Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

649 |

| MoneyManMatt |

490 |

| Still Looking |

399 |

| samcruz |

399 |

| Jon Bon |

397 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| Starscream66 |

281 |

| You&Me |

281 |

| George Spelvin |

270 |

| sharkman29 |

256 |

|

Top Posters

Top Posters |

| DallasRain | 70813 | | biomed1 | 63467 | | Yssup Rider | 61115 | | gman44 | 53307 | | LexusLover | 51038 | | offshoredrilling | 48752 | | WTF | 48267 | | pyramider | 46370 | | bambino | 42980 | | The_Waco_Kid | 37283 | | CryptKicker | 37225 | | Mokoa | 36497 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

04-03-2021, 09:11 PM

04-03-2021, 09:11 PM

|

#76

|

|

Valued Poster

Join Date: Jan 9, 2010

Location: Nuclear Wasteland BBS, New Orleans, LA, USA

Posts: 31,921

|

Quote:

Originally Posted by lustylad

You're a real fucking spoilsport, aintcha? Israel has recently normalized relations with UAE, Bahrain, Sudan, Morocco and Oman - and that counts for nothing? What the fuck are YOU capable of other than being such a party pooper?

Fyi - Moroccan troops fought Israel in the 1973 Yom Kippur War. So you're factually incorrect.

|

didn't know that about morocco. they must've flown their troops to egypt.

|

|

Quote

| 1 user liked this post |

04-03-2021, 09:14 PM

04-03-2021, 09:14 PM

|

#77

|

|

Valued Poster

Join Date: Feb 13, 2011

Location: Denver, CO

Posts: 1,853

|

Quote:

Originally Posted by dilbert firestorm

hes not going to repent.

he's a phony christian who pretends to be one.

|

Kinda like all the christian "clients" on this board, huh?

|

|

Quote

| 2 users liked this post |

04-03-2021, 10:28 PM

04-03-2021, 10:28 PM

|

#78

|

|

Valued Poster

Join Date: Jan 9, 2010

Location: Nuclear Wasteland BBS, New Orleans, LA, USA

Posts: 31,921

|

Quote:

Originally Posted by pfunkdenver

Kinda like all the christian "clients" on this board, huh?

|

well, they're not saints for sure.

|

|

Quote

| 1 user liked this post |

04-03-2021, 10:41 PM

04-03-2021, 10:41 PM

|

#79

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,991

|

Quote:

Originally Posted by lustylad

I can only shudder when I try to imagine how these bills are drafted. I visualize a bunch of aging, '60s hippie dipshits sitting around a conference table on Capitol Hill vying to insert the most humongous amounts for the most frivolous virtue-signaling spending purposes into each bill.

"I want $10 billion for SOCIAL EQUITY INFRASTRUCTURE!" screams one purple-haired woman from Liz Warren's staff.

"I'll see your $10 billion and raise you another $20 billion!" counters Maxine Watters' BLM advisor.

"Fuck that! Go big or go home! Let's spend $100 billion on 'social equity' - and no GAO tabs on where the money goes! I sure as hell don't want anyone to know when I funnel it back as campaign donations!" yells AOC's boyfriend Riley Roberts.

"Now let's move on to all the cool Greenie stuff masquerading as infrastructure!"

Do you think I'm kidding? I'll bet you dollars to donuts it's close to reality. The inmates are now running the asylum. The bulls are stampeding through the streets, trampling everyone in sight. The alcoholics have been given the keys to the liquor cabinet. Pick your metaphor, it ain't pretty. Never let a good pandemic go to waste!

It's enough to make me yearn for the days of odumbo and his misspent 2009 stimulus program. That one totaled a mere $828 billion, if my memory is correct. According to Larry Summers who helped put it together, the ARRA ("American Recovery and Reinvestment Act") was a mere one-sixth the size of the $1.9 trillion covid-19 "relief" package the dim-retards enacted last month, even before the latest faux-infrastructure blowout plan. All of this is an economic and fiscal disaster-in-the-making. The only thing that might save us now is a new reinvigorated Tea Party movement that is six times as strong and determined as the original one.

