Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

646 |

| MoneyManMatt |

490 |

| Still Looking |

399 |

| samcruz |

399 |

| Jon Bon |

396 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| Starscream66 |

281 |

| You&Me |

281 |

| George Spelvin |

265 |

| sharkman29 |

255 |

|

Top Posters

Top Posters |

| DallasRain | 70796 | | biomed1 | 63315 | | Yssup Rider | 61036 | | gman44 | 53296 | | LexusLover | 51038 | | offshoredrilling | 48678 | | WTF | 48267 | | pyramider | 46370 | | bambino | 42772 | | CryptKicker | 37222 | | The_Waco_Kid | 37128 | | Mokoa | 36496 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

12-01-2021, 09:08 AM

12-01-2021, 09:08 AM

|

#811

|

|

Valued Poster

Join Date: Oct 1, 2013

Location: Dallas TX

Posts: 12,555

|

1970ssss Redux

|

|

Quote

| 1 user liked this post |

12-01-2021, 09:24 AM

12-01-2021, 09:24 AM

|

#812

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by CaptainMidnight

.

But here is why I doubt that inflation will look like the most serious concern facing the nation a year or two from now:

Here's a quick rundown of why -- within the next 12-24 months -- inflation could recede sharply, unlike in the 1970s. An entirely different set of dynamics is driving it.

Immediately after World War II ended, we saw what could have been called the mother of all supply capacity issues, and U.S. businesses needed time to completely revamp factories and production patterns to even begin to catch up.

Needless to say, supply of consumer goods was severely constricted during the war. Almost everything was in short supply -- and many items were strictly rationed if available at all. At the same time, the household saving rate was as high as 25% during some of the war years. People were urged to be patriotic and buy "war bonds." The nation had a deep pool of savings and little opportunity to spend them.

Men who fought in WWII came home, got married, started families, bought cars, and bought homes or leased apartments. Demand for almost everything shot through the roof. Refrigerators, washing machines, furniture, radios, TV sets (new then!), cars, you name it.

It took a while for U.S. industrial capacity to shift from guns, ammunition, tanks, airplanes, etc. to cars, appliances, and other civilian goods. But, understandably, they put on a full-court press to get it done. As has so often happened throughout history, supply shortages turned into something of a glut after massive pent-up demand was satisfied. Inflation raged in 1946-47 (at much higher rates than today), but disappeared in 1949 when the U.S. entered a short deflationary recession.

Although the causes are completely different, we now have a similar household savings/supply imbalance. According to some estimates, personal bank balances are $2-2.5 trillion greater than the pre-pandemic trend owing to massive covid relief packages which greatly exceeded pandemic-induced salary and wage deficits. Inflation rates will remain elevated while pent-up demand is satisfied during the supply chain's return to normalcy. Then consumption will slow sharply and inflation rates will likely return to trend in the sort of low-growth trajectory our economy has been following for many years.

So, in my view the "rate of change of the rate of change" in the inflation numbers will itself be changing soon enough, and accelerating to the downside. (Think second derivative.)

The biggest challenges for politicians will occur if the electorate's perception is that wage increases aren't keeping up with the total increase in the consumer price level during the period of higher-than-trend inflation.

.

|

Excellent points...and I concur.

|

|

Quote

| 1 user liked this post |

12-01-2021, 10:11 PM

12-01-2021, 10:11 PM

|

#813

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,937

|

Quote:

Originally Posted by CaptainMidnight

But here is why I doubt that inflation will look like the most serious concern facing the nation a year or two from now....

|

I'm going to do something really stupid, argue with Captain Midnight about economics. I already know I'm going to get my ass kicked. Actually I already got my ass kicked when I argued a similar point with Lusty Lad a few years ago. But I'm a glutton for punishment.

Since this is a little like stepping into the ring with the Muhammed Ali of old, I'm going to need to train first so I can survive. So this is the part where I go run a couple of miles and then come home and drink some raw eggs, like Rocky. OK, actually maybe you should try to picture Pee Wee Herman instead of Rocky, but you get the picture.

