http://research.chicagobooth.edu/igm...download2.aspx

Federal Reserve Governor Jerome H. Powell

At the "U.S. Monetary Policy Forum" conference sponsored by the University of Chicago Booth School of Business, New York, New York

Federal Reserve Governor Jerome H. Powell

At the "U.S. Monetary Policy Forum" conference sponsored by the University of Chicago Booth School of Business, New York, New York

February 22, 2013

Discussion of "Crunch Time: Fiscal Crises and the Role of Monetary Policy"

The issue of fiscal sustainability and its interaction with monetary policy is certainly timely.1 Many advanced economies are in an extended period of slow growth and high deficits, and face long-term fiscal pressures from aging populations.

I agree with much in this broad-ranging paper.2 In particular, the authors join others in finding that accommodative monetary policy is often associated with successful fiscal consolidations. They conclude that a "tough love" alternative, which would call for the Federal Reserve to withhold monetary accommodation until fiscal policymakers enact legislation to reduce budget imbalances, is likely to be counterproductive. Indeed, I would argue that the tough love approach also would require the Fed to deviate from the dual mandate that the Congress has assigned it, while assuming a role in influencing fiscal policy that the Congress has not assigned it.

I find myself in disagreement, however, with the paper's assessment that the current fiscal policy challenges might interfere in the near-term with the conduct of monetary policy in the United States.

Three important propositions underlie the authors' argument on this issue:

The federal government's fiscal path is unsustainable under current policies.

If the market concludes that a government either cannot or will not service its debt, the central bank may be forced to choose ultimately between monetization leading to inflation or standing by as the government defaults--the threat of "fiscal dominance."

The Federal Reserve's balance sheet is currently very large by historical standards and still growing. The process of normalizing the size and composition of the balance sheet poses significant uncertainties and challenges for monetary policymakers.

I believe all of these statements to be true. They are also widely, if not universally, accepted. However, based on these points and, importantly, on their empirical findings, the authors set out to show that fiscal difficulties present a near-term threat to the conduct of monetary policy. The paper argues that rising fiscal pressures, exacerbated by Federal Reserve losses on asset sales and low remittances to the Treasury, could lead the Federal Reserve to delay balance sheet normalization and to fail to remove monetary accommodation as needed to keep inflation expectations stable and inflation in check. In that case, the market could perceive the onset of fiscal dominance, thus setting off a vicious cycle of rising inflation expectations, increasing interest rates, and ever greater fiscal unsustainability.

In my view, this proposition seems highly unlikely. At a minimum, it is premature.

U.S. Fiscal Position

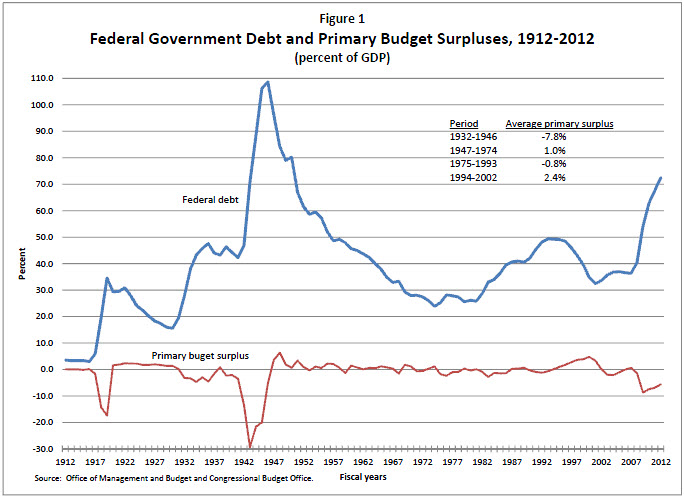

The paper led me to look back over the past century of U.S. sovereign debt history. On two prior occasions, federal debt as a percentage of gross domestic product (GDP) increased significantly--during the Great Depression-World War II era and, to a smaller extent, the two decades ending in the mid-1990s.3

After each of these high-debt periods, fiscal policy responded by running sustained primary surpluses and reducing debt to levels below 40 percent of GDP. In a recent paper, Henning Bohn observed that "the foundation of U.S. debt policy is the promise of safety for bondholders backed by primary surpluses only in response to a high debt-GDP ratio."4 That nicely captures our recent history and suggests a principal reason why the federal debt of the United States still has the market's trust.

The Great Recession has generated a third substantial increase in federal debt, from about 35 percent of GDP in 2007 to around 75 percent at the end of this fiscal year, an increase that is consistent with other increases in sovereign debt for advanced economies after severe financial crises during the post-World War II period.5 History and common sense suggest that the federal government should again run primary surpluses sufficient over time to reduce debt to pre-crisis levels of perhaps 35 to 40 percent of GDP. That would leave fiscal space to address the coming wave of health and pension costs, as well as unexpected new shocks.