Here is the WSJ's initial reaction to the latest Biden fiasco plan. The dim-retards have completely perverted the meaning of the word "infrastructure" - just as they previously stretched beyond all logic and recognition the meaning of "covid relief".

Roads & bridges - $115 bn

Airports - $25 bn

Ports & Waterways - $17 bn

Bottom Line:

1. Total Infrastructure = 7%

2. Total for Dim-Retard Slush Fund Categories to Buy Votes and Reward Crooked Friends = $2.19 trillion or 93%!

|

Hilarious! This is golden! You've one upped Gaston Glock and now deserve the award of Best Writer on Eccie. Your writing style is reminiscent of Adam Smith. Not the 18th century economist, but rather the 20th century author and economist who wrote The Money Game.

Yes, Summers has been all over the news saying the stimulus bill was way too big, and Biden's so-called "infrastructure bill" is really a sop to the progressive left, concentrating first and foremost on green energy.

|

|

Quote

| 1 user liked this post |

04-03-2021, 10:52 PM

04-03-2021, 10:52 PM

|

#80

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,991

|

Quote:

Originally Posted by lustylad

Ok, so the spending blowout is only one side of the coin. Raising your taxes is the other poison, as tiny noted.

Here's the WSJ again:

Here Come the Biden Taxes

The middle class will pay for the largest tax increase since 1968.

|

I believe the huge increase in median household income and the fall in unemployment among hispanics, whites and blacks during the Trump years, pre-covid, was largely attributable to the lower corporate income tax. U.S. corporations were competitive with foreign companies again. The government took less so there was more money left over to hire people and expand. And yes, while Biden's 28% corporate rate sounds reasonable, add in state income taxes and we're back to having one of the highest rates in the developed world.

The 62% total rate on corporate income plus dividends and capital gains is eye opening. Australia doesn't tax dividends. Belgium and New Zealand, both of which have leftist governments, don't tax capital gains. If Biden gets his way, I suspect we'll have among the highest maximum rates on capital gains and dividends in the developed world too, if not the highest.

As to Sinema and Manchin, the Biden/Schumer/Pelosi strategy will probably be to buy them off with pork for Arizona and West Virginia, to try to get them to agree to raise taxes.

|

|

Quote

| 1 user liked this post |

04-04-2021, 01:10 AM

04-04-2021, 01:10 AM

|

#81

|

|

Valued Poster

Join Date: Aug 7, 2010

Location: OPKS

Posts: 7,240

|

Quote:

Originally Posted by lustylad

See my previous post #47. Far from being a "trumptard", Mr. Poole is a recognized non-partisan expert on transportation and infrastructure. You are a nobody. But go ahead and critique Mr. Poole's proposals, if you can. Tell us why raising taxes, slowing the economic recovery and adding yet more to the national debt is preferable to letting private capital play a role.

|

Poole had nothing to do with Trump, thus he could never be a trumptard.

|

|

Quote

| 1 user liked this post |

04-05-2021, 09:04 AM

04-05-2021, 09:04 AM

|

#82

|

|

Valued Poster

Join Date: Oct 1, 2013

Location: Dallas TX

Posts: 12,555

|

Tax's on corps up 43 % if pudding gets his way ,,,, yup were doomed

|

|

Quote

| 1 user liked this post |

04-21-2021, 03:53 PM

04-21-2021, 03:53 PM

|

#83

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,338

|

Perhaps no one will (directly) "pay for all this shit" -- but in the end, EVERYONE will!

Perhaps no one will (directly) "pay for all this shit" -- but in the end, EVERYONE will!

.

Virtually unlimited spending? Uh-oh! Looks like a job for Professor Stephanie! (MMT to the rescue.)

For starters, consider the current debate on the corporate tax rate. As others have pointed out on this site, raising it to formerly excessive levels would once again incentivize U.S. firms to arrange inversions and other maneuvers, just as many did during the middle of the last decade.