I'm going to try to insert an image. If it doesn't work, see this link,

https://ibb.co/HCLW6LD https://ibb.co/HCLW6LD

The blue line on the graph is YoY CPI. The white line is the real interest rate, calculated by subtracting the GDP deflator from the "LENDING interest rate." I didn't go to the trouble to figure out exactly how that's calculated, but I bet the lending rate is something like the prime rate, which is currently 3.25%.

The white curve (real inflation rate) only goes to the end of 2020. The blue curve (CPI) goes to October, 2021. If you extended the white curve to present, the real interest rate would be about -3%. That's the lowest anywhere on the graph, going back to 1960.

Look what happened around 1969 to 1978. The real interest rate slumped to low levels and inflation was sky high, by our historical standards.

Right now my banker will lend me money at 3%, or so he told me. My stockbroker will loan me money against my share portfolio at 0.75%. Meanwhile inflation is 6.2%. Now I'm a conservative fellow, but I imagine a lot of people and businesses are borrowing money hand over fist.

And yet the Fed's still buying bonds! The Fed Funds Rate is 0%, and Fed Funds futures appear to imply the first 0.25% increase won't occur for another 6 months.

More to come. And thanks for your response. While I'm willing to risk my pride for the sake of an argument, I'm sure as hell not willing to risk money. And I agree with WTF, your "macro" thoughts, unlike mine, are worth considering when making investment decisions. I would however part company with my friend in that I believe LustyLad is the other true economic brain in this forum.

|

|

Quote

| 2 users liked this post |

12-01-2021, 10:22 PM

12-01-2021, 10:22 PM

|

#814

|

|

Valued Poster

Join Date: Apr 29, 2013

Location: Milky Way

Posts: 10,914

|

Quote:

Originally Posted by Tiny

I'm going to try to insert an image. If it doesn't work, see this link,

https://ibb.co/HCLW6LD https://ibb.co/HCLW6LD

The blue line on the graph is YoY CPI. The white line is the real interest rate, calculated by subtracting the GDP deflator from the "LENDING interest rate." I didn't go to the trouble to figure out exactly how that's calculated, but I bet the lending rate is something like the prime rate, which is currently 3.25%.

The white curve (real inflation rate) only goes to the end of 2020. The blue curve (CPI) goes to October, 2021. If you extended the white curve to present, the real interest rate would be about -3%. That's the lowest anywhere on the graph, going back to 1960.

Look what happened around 1969 to 1978. The real interest rate slumped to low levels and inflation was sky high, by our historical standards.

Right now my banker will lend me money at 3%, or so he told me. My stockbroker will loan me money against my share portfolio at 0.75%. Meanwhile inflation is 6.2%. Now I'm a conservative fellow, but I imagine a lot of people and businesses are borrowing money hand over fist.

And yet the Fed's still buying bonds! The Fed Funds Rate is 0%, and Fed Funds futures appear to imply the first 0.25% increase won't occur for another 6 months.

More to come. And thanks for your response. While I'm willing to risk my pride for the sake of an argument, I'm sure as hell not willing to risk money. And I agree with WTF, your "macro" thoughts, unlike mine, are worth considering when making investment decisions. I would however part company with my friend in that I believe LustyLad is the other true economic brain in this forum. |

|

|

Quote

| 1 user liked this post |

12-01-2021, 10:45 PM

12-01-2021, 10:45 PM

|

#815

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,937

|

Thanks eccieuser! I don't know how you did that, but it worked!

Welcome back after the hiatus.

|

|

Quote

| 1 user liked this post |

12-01-2021, 11:03 PM

12-01-2021, 11:03 PM

|

#816

|

|

Valued Poster

Join Date: Apr 29, 2013

Location: Milky Way

Posts: 10,914

|

Quote:

Originally Posted by Tiny

Thanks eccieuser! I don't know how you did that, but it worked!

Welcome back after the hiatus.

|

Depending on the device I am using, it's easy. I just don't care to figure it out on the device I don't know how.