In the past two years, spending cuts and tax increases totaling about $3.5 trillion over the next 10 years have been enacted. Assuming these measures are not rolled back--in particular, that the spending sequestration either takes effect or is replaced by equivalent deficit-reducing measures--a reasonable "current policy" projection is that the ratio of debt to GDP will be roughly stable at around 75 percent through about 2020.6 After that, under current policy, health-care costs and, to a much lesser extent, pension costs will produce a sharp, sustained increase in the ratio of debt to GDP.

Fiscal Sustainability and Monetary Policy

The authors review empirical evidence of sovereign borrowing costs for 20 advanced economies. They join others in finding a statistically significant relationship between sovereign debt levels and borrowing costs.7 They also find nonlinear increases in borrowing costs beginning at debt-to-GDP ratios of around 80 percent. But the nonlinearities they find are driven to a great extent by the experience of smaller euro-zone nations that, of course, borrow in euros. The United States borrows in its own currency--the world's primary reserve currency. That difference is crucial for investors, along with the fact that the United States economy remains the world's largest and most productive. The United Kingdom and Japan are also high-debt countries that borrow in their own currencies; neither shows any detectable rate increase, let alone a nonlinear one. These countries present a serious problem for the authors' case.

Of course, the United States is not exempt from concerns about the potential long-term effects of an unsustainable fiscal path. There is almost certainly a level of debt at which the United States would be at risk of an interest rate spike. However, we should expect that level to be substantially above one identified based on the experience of smaller euro-zone nations.

The argument also has a serious timing problem. The Federal Reserve's balance sheet likely will be normalized by late this decade, before the federal debt-to-GDP ratio even increases materially from today's level. Under the reasonable projection mentioned above, the debt-to-GDP ratio will remain roughly stable until 2020 before rising significantly in the next decade.8 That's not a favorable longer-term forecast, all the more so because it is importantly the result of demographic changes that have been expected for decades. But the forecast doesn't support the authors' claim that fears of fiscal dominance could materialize in the United States within the next five to seven years, during the period when the Fed is normalizing its balance sheet.

No current market signal suggests that the United States is near the point of losing the market's confidence. In my view, nothing in the Congressional Budget Office debt forecasts or the authors' empirical findings provides grounds for such an event during this decade. The market has every reason to believe--and apparently still does believe--that the United States will continue the difficult task of fiscal consolidation until the job is done.

Terribly difficult fiscal adjustments lie ahead. Although there is still time to make them, delay will sharply increase the pain of adjustment. The time to act is now. In my view, the problem is not principally one of economics or fiscal policy; it is one of governance. The real threat to the fiscal standing of the United States is that of inaction caused by a long period of political polarization and dysfunction. That would be a self-inflicted wound. And that is a problem that can't be derived from the traditional fiscal metrics.

We may have more room than other economies around the globe, but I do not intend to project any sense of complacency around this topic. The authors' basic message seems just right to me: We don't know where the tipping point is; wherever it is, we are clearly getting closer to it, and the costs of misestimating its location are enormous and one-sided. The benefits to long-term fiscal consolidation--conducted at the right pace, and without jeopardizing the near-term economic recovery--would be substantial.

Balance Sheet Losses and Remittances

The authors' work on Federal Reserve income and remittances to the Treasury overlaps with a paper published last month by Federal Reserve Board staff members Seth Carpenter, Jane Ihrig, Beth Klee, Daniel Quinn, and Alexander Boote.9 Both papers provide a basis for public discussion of these matters, which is a highly positive development. Some of the assets acquired through the Federal Reserve's large-scale asset purchases (LSAPs) may be sold at a loss, and it is important to be transparent about this possibility.

Thus far, the Federal Reserve's asset purchases have greatly increased our income and remittances to the Treasury. Indeed, remittances have run at an annual level of about $80 billion from 2010 to 2012. Both papers show that remittances are likely to decline substantially from these elevated levels as interest rates rise and the Fed balance sheet normalizes, and there may be a period of zero remittances. If so, the balance sheet would show a deferred asset representing a flow of future income to be retained and not remitted to the Treasury. Nonetheless, we expect that the LSAPs, which began in late 2008, will result in a net increase in remittances over the life of these programs. Moreover, any temporary losses should be weighed against the expected social benefits of the increased economic growth generated by the LSAPs, which would include higher tax revenue from increased output.

Greenlaw and his coauthors also note that we have the flexibility to normalize the balance sheet more slowly. For example, a "no asset sale" plan--under which assets would simply run off as they mature--would push out the date of normalization by only a year or so. That approach would also address concerns over potential market disruption from the sale of off-the-run agency mortgage-backed securities. And it would also smooth remittances.

Remittances averaged about $25 billion per year, or 0.2 percent of GDP, over the decade before the crisis. After the balance sheet is normalized, these remittances should return to a similar, modest share of GDP. From the standpoint of the sustainability of federal fiscal policy, remittances are not a first-order concern. That said, an extended period of zero remittances could certainly bring the Federal Reserve under criticism from the public and the Congress. The question is whether the Federal Reserve would permit inflation and thereby abandon its post in the face of such criticism. There is no reason to expect that to happen.