As the editorial board of the Reason Foundation (and many other people) have pointed out, even policymakers in "socialist" Scandinavia understand this.

https://reason.com/2021/04/01/joe-bi...m_medium=email

Now check this:

https://www.usatoday.com/story/opini...mn/7178364002/

Got it? Just by raising corporate tax rates, Biden can "rein in corporate power and launch a new era in which the wealthy finance large-scale investment for the public good."

Apparently this sort of ridiculousness is what passes for reasoned debate in the progressive world nowadays.

Do you think this guy paused to think through any of this nonsense before submitting this piece? Or does he think all he has to do is appeal to those who suffer from an extreme case of innumeracy?

If I remember correctly, it appears that the corporate income tax was collecting around 1.1% of GDP annually in 2018-2019, compared with around 1.7% during the 15-year period preceding those years.

In other words, the revenue deficit relative to the long-term run rate is about 0.6% of GDP, or roughly $130 billion. Needless to say, that won't cover more than a few pennies on the dollar of contemplated non-infrastructure infrastructure, "green new deal," or any other laundry list of progressives' pet projects.

So, if unspecified "rich people" aren't going to pay for much of this, then who is?

Well, I'm sorry, but there are no easy economic free lunches. If we burden the economy with even more massive debt loads, we will be virtually assured of enduring a slow-growth slog for years to come as the bloated debt hangs like a rotting dead albatross around its neck. Students of this issue quite rightly point to the Japanese experience of the last three decades.

This does not augur well for citizens of working- and middle-class America who need a vibrant and growing economy in order to have the best shot at greater prosperity.

So -- even though progressives have promised those making less than $400K annually that they will not see a tax increase, they seem hell-bent on imposing one, at least in a de facto sense, by indirect means.

.

|

|

Quote

| 4 users liked this post |

04-21-2021, 09:12 PM

04-21-2021, 09:12 PM

|

#84

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,991

|

Good post Midnight.

Quote:

Originally Posted by CaptainMidnight

|

The good people at Reason fail to consider state income taxes, which average around 4% or 5%. Add to the 28% federal rate proposed by Biden and you're at a 32% or 33% overall corporate rate, among the highest in the world, and much higher than Scandinavian countries.

Quote:

Originally Posted by CaptainMidnight

Well, I'm sorry, but there are no easy economic free lunches. If we burden the economy with even more massive debt loads, we will be virtually assured of enduring a slow-growth slog for years to come as the bloated debt hangs like a rotting dead albatross around its neck. Students of this issue quite rightly point to the Japanese experience of the last three decades.

|

I brought this up earlier in the thread. Bambino and I among others are freaked out about the national debt. I told him maybe we're just being paranoid, as the economic policy "brain trust" of the eccie board (LustyLad and Captain Midnight) is not freaked out. Well, maybe I was wrong.

The difference between the USA and Japan is that the Japanese are prolific savers. And Japan runs perennial current account surpluses. It's the Japanese, not foreigners, who own most Japanese debt. Japan's not going to have a currency crisis because of its foreign debt.

The USA on the other hand, well, our external debt (government and corporate) stands at 21 trillion, or a touch over 100% of GDP. Our net federal government debt is around the same level. You look at southeast Asian countries that went through a depression in 1998 to 2003, and Latin American countries that went through hyperinflationary periods before and after that, and I bet their numbers as a % of GDP weren't as out of whack as ours are now. Granted, most of our external debt and all of our government debt is in dollars, so if the dollar depreciates we're not faced with huge interest bills in our local currency, like say Argentina and Indonesia were when their currencies depreciated, but still our numbers are out of whack.

I read an interview with Larry Summers, where he predicted we're going to have one of three outcomes, each with about a 1/3rd probability of occurring,

1. We have too much inflation as a result of the massive stimulus provided by politicians in response to Covid. The Fed doesn't do enough to combat the inflation. We go into a period of stagflation, like the early 1980's.

2. We have too much inflation (same as scenario "1") but the Fed overreacts, sending us into a deep recession.

3. Neither "1" nor "2" happens, and we manage to muddle through this without huge economic problems. We end up with something like what you're describing above for Japan.

