Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

646 |

| MoneyManMatt |

490 |

| Still Looking |

399 |

| samcruz |

399 |

| Jon Bon |

396 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| Starscream66 |

279 |

| George Spelvin |

265 |

| sharkman29 |

255 |

|

Top Posters

Top Posters |

| DallasRain | 70793 | | biomed1 | 63254 | | Yssup Rider | 60974 | | gman44 | 53294 | | LexusLover | 51038 | | offshoredrilling | 48657 | | WTF | 48267 | | pyramider | 46370 | | bambino | 42599 | | CryptKicker | 37220 | | The_Waco_Kid | 37020 | | Mokoa | 36496 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

03-08-2022, 11:20 AM

03-08-2022, 11:20 AM

|

#91

|

|

Premium Access

Join Date: Oct 3, 2013

Location: pittsburgh

Posts: 2,511

|

This is what it took to end Covid. They needed something huge to get people to think about anything but Covid. Well congrats they succeeded. No way in hell a Democrat wins the next Presidential election.

|

|

Quote

| 2 users liked this post |

03-08-2022, 11:25 AM

03-08-2022, 11:25 AM

|

#92

|

|

Valued Poster

Join Date: Nov 11, 2012

Location: Pittsburgh

Posts: 16,225

|

You can see and smell the panic from the libtards now. Trying to change the subject and resorting to truly one of the dumbest talking points imaginable. blaming private industry. Senile Biden enacted policies intended to cripple US energy production. He can reverse them any time he wants.

Additionally he declared war on Canadian energy, Construction on the long disputed Keystone XL oil pipeline has been halted as President Joe Biden revoked its permit. Biden, on his first day in office, said the pipeline isn't consistent with the new administration's "economic and climate imperatives.”

On Feb 22, Biden halted new oil and gas drilling in the name of climate change. Russia invaded Ukraine 2 days later.

Senile Biden says now is the time to "accelerate the transition to clean energy." His attack on America continues

Don't act surprised when Senile Biden says the next phase in the 'transition to the green economy' is a tax on how many miles you drive, and blames it all on Russia

|

|

Quote

| 1 user liked this post |

03-08-2022, 11:59 AM

03-08-2022, 11:59 AM

|

#93

|

|

Valued Poster

Join Date: Nov 11, 2012

Location: Pittsburgh

Posts: 16,225

|

Former Obama U.S. Treasury official Mark Mazur says quiet part out loud: ‘We don’t want lower prices for fossil-fuel buyers, we prefer higher prices’ to achieve ‘climate change goals’

https://t.co/8aKWjMDJvW

And they found a dementia addled fool to do their bidding. Senile Biden in 2020: "No more subsidies for the fossil fuel industry. No more drilling including offshore. No ability for the oil industry to continue to drill period. It ends."

https://twitter.com/i/status/1501202578033438720

|

|

Quote

| 1 user liked this post |

03-08-2022, 01:43 PM

03-08-2022, 01:43 PM

|

#94

|

|

Valued Poster

Join Date: Jan 21, 2011

Location: Bonerville

Posts: 5,959

|

Why don't one of you knowledgeable experts here from the right, articulate exactly why prices are now higher with the knowledge that there Are already existing Wells for NG, and oil that are not producing or currently part of the upstream part of production?

Specifically tell why a company would not open up a well that's already drilled and produced, and leave it closed?

With any And all permits that are not being used currently, why are they not running to drill?

Why does oil pricing go up internationally vs just domestically?

I'd love to hear the rationalizing of you supposed commodity experts on those topics?