The Federal Reserve was created as an independent agency, and a broad consensus has emerged among policymakers, academics, and other informed observers around the world that better overall economic performance is achieved when the conduct of monetary policy is free from political control.10 Of course, we are accountable to the Congress and the American people. The Congress has given us a job to do, and as long as I am a member of the Federal Reserve Board, I will do my utmost to carry out our mandate.

Other Observations

The authors note that Federal Reserve asset purchases shorten the duration of debt held by the public, by the issuance of reserves to fund purchases of long-term securities. And shortening the maturity of the public debt does make any government more susceptible, in theory, to fiscal dominance. There is also a general assumption that under fiscal dominance any government has a strong incentive to allow inflation to reduce the real value of the debt. In the case of the United States, there is less to that than one might expect. By shortening the duration of debt held by the public, asset purchases have also reduced any benefit to the government of an unexpected inflation. More fundamentally, the liabilities that matter in the long term for the federal budget are those associated with health care and pension costs. These liabilities are not nominal but real, and cannot be inflated away.

Conclusion

I am not suggesting, and I do not expect, that the path ahead for monetary policy will be an easy one. There are legitimate concerns associated with the costs and benefits of continuing asset purchases. We may face challenges related to financial stability, as well as market function and inflation expectations. I do not personally see fiscal dominance as high on the list of near term risks.

I thank the authors for their interesting work.

1. The views expressed here are my own and not necessarily those of my colleagues in the Federal Reserve System. I am indebted to members of the Board staff--Eric Engen, Edward Nelson, David Lopez-Salido, and Jon Faust--who contributed to the preparation of these remarks. Return to text

2. See David Greenlaw, James D. Hamilton, Peter Hooper, and Frederic S. Mishkin (2013), "Crunch Time: Fiscal Crises and the Role of Monetary Policy," paper written for "U.S. Monetary Policy Forum," a conference sponsored by the University of Chicago Booth School of Business, held in New York, February 22. Return to text

3. Figure 1 shows federal debt held by the public and primary budget surpluses--that is, the difference between federal revenues and federal noninterest outlays--as a percent of nominal GDP from fiscal year 1912 through fiscal 2012. Return to text

4. See quote on p. 290 in Henning Bohn (2011), "The Economic Consequences of Rising U.S. Government Debt: Privileges at Risk," FinanzArchiv/Public Finance Analysis, vol. 67 (September), pp. 282-302. Return to text

5. See Carmen M. Reinhart and Kenneth S. Rogoff (2009), "The Aftermath of Financial Crises," American Economic Review, vol. 99 (May), pp. 466-72. Return to text

6. See Loren Adler, Shai Akabas, and Brian Collins (2013), "Key Takeaways from the 2013-2023 CBO Budget and Economic Outlook," Bipartisan Beat Blog, Bipartisan Policy Center, February 7. Numbers are modified to assume that the spending sequestration either takes effect or is replaced by equivalent deficit reducing measures. Return to text

7. For example, see Eric Engen and R. Glenn Hubbard (2005), "Federal Government Debt and Interest Rates," in Mark Gertler and Kenneth Rogoff, eds., NBER Macroeconomics Annual 2004, vol. 19 (Cambridge, Mass.: MIT Press), pp. 83-138; Thomas Laubach (2009), "New Evidence on the Interest Rate Effects of Budget Deficits and Debt," Journal of the European Economic Association, vol. 7 (June), pp. 858-85; and Joseph W. Gruber and Steven B. Kamin (2012), "Fiscal Positions and Government Bond Yields in OECD Countries," Journal of Money, Credit and Banking, vol. 44 (December), pp. 1563-87. Return to text

8. This is the alternative baseline scenario presented in Adler, Akabas, and Collins, "Key Takeaways," in note 6. Return to text

9. See Seth B. Carpenter, Jane E. Ihrig, Elizabeth C. Klee, Daniel W. Quinn, and Alexander H. Boote (2013), "The Federal Reserve's Balance Sheet and Earnings: A Primer and Projections," Finance and Economics Discussion Series 2013-01 (Washington: Board of Governors of the Federal Reserve System, January). Return to text

10. Among many studies, see, for example, Alex Cukierman (1992), Central Bank Strategy, Credibility, and Independence: Theory and Evidence (Cambridge, Mass.: MIT Press); Alberto Alesina and Lawrence H. Summers (1993), "Central Bank Independence and Macroeconomic Performance: Some Comparative Evidence," Journal of Money, Credit and Banking, vol. 25 (May), pp. 151-62; and Alex Cukierman, Pantelis Kalaitzidakis, Lawrence H. Summers, and Steven B. Webb (1993), "Central Bank Independence, Growth, Investment, and Real Rates," Carnegie-Rochester Conference Series on Public Policy, vol. 39 (December), pp. 95-140. Return to text

US Treasury Department 2012 Financial Report Of The US Government: Federal Budget Deficit Hit $6.9 Trillion