None of those sound like a happy ending.

|

|

Quote

| 2 users liked this post |

04-22-2021, 08:48 AM

04-22-2021, 08:48 AM

|

#85

|

|

Valued Poster

Join Date: Oct 1, 2013

Location: Dallas TX

Posts: 12,555

|

WE are NOT , just kick the can Enlightened superiority

|

|

Quote

| 1 user liked this post |

05-10-2021, 09:26 PM

05-10-2021, 09:26 PM

|

#86

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,338

|

Will we be facing a "muddle-through" sceanrio for much of the 2020s?

Will we be facing a "muddle-through" sceanrio for much of the 2020s?

.

Quote:

Originally Posted by Tiny

I read an interview with Larry Summers, where he predicted we're going to have one of three outcomes, each with about a 1/3rd probability of occurring,

1. We have too much inflation as a result of the massive stimulus provided by politicians in response to Covid. The Fed doesn't do enough to combat the inflation. We go into a period of stagflation, like the early 1980's.

2. We have too much inflation (same as scenario "1") but the Fed overreacts, sending us into a deep recession.

3. Neither "1" nor "2" happens, and we manage to muddle through this without huge economic problems. We end up with something like what you're describing above for Japan.

None of those sound like a happy ending.

|

For sure, none of those scenarios sound exactly like anyone's idea of a happy ending. My sense of the issue is that the coming decade will be much better for asset owners than for America's working- and middle classes.

The recent Summers comments have been the subject of much discussion lately. Remember, he morphed form "Mr. Escape Velocity" back around 2010 to "Mr. Secular Stagnation" just a few years later.

I believe it's more likely than not that we'll experience something like scenario 3 above; the "muddle-through" economy.

Obviously there is now a quick, strong reflation from what Todd Buchholz recently referred to as the "Great Cessation," but then what is the follow-through? We've dropped sizeable amounts of cash into the accounts of nearly every non-affluent household in the land, not just the neediest. This is likely to pull a lot of consumption that might have occurred over the next 12-24 months into the much nearer-term future.

Following that, a significant slowdown is likely as the current rate of borrowing and printing cannot be sustained indefinitely, notwithstanding what Professor Stephanie (Kelton) might be telling us.

Massive binges on fiat credit are likely to leave our economy with a long, very uncomfortable hangover as the marginal product of debt accumulation declines, just as in Japan over the years.

.