I hear many people on the right call this a war on domestic oil production, but if there are open permits, and people like Steve scalise accusing that this is a political decision, how does that contradict the model of capitalism, and the production of oil right now when it's worth three times what it was 6 months to 12 months ago?

|

|

Quote

| 1 user liked this post |

03-08-2022, 01:57 PM

03-08-2022, 01:57 PM

|

#95

|

|

Premium Access

Join Date: Feb 17, 2020

Location: PA

Posts: 2,704

|

Quote:

Originally Posted by eyecu2

Why don't one of you knowledgeable experts here from the right, articulate exactly why prices are now higher with the knowledge that there Are already existing Wells for NG, and oil that are not producing or currently part of the upstream part of production?

Specifically tell why a company would not open up a well that's already drilled and produced, and leave it closed?

With any And all permits that are not being used currently, why are they not running to drill?

Why does oil pricing go up internationally vs just domestically?

I'd love to hear the rationalizing of you supposed commodity experts on those topics?

I hear many people on the right call this a war on domestic oil production, but if there are open permits, and people like Steve scalise accusing that this is a political decision, how does that contradict the model of capitalism, and the production of oil right now when it's worth three times what it was 6 months to 12 months ago?

|

Because their other wells are currently making orders of magnitude more profit. If they open more wells, their profit will drop. Demand is high. Keep supply artificially low, so profits stay high. This is the same reason why the Saudis aren't producing more. Because they are making more producing the same they they had been using.

If you were in the position where, half of the competition is out of the game, and you are the only supplier, and the things you supply are skyrocketing, you can do two things.

1. Increase your production. This will lead to higher income, but less net profit, because you are spending a small amount more for production. Also, you have the chance to 'calm everyone down' so the prices go back down, resulting in less profit.

2. Don't change anything. Your production and cost of operation remain the same. Your profits skyrocket because demand has skyrocketed. You make the most money. You also fuck the most people.

These are the big moneybags who got a chuckle out of people losing their livelihood when the gulf got fucked with that oil spill. They lost a little bit but relative to the fishermen, was nothing. These are the people who are going to be reporting record profits in the next quarter DESPITE the price going up.

This is capitalism. It fucks the little guy, and lines the pockets of a select few, and this situation is a really good one to argue in favor of the government regulating industry to some degree. I'm not saying all gas production needs to be state owned and operated, but they should at least have some say with regards to 'Hey Oil Execs, stop fucking the minimum wage worker during a world crisis or we are going to put out foot down on you, ok?'

|

|

Quote

| 2 users liked this post |

03-08-2022, 04:05 PM

03-08-2022, 04:05 PM

|

#96

|

|

Valued Poster

Join Date: Nov 11, 2012

Location: Pittsburgh

Posts: 16,225

|

Quote:

Originally Posted by eyecu2

Why don't one of you knowledgeable experts here from the right, articulate exactly why prices are now higher with the knowledge that there Are already existing Wells for NG, and oil that are not producing or currently part of the upstream part of production?

Specifically tell why a company would not open up a well that's already drilled and produced, and leave it closed?

With any And all permits that are not being used currently, why are they not running to drill?

Why does oil pricing go up internationally vs just domestically?

I'd love to hear the rationalizing of you supposed commodity experts on those topics?

I hear many people on the right call this a war on domestic oil production, but if there are open permits, and people like Steve scalise accusing that this is a political decision, how does that contradict the model of capitalism, and the production of oil right now when it's worth three times what it was 6 months to 12 months ago?

|

If you knew anything about oil and gas exploration, you would know it is not that simple to bring a new well online. And you would also know that there is typically a long lead time in drilling new wells. There is geological work that needs done to minimize the risk of dry holes, drilling rigs need to be contracted or scheduled, crews need to be available, supplies need to be ordered and available, etc, etc. You don't just go from saying increase production to seeing it instantaneously happen.

As to wells that may be shut in (and please provide the details on how many of these there are because there is not some vast number out there, are they oil or NG, etc) you would also realize if you knew anything about oil and gas that there has to be work done after a well is complete to connect it to transportation and distribution systems. Pipelines just don't build themselves. Again companies have to deal with crew issues, supply issues, etc. If you really think companies aren't pumping what they can at these price levels in order to maximize profits and instead just letting the oil sit in the ground for when prices at some point fall, well you don't understand business.

