Quote:

Originally Posted by Chung Tran

Musk is a big Baby. No other CEO would give two shits that his stock was shorted. Fucking cry baby.

If Musk wants to get even, remind Gates of his Coupang long position in the mid-40's, trading at $14 and change today  |

seems some experts agree with Muskrat.

Coupang: The Case For Going Long As The Company Evolves

https://seekingalpha.com/article/449...for-going-long

Feb. 27, 2022 6:00 AM ET

Coupang, Inc. (CPNG)12 Comments10 Likes

Summary

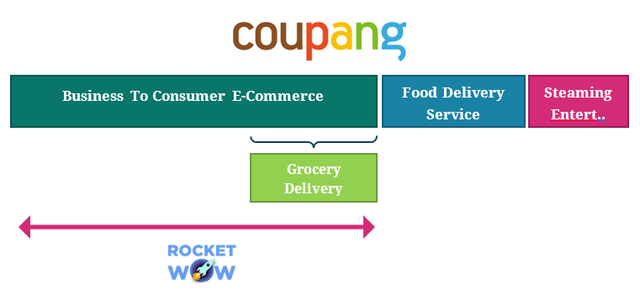

- Coupang is known as a South Korean e-Commerce player. It is now transforming into something a lot more.

- In addition to e-commerce strength, the business has taken on food delivery services (Coupang Eats), and streaming entertainment (Coupang Play).

- Both new verticals have taken rapid market share since launch. Coupang Eats is on track to become the dominant food-delivery platform. The two business models are gross margin expansionary.

- The company has shown signs of exercising its pricing power by raising Rocket subscription prices; furthermore it has began monetizing it's e-commerce platform rapidly with advertising levers.

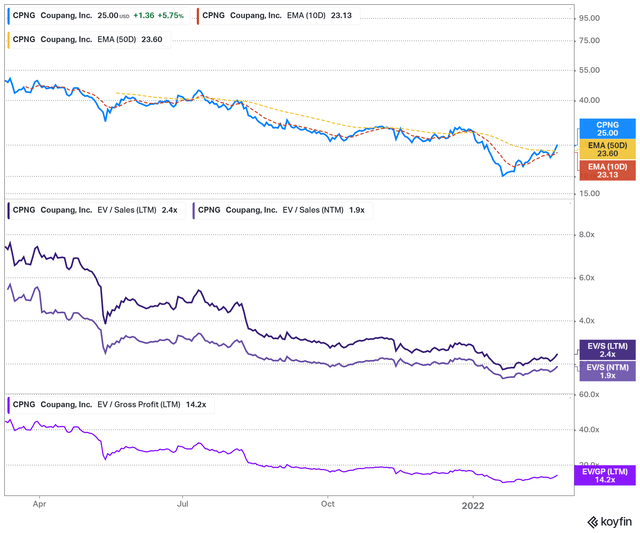

- CPNG is undervalued at a ~14x LTM EV/GP for strong projected growth. The current price presents a compelling opportunity to go long.

- This idea was discussed in more depth with members of my private investing community, The Abstract Portfolio. Learn More »

Coupang's (NYSE:

CPNG) share price has been battered since the IPO. A mix of the technology selloff, a mid-2021 sentiment shift after a major fulfilment centre fire, a Q3 revenue miss, and continuous cash burn has pressured the stock price into submission to the low $20s range from the once mid-$40s.

The view I will present is somewhat contrarian in the scheme of things. Catalysts and new verticals are signaling well as future growth drivers, and have yet to meaningfully come to move the financial performance. As I've said to my subscribers, great opportunities whisper... they don't yell out. Our thesis is based on the narrative that Coupang is evolving into something well beyond e-commerce: a connected ecosystem of consumer internet services. We're long CPNG at the Abstract Portfolio.

Coupang's Core E-Commerce Business

Let's discuss e-Commerce first.

To most retail investors, Coupang is known as a vanilla B2C E-Commerce Marketplace operating in a constrained and saturated South Korean market opportunity. Amidst this opportunity, investors would note of competition from Korea's well-funded Naver (Think Korea's Google) as a key threat, with its strategic partnership with leading logistics companies and e-Mart (Korean Walmart).