|

|

Quote

| 2 users liked this post |

05-10-2021, 09:34 PM

05-10-2021, 09:34 PM

|

#87

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,338

|

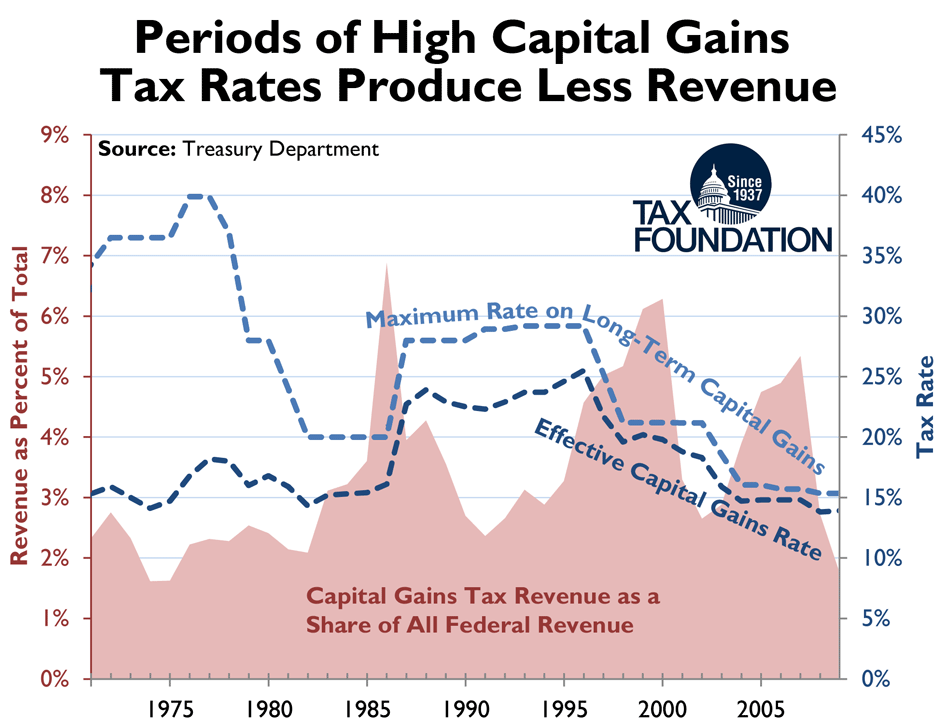

Regarding taxation of capital gains, some have learned nothing from history

Regarding taxation of capital gains, some have learned nothing from history

.

There is another group that "isn't going to pay for any of this shit."

That is, investors who pay capital gains tax. Biden's camp proposes to push the rate (now 23.8%) all the way to 43.4%

Is that a good idea? A lot of people think so, as a "new study" estimates that the revenue-maximizing capital gains tax rate may be about 47%.

https://www.taxpolicycenter.org/taxv...tes-47-percent

Seriously? What rank bullshit! But this is the sort of nonsense that actually passes for policy debate in some circles.

The last time liberals in congress pushed the capital gains tax rate to nearly 40% was in the 1970s. It didn't work as well as anticipated, and in 1978 Jimmy Carter was prevailed upon to sign legislation lowering the rate to 28% (not quite good enough, but at least it was a start).

Here is a table that shows capital gains tax collections by year, going all the way back to 1954:

https://taxfoundation.org/federal-ca...storical-data/

Notice a trend beginning in 1979?

Selling assets is (normally, anyway) entirely optional.

If progressives push the rate significantly, the anticipated additional revenue will simply pull a disappearing act.

.

|

|

Quote

| 2 users liked this post |

05-11-2021, 12:04 AM

05-11-2021, 12:04 AM

|

#88

|

|

Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 18,703

|

Quote:

Originally Posted by CaptainMidnight

There is another group that "isn't going to pay for any of this shit."

That is, investors who pay capital gains tax. Biden's camp proposes to push the rate (now 23.8%) all the way to 43.4%

Is that a good idea? A lot of people think so, as a "new study" estimates that the revenue-maximizing capital gains tax rate may be about 47%.

https://www.taxpolicycenter.org/taxv...tes-47-percent

Seriously? What rank bullshit! But this is the sort of nonsense that actually passes for policy debate in some circles. |

Hey Cap'n - that Tax Policy Center article is a real hoot!

The author cites a study by two Princeton knuckleheads named Agersnap and Zidar. After praising them for producing a "clever new analysis" utilizing 15 models, he goes on to tell us those models are utterly worthless:

"... estimates of the revenue-maximizing tax rates all come with wide margins of error, especially in the models that generated those high tax rates. One of those estimates suggests a potential range of revenue-maximizing tax rates from 0 to 94 percent. I doubt revenues from taxing long-term capital gains income can be maximized at rates remotely near 94 percent, and they certainly cannot be maximized when rates are zero. The margin of error on another model ranges from negative tax rates to 100 percent, with both end points also being implausible."

If I understand correctly, these two Princeton wizards are telling us they can confidently predict (with 95% certainty!) that the optimal revenue-maximizing rate is somewhere between 0% and 94%. So hey, let's just split the difference and call it 47%!

Seriously? This is what passes as economic scholarship nowadays at one of the most prestigious (but "woke") Ivy colleges in the land?

All I can do is echo the Waco Kid...

BAAHAHAHAHAHA!!!

Quote:

Originally Posted by CaptainMidnight

The last time liberals in congress pushed the capital gains tax rate to nearly 40% was in the 1970s. It didn't work as well as anticipated, and in 1978 Jimmy Carter was prevailed upon to sign legislation lowering the rate to 28% (not quite good enough, but at least it was a start).

Here is a table that shows capital gains tax collections by year, going all the way back to 1954:

https://taxfoundation.org/federal-ca...storical-data/

Notice a trend beginning in 1979?

Selling assets is (normally, anyway) entirely optional.

