This senile fucker brandon isn't happy until he COMPLETELY destroys the American economy. This is the libtard ideology on display for ALL the world to see....the S&P has tumbled 20% this year alone and forcast to get worst!! I has never seen my investments take such a hit in my life...the sooner we get these libtards fuckers out of our lives the better!! Liberalism is a DESTRUCTIVE ideology that is being shoved down the American people's throats. Anybody that supports this need their asses kicked.

Jun 23, 2022

S&P 500 May Have Another 24% to Fall, 150 Years of Market History Shows

Isabelle Lee, Bloomberg News

- AddThis Sharing ButtonsShare to Facebook

Share to TwitterShare to LinkedInShare to EmailShare to More

BC-S&P-500-May-Have-Another 24%-to-Fall-150-Years-of-Market-History-Shows , via Bloomberg

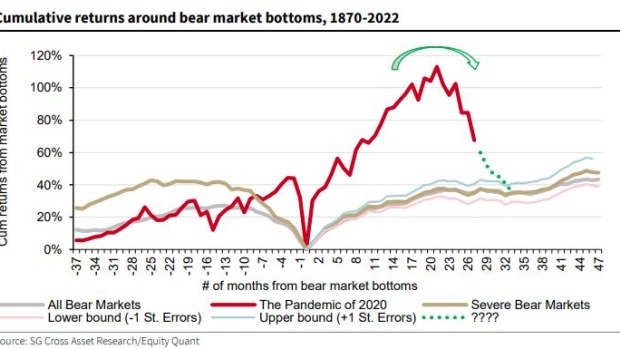

(Bloomberg) -- The S&P 500 Index may have another 24% to fall by year-end, if the past 150 years of financial-market history are any guide.

That’s according to Societe Generale, which calculates the benchmark gauge may need to tumble as much as 40% from its January peak in the next six months to hit bottom. That comes out to 2,900. The upper end of the range the firm gave is for the index to slump by roughly 34% from its top, to 3,150.

Societe Generale arrived at this range by studying post-crisis market valuations starting in the 1870s, using quantitative analysis, as opposed to factors such as earnings projections and valuations.

“The current market valuation clearly stands as a bubble vis a vis the valuation reset of March 2020 and its trajectory,” quant strategists including Solomon Tadesse wrote in a research note Thursday. “The dynamics of post-crisis fair value still call for a deeper correction to bring current prices in line with the reset anchor fundamental fair value.”

The firm computed 3,020 as fair value for the S&P 500, in line with its historical post-crisis market valuation trendline. The index gained about 1% on Thursday to 3,796, after Federal Reserve Chair Jerome Powell said in House testimony that his commitment to bring down price increases is “unconditional.” The S&P 500 has tumbled about 20% this year amid building recession worries as the Fed has boosted borrowing costs to combat inflation.

To be sure, not everyone is as bearish. John Stoltzfus, chief investment strategist at Oppenheimer & Co., said Tuesday that he’s sticking to a January forecast that the benchmark will end the year at 5,330 -- a whopping 40% above Thursday’s close.

©2022 Bloomberg L.P.