Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

650 |

| MoneyManMatt |

490 |

| Jon Bon |

400 |

| Still Looking |

399 |

| samcruz |

399 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| Starscream66 |

282 |

| You&Me |

281 |

| George Spelvin |

270 |

| sharkman29 |

256 |

|

Top Posters

Top Posters |

| DallasRain | 70831 | | biomed1 | 63764 | | Yssup Rider | 61310 | | gman44 | 53378 | | LexusLover | 51038 | | offshoredrilling | 48840 | | WTF | 48267 | | pyramider | 46370 | | bambino | 43221 | | The_Waco_Kid | 37431 | | CryptKicker | 37231 | | Mokoa | 36497 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

05-09-2022, 11:13 AM

05-09-2022, 11:13 AM

|

#166

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by Chung Tran

He's not responsible. Trump said if we elected Biden ''your 401k will go to zero''. Today's Market is making Trump look prescient, but averages are still higher than when Trump left Office kicking, screaming, and fomenting an insurrection.

Jay ''inflation is transitory'' Powell is responsible. Trump's FED pick, whom he blamed for the 2018 downturn.

|

I'm more inclined to believe it was 2 unfortunate occurrences. Pandemic and War. This transitory verbiage was conjured up when they thought the virus was under control and all countries would ramp up like we were....Trump's vaccine, though great, was not as great as first assumed. The war was just a bad move on Putin's part.

So is Powell behind the curve? Probably but he had Trump on his ass early on pleading for negative rates and Biden twiddling his thumbs before reappointment.

Plus what difference does it make to investors when he eventually raised rates? To politicians though...it means everything! The Democrats will find that out come November.

Who has more real power the WH and Congress or the Fed and SC? I'd argue the latter.

|

|

Quote

| 1 user liked this post |

05-09-2022, 11:28 AM

05-09-2022, 11:28 AM

|

#167

|

|

BANNED

Join Date: May 5, 2013

Location: Phnom Penh, Cambodia

Posts: 36,100

|

Quote:

Originally Posted by WTF

Plus what difference does it make to investors when he eventually raised rates? To politicians though...it means everything! The Democrats will find that out come November.

Who has more real power the WH and Congress or the Fed and SC? I'd argue the latter.

|

It matters to Investors, because the Market downturn lingers longer, and the economy keeps cracking. Had he raised rates last Autumn, when he should have, the soft landing could be achievable.

The FED and SC have way more power than the WH and Congress.

|

|

Quote

| 1 user liked this post |

05-09-2022, 12:28 PM

05-09-2022, 12:28 PM

|

#168

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,341

|

Quote:

Originally Posted by Tiny

I share your appreciation of dividends. You can fake a lot of things -- income, accounts receivable, inventories, net cash, even cash flow. But it's damn hard to fake dividends.

|

Somehow this reminds me of a statement a lady friend made to me a few years back.

"Yes, you guys sometimes accuse us of faking orgasms, and sometimes with justification. But you men are in a league of your own, as you can fake whole relationships!"

(Since we had a rather casual "uncommitted" relationship, I was able to laugh with her at that one!)

|

|

Quote

| 2 users liked this post |

05-09-2022, 12:28 PM

05-09-2022, 12:28 PM

|

#169

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,341

|

(CaptainMidnight's comments in red)

Quote:

Originally Posted by Tiny

Yes, if shares are cheap, you need to know why they're cheap. Of course!

There are a lot of reasons why high dividend yields may deceive. You brought up one, I think (I'm not familiar with Fieldstone), too much debt and a downturn in business.

I'm with you on that -- can't recall whether I've ever even heard of Fieldstone.

Right now you're going to see coal exporters, refiners and bulk shipping companies paying generous dividends. But when coal prices, refining margins and shipping rates go down, so will the dividends. The market realizes this and so they sell at high dividend yields. Still, for some of these companies, it's possible the dividends you'll receive in the next few years may justify the share price. Some are probably cheap.