And then there are the storage costs once the oil is pumped. Depending on where the well is located and a companies customers, they may need to store the oil til the customer needs it. And storage is not unlimited nor is it free

Now factor in a White House that has been extremely unfriendly and declared war on the oil and gas industry and there is even less incentive to risk capital at this time even if rigs could be obtained

|

|

Quote

| 3 users liked this post |

03-08-2022, 04:20 PM

03-08-2022, 04:20 PM

|

#97

|

|

Valued Poster

Join Date: Nov 11, 2012

Location: Pittsburgh

Posts: 16,225

|

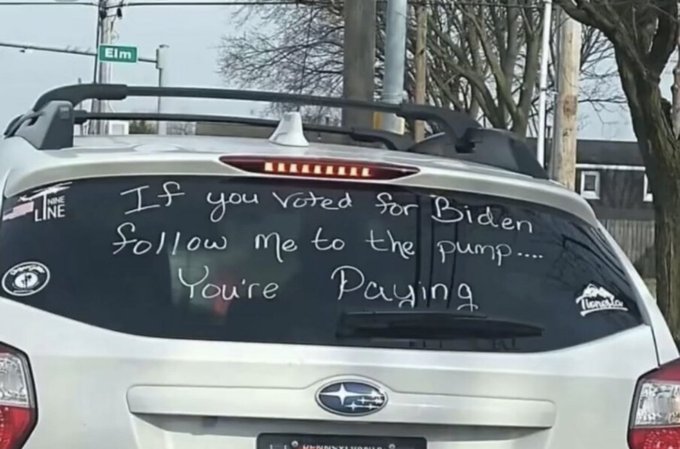

No one respects Senile Biden

Saudi and UAE leaders declined to have a call with Biden regarding Ukraine and the spike in oil prices

And back in the US:

|

|

Quote

| 4 users liked this post |

03-08-2022, 04:35 PM

03-08-2022, 04:35 PM

|

#98

|

|

Valued Poster

Join Date: Nov 11, 2012

Location: Pittsburgh

Posts: 16,225

|

Saying the quiet part out loud - Senile Biden by his actions wants the high cost of oil to satisfy his crazy climate objectives

Biden economic advisor Brian Deese: "The only viable path to energy independence" is to reduce fossil fuel use to "zero."

https://twitter.com/i/status/1501286901868810247

|

|

Quote

| 1 user liked this post |

03-08-2022, 05:36 PM

03-08-2022, 05:36 PM

|

#99

|

|

Valued Poster

Join Date: Jan 21, 2011

Location: Bonerville

Posts: 5,959

|

Quote:

Originally Posted by berryberry

If you knew anything about oil and gas exploration, you would know it is not that simple to bring a new well online. And you would also know that there is typically a long lead time in drilling new wells. There is geological work that needs done to minimize the risk of dry holes, drilling rigs need to be contracted or scheduled, crews need to be available, supplies need to be ordered and available, etc, etc. You don't just go from saying increase production to seeing it instantaneously happen.

As to wells that may be shut in (and please provide the details on how many of these there are because there is not some vast number out there, are they oil or NG, etc) you would also realize if you knew anything about oil and gas that there has to be work done after a well is complete to connect it to transportation and distribution systems. Pipelines just don't build themselves. Again companies have to deal with crew issues, supply issues, etc. If you really think companies aren't pumping what they can at these price levels in order to maximize profits and instead just letting the oil sit in the ground for when prices at some point fall, well you don't understand business.

And then there are the storage costs once the oil is pumped. Depending on where the well is located and a companies customers, they may need to store the oil til the customer needs it. And storage is not unlimited nor is it free

Now factor in a White House that has been extremely unfriendly and declared war on the oil and gas industry and there is even less incentive to risk capital at this time even if rigs could be obtained

|

Berry-. I spent 12 years in a high level role in oil and gas production specifically. You know more about putting milk on your lucky charms than you do about how wells operate.