If progressives push the rate significantly, the anticipated additional revenue will simply pull a disappearing act. |

They say a picture is worth a thousand words. Here's a graph for 1970-2009.

I couldn't find a more up-to-date graph (if I had more time & patience I could probably create one from the St. Louis Fed website) but eyeballing your numbers for 2010-2018 indicates the correlation persists.

History demonstrates if you want to produce a nice, hefty spike in capital gains tax revenues, you should be cutting the rates, not raising them!

|

|

Quote

| 2 users liked this post |

05-11-2021, 12:24 AM

05-11-2021, 12:24 AM

|

#89

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,991

|

I started to read the paper by the two Princeton economists a couple of weeks ago. I stopped when I got to this:

We find a total of 584 changes in state capital gains tax rates throughout our panel. Most of these changes are fairly small, which reflects the fact that our tax rate measure includes the effect of deductions and other minor provisions of state tax codes, so any changes to these provisions can cause the capital gains tax rate to change. The largest changes, however, are in excess of 4 percentage points (Table A.1). In total, we have 128 state tax changes that exceed 1 percentage point in absolute value.

These two bozos are taking changes in state capital gains tax rates, most of which are below one percentage point, and looking at the correlation between the change in tax rate and change in tax revenues. And you're going to extrapolate that to an increase in the rate from 23.8% to 43.4%? If they raise the capital gains tax rate by 1%, then yeah, it's not going to affect a taxpayer's propensity to sell the asset. Raise it by 20% and it damn sure will. Maybe he won't sell, so the government gets no revenues. Or maybe he'll do like John Kerry and his wife Teresa Heinze Kerry. Sell all his assets, preferably before they hike the rate, and invest everything in tax free municipal bonds. Why invest in something risky when you're going to pay a federal + state capital gains tax of 50% if you make money, but only get a $3,000 tax deduction if you lose everything? The Democrats in Washington, D.C. are going to kill the goose that laid the golden egg, and get 43.4% of nothing instead of 23.8% of something.

Btw, earlier this year Larry Summers slapped his name onto another paper with one of these Princeton jokers. That too was trying to justify jacking up the capital gains tax rate. I didn't read it either.

I believe both the Congressional Budget Office and the Joint Committee on Taxation, which are required by federal law to estimate the cost of proposed legislation, assume any capital gains tax rate in excess of 28% will reduce tax revenues. So this sudden burst of research looks like an attempt to get them to jack that number up.

So why would you increase the capital gains tax if it were going to reduce federal revenues? Barrack Obama was asked this in 2008 by Charlie Gibson. He said he'd raise the tax "for the purposes of fairness." That makes a hell of a lot of sense. You make everyone worse off, in order to make the system "fairer." Apparently Biden shares a similar philosophy.

|

|

Quote

| 2 users liked this post |

05-11-2021, 01:05 AM

05-11-2021, 01:05 AM

|

#90

|

|

Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 18,703

|

Quote:

Originally Posted by Tiny

I started to read the paper by the two Princeton economists a couple of weeks ago. I stopped when I got to this:

We find a total of 584 changes in state capital gains tax rates throughout our panel...

|

Yeah, I saw the reference to STATE capital gains taxes and scratched my head. So that's how they generated 15 "models".

Would someone please explain to me how/why state revenue experiences should inform federal tax policy on this question? (Answer: They shouldn't.)

Not only are state rates dwarfed by the federal levy (even in confiscatory dim-retard havens like New Yuck and Californicate), but state taxes were also deductible prior to the 2017 GOP tax reform.

Quote:

Originally Posted by Tiny

So why would you increase the capital gains tax if it were going to reduce federal revenues? Barrack Obama was asked this in 2008 by Charlie Gibson. He said he'd raise the tax "for the purposes of fairness." That makes a hell of a lot of sense. You make everyone worse off, in order to make the system "fairer." Apparently Biden shares a similar philosophy.

|

+1

Want to know how to shut up a progressive SJW? Ask him/her to define EXACTLY what "paying their fair share" means!

What's the exact rate of taxation at which that nebulous thing called FAIRNESS is finally achieved? 50%? 75%? 110? They never say.

|

|

Quote

| 2 users liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|