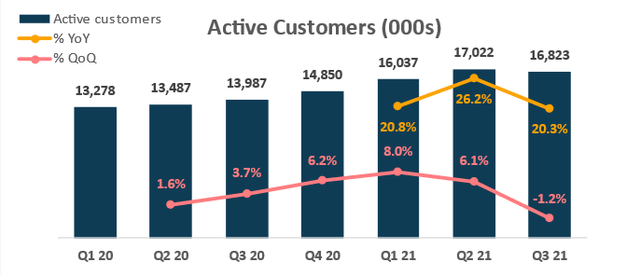

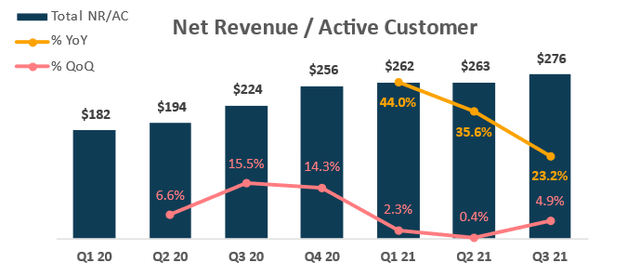

As of Q3, Coupang's online retail has continued showing strength, outpaced the local e-commerce market's expansion rate, and on an interesting note: recorded impressive spend/user expansion clocking in above 20% YoY, more than two years after the pandemic's onset.

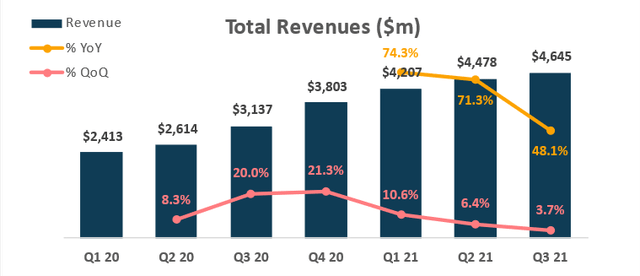

See the following charts at the overall company level.

Chart, Author (Quarterly Filings Coupang IR)

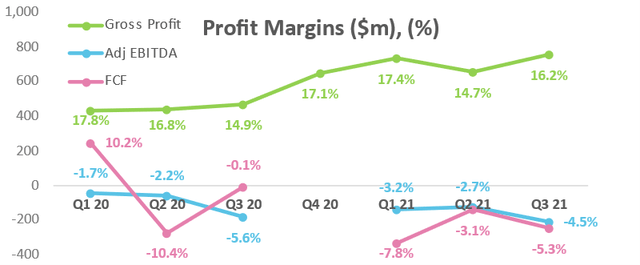

Chart, Author (Quarterly Filings, Coupang IR)

The active customer count showed a slight sequential decline in Q3 due to the fact that Coupang deliberately slowed down its sales and marketing towards customer acquisition; this was done in order to maintain their level of rapid delivery service times (Rocket Delivery) and customer experience at their famously high levels.

We sacrificed to preserve customer experience several percentage points of revenue growth. By our estimates, we sacrificed at least 5 percentage points. And it was done through measures such as not taking orders when we reach our daily capacity.

On the competitive front, we did not see -- we saw virtually no impact from competitive factors. I think it's safe to say, from our perspective, more so than at any point in our company's history, we think the drivers of our business are unaffected by competition. As you saw, our demand was not constrained. It was really our capacity.

- Q3 Earnings Call, CEO Bom Kim

Those critical of the high growth would point to Coupang's cash burn and the fact that it is operating in the low-margin e-commerce space, hardly making any money and probably won't anytime soon due to competition. To this point, I'd argue that the in-house logistics infrastructure is one-of-a-kind and inherently drives a price moat that's available, but yet to be exercised. It has been designed, built, and optimized over several years to deliver exceptional convenience:

- Rocket Delivery - One day delivery for nearly all items

- Rocket Dawn Delivery for qualifying items - book the order by 12 am, get it before breakfast

Speed and customer service is widely known to be unmatched by other e-commerce platforms. For the South Korean population that are used to 6-day workweeks and extremely long working hours, the extra convenience is arguably worth paying up for. Investor's should note that South Korea is a richer country on GDP/Capita compared to most other Asian economies and isn't far off from the mature and highly developed Japan.