Many Wells specifically in Western Pennsylvania and West Virginia, dig into the marcellus, devonian and Utica shale plains. High pressure Wells on a gathering line can be both good and bad. But a high pressure well that is on a gathering line with 10 other Wells, will literally shut in, or shut down the other Wells on that same line. The fact of the matter is oil and gas is only sold at cost or below cost, when operating companies need to generate revenue to stay afloat. Otherwise they should have well off, or minimize the production until profits and pricing are more desirable.

Drill sites go from beginning to production in usually less than 9 months depending on lots of things. But the most expensive thing to produce a well is water. The fact that you didn't mention that at all tells me you know zero or very little about how Wells are produced. Production water / wastewater can be used to produce another well, so usually has to be truck from site to site, which is one of the bigger delays when it comes to actually fracking / producing a well.

When it comes to production lines and gathering lines, a vast majority of these Wells are placed strategically along a corridor root so it's not a big deal to add new wells on with usually a minimum run of a mile or two of pipe, but for bigger production runs that have to go onto a midstream plant, then they have to go through a stabilization and compressors.

I specifically asked if any of you guys on the right understood why things didn't happen a certain way and you didn't hit on a single valid point. Why you pretend and pose on your keyboard, you know very little about what it takes to produce a gas well, let alone an oil well. I've been involved in the financials and operational expenses associated to oil and gas well productions for upstream and midstream groups.

Do some research and come back when you have a better understanding of things, but stop misinforming people on this site about shit you don't know anything about. For example the only thing you know about snubbing is how you treat ppl on a board. You wouldn't know shit about what that means in the production field, or you would have mentioned it. And if you are a real oil field person, or understood what happens on a rig you know what the term tripping pipe means. But you didn't and you don't. The term you used about geology in the oil business is not referred to as that, they are called reservoir engineers / engineering so you didn't mention that either. I doubt you know what a Landman does any more than a roustabout does!

Just like you don't know how the economy of gas and oil come out of the prices work, but you pretend like you do. There's a term for people who do shit like that. Poser

|

|

Quote

| 2 users liked this post |

03-08-2022, 05:57 PM

03-08-2022, 05:57 PM

|

#100

|

|

Valued Poster

Join Date: Sep 26, 2021

Location: down under Pittsburgh

Posts: 10,073

|

... How many times and ways can we posters say it?

... "WE DON'T BELIEVE YOU!"

|

|

Quote

| 2 users liked this post |

03-08-2022, 06:25 PM

03-08-2022, 06:25 PM

|

#101

|

|

The Man (He/Him/His)

Join Date: May 7, 2019

Location: The Box... Indeed

Posts: 4,941

|

Eye, given the recent developments with Calcasieu Pass and with Golden Pass being about 2 years out... are you positive or negative on US LNG over the next 3 years?

|

|

Quote

| 1 user liked this post |

03-08-2022, 07:40 PM

03-08-2022, 07:40 PM

|

#102

|

|

Valued Poster

Join Date: Jan 21, 2011

Location: Bonerville

Posts: 5,959

|

Quote:

Originally Posted by HDGristle

Eye, given the recent developments with Calcasieu Pass and with Golden Pass being about 2 years out... are you positive or negative on US LNG over the next 3 years?

|

Once those LNG plants are up and running full bore, the cost of gas will likely go up locally, and down internationally. The export business is great for producers and all the gas lines and midstream large lines will be banking money. Because local gas will now be considered a global commodity even more so, we will see costs go up 1.5 to 2x to "normalize" the value. But states like PA will create excise taxes for gas on midstream lines that will keep it from being too profitable only to export. The reality of our pricing is that production cost is sub 1.00 per mmf. and the time it reaches the coast is triple or so export plants. The value though is that in Japan they pay 18 to 20 times that. So their costs will likely come way down, while ours goes up slightly. Depends on how much gas floods the market but LNG is not a cheap product to transport via large shipping. What's funny is a lot of those plants started off as import sites originally to bring natural gas and petroleum products into the US and now they've been re-engineered to be export sites.