Good point, since with a reasonable measure of transparency, influencing factors should become easily known.

Some companies will juice the dividend yield so the insiders can dump shares. This is common with some Chinese companies listed on foreign exchanges. Some are frauds. You can guard against this by being careful with companies that haven't been listed and traded for a long time -- probably one of the reasons CM prefers companies that have paid good dividends for many years.

Yes, indeed. That's why I mentioned that I like companies financed with conservative and sustainable debt levels. And history matters!

Resource companies can be sitting on key mines and oil fields that have low reserve/production ratios. That is their gold or oil or whatever is about to play out. So they too can sell at high yields, for a reason.

Excellent point.

Capex and working capital investment have a big effect. If a company was minting free cash flow and then decides to embark on a major project or expansion or acquisition, it may cut or omit dividends, and may in addition go deep into debt. If the return on their additional investment is poor, it may be a long while before you see good dividends again.

Another excellent point.

In addition to future capex and other investment, keeping an eye on net debt is a good idea. Once a company pays down debt dividends are likely to increase, and vice versa. Yes!

Read the disclosure and analyst reports, find out if they have a dividend policy, try to talk to the investor relations person or management. It's not a bad idea to talk to competitors, suppliers and employees too, although I'm usually too lazy to do that. All these help to understand not only what's behind the dividend, but the prospects and fundamentals of the company. You're buying a share of a business so you want to understand the company.

You want to be forward looking. Yes, there are empirical relationships, which haven't worked as well in recent years because of the market's obsession with growth, like historical price/earnings, price/book, price/free cash flow, and dividend yield. But what you'd really like to have a handle on are earnings, free cash flow, and dividends going forward. And how management treats shareholders and what it does with its free cash. Those are what drive share prices, or at least should drive them.

|

Very good post.

As I said, I'm not sure I've ever even heard of Fieldstone, or may be confusing it with something else. Too lazy to look it up.

Obviously, it is essential to be sure that a company paying good dividends can sustain the free cash flow with which to continue doing so. There can occasionally be examples of big-cap companies failing to do so, and you have to watch out for that.

A good example is T (AT&T) which loaded itself up with debt to finance Direct TV and a couple of other unfortunate ventures. At that time, "T" left the playing field of sound dividend-paying stocks.

.

|

|

Quote

| 2 users liked this post |

05-09-2022, 12:43 PM

05-09-2022, 12:43 PM

|

#170

|

|

Valued Poster

Join Date: Apr 29, 2013

Location: Milky Way

Posts: 10,954

|

Quote:

Originally Posted by CaptainMidnight

(CaptainMidnight's comments in red)

Just like someone who would profile himself a Captain. Of what? Industry? Military?

Anyway. I thought standard protocol was blue. Code blue. But, seeing as this be end times, I'll allow it.

Sir.

Very good post.

.

|

|

|

Quote

| 1 user liked this post |

05-09-2022, 12:44 PM

05-09-2022, 12:44 PM

|

#171

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,341

|

Quote:

Originally Posted by Chung Tran

Anyone know a good contact, to fight an overly high appraisal? Never done it, want to now. I know May 15 is the deadline. I know there are Firms that will take a cut of your property tax savings, if they fight and win. Any recommendations? No time or inclination to do it myself.

|

I still own a home in Dallas and have been using an outfit called North Texas Property Tax Services for about the last 10 years. As with most people working within this space, they take a contingency fee, but I feel that they're done a pretty good job for me.

Most people who try to deal directly with the county appraisal districts tend not to do as well, since unless you are doggedly persistent and well-armed with data, their representatives will just make an effort to try your patience or try to get away with tossing you a nickel or two. Just not worth your time and effort.

https://ntpts.com/

.

|

|

Quote

| 1 user liked this post |

05-09-2022, 12:45 PM

05-09-2022, 12:45 PM

|

#172

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,341

|

Quote:

Originally Posted by Chung Tran

It matters to Investors, because the Market downturn lingers longer, and the economy keeps cracking. Had he raised rates last Autumn, when he should have, the soft landing could be achievable.

|

I'm not so sure about that, as I have a slightly different take from that of most of my friends in the financial world.