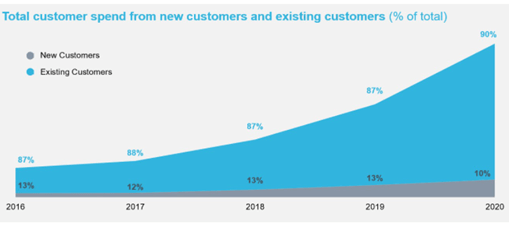

To back the value proposition Coupang offers, historical data display strong engagement trends over time. Revenue expansion by cohort indicates the sticky and expansive power of the Coupang experience in spades:

- Customers keep spending more as time goes on; once Coupang establishes its new cohorts, the cohorts recurringly transact through the platform at an increasing rate every year that goes by. Post-Covid 2021 has seen the trend flatten, but results are still going strong.

Expansion chart (S-1 Filing, Coupang IR)

Then there's of course Rocket WoW membership. A monthly subscription that gets you Rocket Delivery, Rocket Fresh (groceries), and a few other perks (free deliveries, returns, etc.) at KRW 2900 ($2.45/month). That price is being raised to KRW4990 ($4.21/month) for only new members as of 2022. Coupang is actively leveraging its goodwill and customer service to extract more from its expanding customer base.

Raising prices here has no impact on costs, and is directly accretive to the top and bottom lines. With a service that's loved and delivers on the company's mission, Coupang is likely going to get away with this with minimal churn.

A reminder on the Mission Statement:

To create a world where customers wonder: “How did I ever live without Coupang?”

Source: S-1 Filing

Evolution

Here are a few interesting bullet points from the Q3 Earnings Release:

- Fulfilment centre infrastructure for Rocket Fresh, our fresh grocery offering, increased by nearly 90% year-to-date through Q3 and is on track to double in 2021.

- Coupang Eats is the most downloaded mobile app for iOS and the second most downloaded mobile app for Android in Korea in 2021 to date.

Source: Q3 Earnings Release

The two points above attribute to the grocery delivery service, and the rather young (but virally expanding) food delivery service. Considering delivery is where Coupang is currently unparalleled, they've leveraged their expertise to go beyond traditional online retail. The numbers are strong, showing excess growth adding to the top line. Specifically, Coupang Eats has rocket-shipped and has been taking market share against the dominant existing food delivery services, Bae-Min, over the last year.

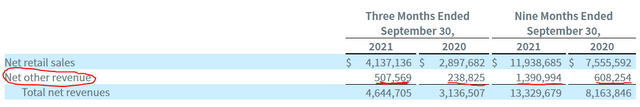

The results of this effort are hidden in the rather vague revenue breakdown of "Net Other Revenue".

Q3 Earnings Release Snip (Coupang IR)

According to management, Net other revenues outpaced due to Coupang Eats as well as advertising monetization on the e-commerce platform - both business models are inherently gross margin accretive compared to retail e-commerce. In addition, the figure still grew in excess of 100% YoY. In Q3, the section comprised an eighth of the total revenues, but should theoretically add excess instrinsic value to the enterprise due to the gross margin accretion.

Internally, I estimated that Coupang Eats, by itself, could add an extra ~10% pts of YoY growth on the business as a whole for the coming year. This is significant as the rate of sales growth is likely a key factor that moves the price.

To me, the Coupang ecosystem has evolved and is looking a bit more like this flowchart below:

Flowchart, Author (Logos from Coupang Website)

Non-traditional e-commerce is expanding rapidly (Groceries under "Rocket Fresh"), and so is everything else outside of it. Coupang will seemingly continue to exercise monetization such as advertising capture on their existing e-comm network as well. It just requires patience.