Relative to my economic position on natural gas producers, it's a long-term hold as I see production increasing, especially with the current state of pricing we're more lines and Wells will be brought into production. I can see profits for several domestic companies being through the roof.

Of course that's off the back of consumers just like always. Except this time it will be primarily by large volume versus limited availability.

|

|

Quote

| 1 user liked this post |

03-08-2022, 08:09 PM

03-08-2022, 08:09 PM

|

#103

|

|

The Man (He/Him/His)

Join Date: May 7, 2019

Location: The Box... Indeed

Posts: 4,941

|

Your credentials check out, my man

|

|

Quote

| 1 user liked this post |

03-08-2022, 09:11 PM

03-08-2022, 09:11 PM

|

#104

|

|

Valued Poster

Join Date: Jan 21, 2011

Location: Bonerville

Posts: 5,959

|

Quote:

Originally Posted by onawbtngr546

Because their other wells are currently making orders of magnitude more profit. If they open more wells, their profit will drop. Demand is high. Keep supply artificially low, so profits stay high. This is the same reason why the Saudis aren't producing more. Because they are making more producing the same they they had been using.

If you were in the position where, half of the competition is out of the game, and you are the only supplier, and the things you supply are skyrocketing, you can do two things.

1. Increase your production. This will lead to higher income, but less net profit, because you are spending a small amount more for production. Also, you have the chance to 'calm everyone down' so the prices go back down, resulting in less profit.

2. Don't change anything. Your production and cost of operation remain the same. Your profits skyrocket because demand has skyrocketed. You make the most money. You also fuck the most people.

These are the big moneybags who got a chuckle out of people losing their livelihood when the gulf got fucked with that oil spill. They lost a little bit but relative to the fishermen, was nothing. These are the people who are going to be reporting record profits in the next quarter DESPITE the price going up.

This is capitalism. It fucks the little guy, and lines the pockets of a select few, and this situation is a really good one to argue in favor of the government regulating industry to some degree. I'm not saying all gas production needs to be state owned and operated, but they should at least have some say with regards to 'Hey Oil Execs, stop fucking the minimum wage worker during a world crisis or we are going to put out foot down on you, ok?'

|

Lol. Pretty much right

|

|

Quote

| 1 user liked this post |

03-08-2022, 09:41 PM

03-08-2022, 09:41 PM

|

#105

|

|

Valued Poster

Join Date: Nov 11, 2012

Location: Pittsburgh

Posts: 16,225

|

Quote:

Originally Posted by eyecu2

Berry-. I spent 12 years in a high level role in oil and gas production specifically. You know more about putting milk on your lucky charms than you do about how wells operate.

|

Blah, blah, blah, blah, blah

You are all butthurt because I responded to your silliness with actual facts and it made you feel small and insignificant.

I called out your BS about all these wells being shut-in - which you clearly know was misinformation on your part.

And you continue to completely ignore the negative environment Senile Biden and the libtards have created for the oil and gas industry which has hurt production. You continuing to ignore this shows just how disingenuous you are.

In fact Senile Biden's allies in Congress just months ago pressured oil executives to decrease outputs because of climate change. In late October for example, the House Oversight and Reform Committee called in the CEOs of Exxon, BP, Shell, and Chevron pressuring them to explain what steps they are taking to produce less oil and gas, with Rep. Hank Johnson (D., Ga.) alleging that "the world can't wait" any longer. At the time, gas prices were hovering around a 10-year high.

But go ahead, keep defending Senile Biden and spreading your miss-information, that is all you seem capable of doing

|

|

Quote

| 2 users liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|