sir. Very nice.

The highest form of flattery?

|

The pointy toed black boots are a nice touch.

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|