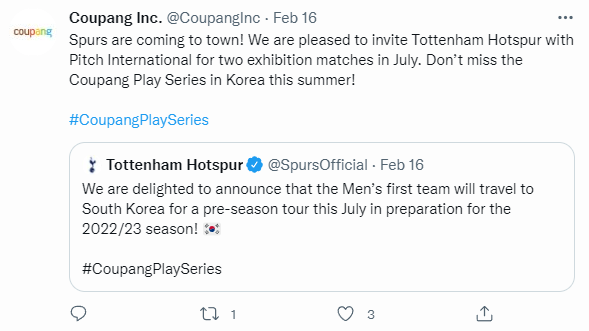

A notable development after Q3, was Coupang Play, the company's attempt to break into streaming entertainment. According to

news sources, Coupang's attempts at streaming have been more than successful. Since its launch, Coupang Play has been one of the most downloaded apps in Korea. Korean drama "One Ordinary Day" has taken off with an A-list cast on the platform. Coupang has also arranged for domestic exhibition football matches that involve a top tier premier league team, Tottenham Hotspur's participation, to stream on Coupang Play. Tottenham features Son Heung-min, a star South Korean player. Such strategic developments are likely to bolster growth and engagement.

Twitter (@CoupangInc)

To sprinkle some data to confirm all the pieces, here are a few bullet points:

- Coupang Play was consistently the #1 ranked app on Downloads for iOS and Anroid in the Entertainment category in South Korea over the past 90 days.

- Coupang Eats was dominantly the #1 ranked app on Downloads for both iOS and Android in the "Food & Drink" category in South Korea over the past 90 days. It also consistently ranks among the Top 5 apps Overall.

Source: App Annie Data (Free Version)

Both Food Delivery and Entertainment, have entered into a stage of immense momentum on capturing large customer bases. Coupang Eats has been the more impressive of the two so far and management also mentioned that they're extracting increased transaction activity from recurring customers over time, just as they've done with e-commerce.

What excites me, however, aren't just the individual apps, but the prospects of Coupang leveraging its subscription service to unify all the services into one. Rocket WoW, which was seemingly constrained to delivery on e-commerce, now includes Coupang Play as well. Coupang is turning into South Korea's Amazon in more ways than one if you consider the Prime vs. Rocket, and Prime Video vs. Coupang Play parallels. Ultimately, a unification of consumer internet services lends the overall business a wider moat to exercise; this in turn spurs a disruption platform where new verticals, both big and small, have an almost unfair advantage on reaching mass adoption locally.

Financials

Sales Growth (Author w data from Coupang IR)

Profit Margins (Author, w data from Coupang IR)

Revenues show decelerating sequential trends, but it's likely that "Net other revenues" will cushion the e-commerce slowdown as it grows exponentially larger over a large revenue base. QoQ momentum decline for Q3 is a result of Coupang's decision to forego extra customer acquisition until they can expand capacity and build out the back-end infrastructure to fulfil demand. This is not a problem.

These investments will take time to show some fruition, though I think we'll be seeing substantial strength in the business on capacity by the end of 2022. When Founder CEO Bom Kim, who has beaten the odds, and has consistently come from behind to eat up market share against established competitors, says they're investing in the business and have little competition, it's worth taking his view into account. Long-term focused Founder CEOs aren't aligned with short-term market sensibilities, and this is an opportunity for those that look beyond a quarter or two.

Gross margins, as I mentioned, have factors that are driving it upwards. The increase of Rocket WoW membership revenue, increasing advertising monetization, and the acceleration of the Coupang Eats business will drive that margin higher over time. Continued economies of scale on the logistics part will likely help too.

On cash burn and profitability, Coupang fairs rather poorly. However, given my analysis of the quality of the services, growth, and the data points that indicate substantial customer engagement, I don't think the company is even close to fully monetizing its e-commerce market yet. One has to judge

the ability to monetize in such a situation rather than the actual margins today. With an established market leader that's executing so well, this ability is highly likely to turn into a reality. Investors can also be reassured that Coupang has over $4B of cash on its balance sheet to keep funding growth and new verticals. This is enough cash ammunition for the next 2-3 years in my view at the current burn rate.

2021 has largely been a year of declining growth after the pandemic surge of consumer internet stocks. However, the company is strategically positioning itself to evolve well beyond its historical addressable market towards a more cohesive consumer internet ecosystem. Their services aren't going anywhere and the business is leveraging its brand and network to expand into new territories. This execution stands despite the digitally saturated and developed Korean market. Coupang is winning in all the new games it's playing, and as of late 2021, there's enough of a track record to draw upon some bullishness.

Valuation

Without a financial breakdown by new venture segments, it's difficult to value the entity by summing up the parts. I believe a suitable method is to look at Gross Profit and Sales Multiples, although they're not perfect.