My take on the issue is that the damage had already been done on the fiscal side, and that the looming downturn arising from what will necessarily be a sharp wind-down from the humongous multitrillion-dollar surge of covid-era spending was baked solidly into the pie with the grotesquely excessive $1.9 trillion American Rescue Plan -- which itself was stacked atop already excessive spending levels.

But Powell can certainly be faulted for encouraging the aforementioned spending blowout by indicating that the Fed stood ready to accommodate with continued balance sheet expansion at an annual run rate of close to $1.5 trillion, and for as long a period of time as deemed necessary to prevent anything from falling apart.

.

.

|

|

Quote

| 1 user liked this post |

05-09-2022, 12:46 PM

05-09-2022, 12:46 PM

|

#173

|

|

BANNED

Join Date: May 5, 2013

Location: Phnom Penh, Cambodia

Posts: 36,100

|

|

|

Quote

| 1 user liked this post |

05-09-2022, 12:48 PM

05-09-2022, 12:48 PM

|

#174

|

|

Valued Poster

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 18,787

|

Go Back to Grade School Civics Class

Go Back to Grade School Civics Class

Quote:

Originally Posted by WTF

Who has more real power the WH and Congress or the Fed and SC? I'd argue the latter.

|

Quote:

Originally Posted by Chung Tran

The FED and SC have way more power than the WH and Congress.

|

What a dumb question! Power over WHAT?? Don't you fuckers ever grasp NUANCE?

The WH has the most power over our military decisions.

Congress has the most power over taxes & spending.

The Fed has the most power over monetary policy & interest rates.

The SC has the most power over legal issues.

Seriously, this is just the latest example of how the simple-minded simpleton WTF "thinks"! He makes broad, sweeping comments and insists that simple correlations can explain complex situations. He is completely lacking in depth or nuance appreciation.

It's disappointing to see Chungy fall for it.

|

|

Quote

| 1 user liked this post |

05-09-2022, 12:49 PM

05-09-2022, 12:49 PM

|

#175

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,341

|

Quote:

Originally Posted by Chung Tran

|

Thanks for the link.

November, 2007? Jeez, that was not a great time to be a mortgage lender, was it!??

|

|

Quote

| 1 user liked this post |

05-09-2022, 12:53 PM

05-09-2022, 12:53 PM

|

#176

|

|

BANNED

Join Date: May 5, 2013

Location: Phnom Penh, Cambodia

Posts: 36,100

|

Quote:

Originally Posted by lustylad

Seriously, this is just the latest example of how the simple-minded simpleton WTF "thinks"! He makes broad, sweeping comments and insists that simple correlations can explain complex situations. He is completely lacking in depth or nuance appreciation.

It's disappointing to see Chungy fall for it.

|

Fall for what? What has you so triggered?

Why do I have to provide nuance? I simply agreed that on the whole, the 2 cited Institutions weild more aggregate power.

|

|

Quote

| 1 user liked this post |

05-09-2022, 12:55 PM

05-09-2022, 12:55 PM

|

#177

|

|

BANNED

Join Date: May 5, 2013

Location: Phnom Penh, Cambodia

Posts: 36,100

|

Quote:

Originally Posted by CaptainMidnight

Thanks for the link.

November, 2007? Jeez, that was not a great time to be a mortgage lender, was it!??

|

It was not! not as bad as being a Savings and Loan Lender in the 1986-87 period, perhaps.