Valuation Multiples (Koyfin)

Source: Koyfin

To rack up multiple comparisons, we have to note that Coupang is the #1 B2C ecosystem in its geographical domain. With this in mind: Alibaba, JD, Sea Group, and MercadoLibre come to mind as worthy competitors. Amazon's gross margin mix is locked in with AWS, so it makes for a less fair comparison.

Name Ticker Gross Margin LTM EV/GP LTM Rev Growth % NTM

Coupang Inc CPNG 17.2% 14.2x 31.3

% Amazon

AMZN 42.0% 8.1x 15.1%

Alibaba

BABA 38.8% 5.3x 15.2%

JD

JD 7.3% 9.2x 23.9

% MercadoLibre

MELI 47.3% 19.0x 38.3%

Sea Ltd

SE 37.6% 22.3x 56.8%

Data Source: Koyfin

Note that LTM stands for "Last Twelve Months", and NTM is "Next Twelve Months"

With the China multiple compression from last year and the recent tech selloff, there's a fair argument that a lot of the valuation multiples here are cheaper than they were even pre-pandemic. Unsurprisingly, businesses expected to grow more this year are priced higher on multiples: With Sea leading the pack (+57% YoY), MercadoLibre right behind, and Coupang at 3rd at 31% YoY expected. The faster they grow in the future, the further the gross profit multiples will compress long-term. One would expect CPNG to slot in between JD and MELI, and it does on purely gross profit multiples vs consensus sales growth.

However, as we've established, the gross margin is likely to expand given the faster growth in food delivery services and advertising monetization of e-commerce. Recent alternative data and management commentary point to new verticals like Coupang Eats truly taking off in rocket-ship mode. Coupang Play has made a splash too, and importantly Rocket Membership subscription prices are exercising their ecosystem advantages for the bottom line. If one considers the possibility that CPNG maintains high growth, and gross profit margins head to 20-25%+, there is a lot to like at these valuations on both a relative and absolute basis against the entire e-commerce cohort.

Coupang may not have the free-range possibility of Sea Group's Shopee domination, but it has shown evidence of holding ground, taking market share, and launching verticals that are succeeding quickly against a local TAM (Total Addressable Market) right within South Korea. It, therefore, offers "optionality", that often goes underrated in long-term compounders by the Street. At these valuations, I believe CPNG makes for a compelling investment.

Risks

- Competition: From Naver, e-Mart, and other e-commerce players. Food Delivery competition from Bae-Min (owned by Delivery Hero). Streaming entertainment channels like Netflix.

- International Expansion Doesn't Work: Coupang is leveraging its expertise in dense population logistics to try out Japan. It's new territory with established players and the bet might not work out leading to deep losses on cash.

- Cash Burn Extends On Other Big Bets: Although Coupang has about $4B on the balance sheet to fund perhaps 2 years of growth, there is some pressure to turn profitable and losing big bets (including streaming) will increase financial risks.

- Financial Risks: Coupang is not risky at all from a solvency standpoint, but the need to raise cash later becomes a self-fulfilling cycle that slows momentum, market share, and growth.

- Geopolitical/Macro/FX/Country Specific: South Korea's economy plays a big factor. Macro, geopolitical, and foreign exchange risks for US investors are valid factors to consider.

Conclusion

Coupang is no longer just an e-commerce marketplace. It's evolving into a thriving ecosystem of varied consumer internet services; this includes a sizeable food delivery service and streaming entertainment. The entire ecosystem is unified with the Coupang brand, and the Rocket membership (analogous to Amazon's Prime). I believe multiples have compressed to lows and there's likely outperformance on sales and gross margins in store, that will improve the fundamental narrative of Coupang's long-term sustenance.

Execution on the new verticals has been simply excellent thus far. Coupang Eats was one of the most downloaded apps in South Korea, and customers become increasingly engaged as time goes by. Coupang Play (streaming) has kicked off with excellent adoption as well. The company is not just expanding its TAM, but winning across every vertical it attempts, and capturing market share against established players while at it. At the current price of ~$24 a share, CPNG is a compelling investment opportunity.

Searching for more opportunities in tech-enabled growth? Try out

The Abstract Portfolio.