Your link didn't work, by the way. Still looking for property tax relief!

|

|

Quote

| 1 user liked this post |

05-09-2022, 12:59 PM

05-09-2022, 12:59 PM

|

#178

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Ok twiddle dumb

Ok twiddle dumb

Quote:

Originally Posted by lustylad

What a dumb question! Power over what?? Don't you fuckers ever grasp NUANCE?

The WH has the most power over our military decisions.

Congress has the most power over taxes & spending.

The Fed has the most power over monetary policy & interest rates.

The SC has the most power over legal issues.

Seriously, this is just the latest example of how the simple-minded simpleton WTF "thinks"! He makes broad, sweeping comments and insists that simple correlations can explain complex situations. He is completely lacking in depth or nuance appreciation.

It's disappointing to see Chungy fall for it.

|

Once you have control of the Supreme Court...well they can fit any convoluted law as legal under our constitution.

The Fed can effect which party gets elected with their lil lo monetary policy and intrest rates...

Your obsession to try and paint anything I've written in a negative light is clouding your judgement.

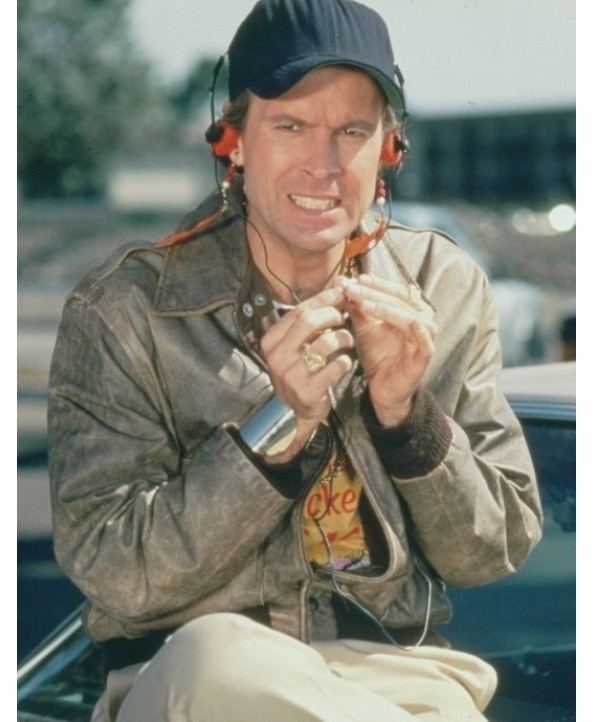

I think you need to get over the fact that I know you to be the asshole in Good Will Hunting that Matt Damon demolished in the bar scene

|

|

Quote

| 1 user liked this post |

05-09-2022, 01:00 PM

05-09-2022, 01:00 PM

|

#179

|

|

Valued Poster

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 18,787

|

Quote:

Originally Posted by Chung Tran

Fall for what? What has you so triggered?

Why do I have to provide nuance? I simply agreed that on the whole, the 2 cited Institutions weild more aggregate power.

|

Not triggered. To speak of "aggregate power" is obviously meaningless. You can't "aggregate" the various power dimensions - military, fiscal, monetary, legal. So it's a dumb question. I thought you would recognize that.

This is an interesting thread, especially with the comments by CM and Tiny. Let's get back on topic and not let WTF hijack it.

|

|

Quote

| 1 user liked this post |

05-09-2022, 01:12 PM

05-09-2022, 01:12 PM

|

#180

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by Chung Tran

It matters to Investors, because the Market downturn lingers longer, and the economy keeps cracking. Had he raised rates last Autumn, when he should have, the soft landing could be achievable.

The FED and SC have way more power than the WH and Congress.

|

I believe how soft the landing is depends on where you are invested.

Powell has done exactly as he has warned for the most part.

Yes I agree...the Fed and SC rule the roost mid term for sure.

That is why I continue to make bets of the country turning more and more to the right. That will in the short to mid term benefit the investor class.

In the long run it will lead to a Putin'ish Russia. And then all the power will fall to the WH. Trump came close imho

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|