Anyway. I just right-click the image, copy image address, then the "insert image" icon between the quote and e-mail link icons. Insert the image address replacing the default https:// . . . . Go directly to the site where the image is being used. Not on the search engine.

Example:

https://arsof-history.org/articles/v...ns_page_1.html

https://www.oxfordreference.com/view...10803095705831

https://www.oxfordreference.com/view...10803095705831

|

|

Quote

| 1 user liked this post |

12-01-2021, 11:09 PM

12-01-2021, 11:09 PM

|

#817

|

|

AKA Admiral Waco Kid

Join Date: Jan 8, 2010

Location: The MAGA Zone

Posts: 37,128

|

Quote:

Originally Posted by eccieuser9500

|

or ... you simply could have copied then pasted the image ....

|

|

Quote

| 1 user liked this post |

12-01-2021, 11:23 PM

12-01-2021, 11:23 PM

|

#818

|

|

Valued Poster

Join Date: Jan 9, 2010

Location: Nuclear Wasteland BBS, New Orleans, LA, USA

Posts: 31,921

|

The waco way is bettet!

|

|

Quote

| 2 users liked this post |

12-02-2021, 09:30 AM

12-02-2021, 09:30 AM

|

#819

|

|

Valued Poster

Join Date: Oct 1, 2013

Location: Dallas TX

Posts: 12,555

|

5.00 a gallons gonna help

|

|

Quote

| 1 user liked this post |

12-02-2021, 10:38 PM

12-02-2021, 10:38 PM

|

#820

|

|

Valued Poster

Join Date: Jan 9, 2010

Location: Nuclear Wasteland BBS, New Orleans, LA, USA

Posts: 31,921

|

Quote:

Originally Posted by dilbert firestorm

The waco way is bettet!

|

oh poo. there its fixed!

The waco way is better!

|

|

Quote

| 1 user liked this post |

12-03-2021, 09:39 AM

12-03-2021, 09:39 AM

|

#821

|

|

Valued Poster

Join Date: Oct 1, 2013

Location: Dallas TX

Posts: 12,555

|

We're living Idiocy the movie I'm done

|

|

Quote

| 1 user liked this post |

12-03-2021, 12:13 PM

12-03-2021, 12:13 PM

|

#822

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

LL is a partisan hack. My praise for him is reserved with a swift kick in the ass. Verbally of course.

LL is a partisan hack. My praise for him is reserved with a swift kick in the ass. Verbally of course.

Quote:

Originally Posted by Tiny

I would however part company with my friend in that I believe LustyLad is the other true economic brain in this forum.

|

One is a Lightening Bolt and the other a Lightening Bug.

|

|

Quote

| 1 user liked this post |

12-06-2021, 12:28 AM

12-06-2021, 12:28 AM

|

#823

|

|

Premium Access

Join Date: Jan 8, 2010

Location: Steeler Nation

Posts: 18,670

|

Exposing WTF as a Lying Partisan Hack...

Exposing WTF as a Lying Partisan Hack...

Quote:

Originally Posted by Tiny

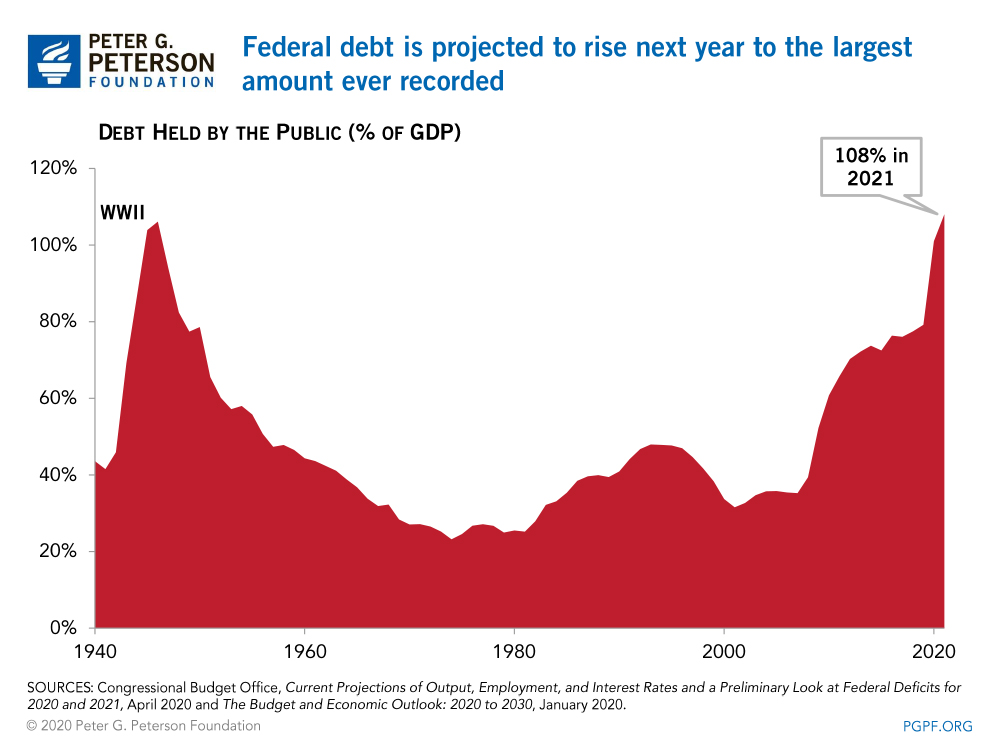

Here's an interesting graph, federal debt held by the public as a % of GDP,

https://fred.stlouisfed.org/series/FYGFGDQ188S

The federal debt, net of government holdings, was around 40% at the end of the Reagan Administration. That's a pretty healthy level. |

Quote:

Originally Posted by WTF

Excellent graph Tiny.

Here's an even better graph that underscores how wtf likes to distort the historical record. Let's look at the same ratio (public debt/GDP) going all the way back to 1940:

A few points....Reagan took it from under 25% to the forties. It had never been over 30% between 1970 and 1980.

Playing loose with the numbers again, wtf?

The actual numbers show the ratio rose from 26.2% in 1980 to 40.9% in 1988.

And why do you fail to point out the ratio was way, way, way over 30% during all those decades prior to the 1970s?

Reagan increased (sic) was almost 2/3.

Caught you lying again! It works out to an increase in the ratio of 56%. That's a full 10 percentage points less than 2/3.

Taken in that context his numbers do not look so great. In fact Bush thought Reagan economics, Voodoo. I tend to agree.

Not even a witch doctor from Port au Prince can cure your cherry-picking ignorance and hyper-partisan bias every time you open your yap and pretend to understand economics! A glance at my graph shows how to put everything in proper context.

Let's start with FDR. Leaving aside his first 2 terms, you can see from the graph that our debt/GDP ratio skyrocketed from 41% in 1940 to 104% in 1945. Oh, dear! That sounds off the charts! And yet, wtf wants us to believe "Reagan started this whole debt mess". Heck, Ronnie looks like a piker compared to what the guy from Hyde Park did 40 years earlier.

But wait, I hear someone say... FDR had to run up all that debt to whip the Nazis and the Japs in WW2, right? Ok, fair enough. But then let's not lose sight of the fact that Reagan increased the debt ratio (much more modestly) in order to outspend the USSR and win the Cold War without firing a shot. Sounds like it was a good idea. I thought so at the time and even more so in retrospect.

Clinton brought that number way down... with Bush Sr and Ross Perot huge helping hands.

You need to study my graph more closely. The debt ratio didn't go down under Bush Sr. In fact, it continued to increase from 40.9% in 1988 to 48.3% in 1992. At least you got one thing right - the ratio receded again under Clinton. When Slick Willy left office it was back down to 34.5%, thanks to a gusher of tax revenues generated by the dot.com boom and the 1997 cut in the capital gains tax, as well as the so-called "peace dividend" that allowed us to slash defense spending nearly in half from 6% of GDP to around 3%. And where did that peace dividend come from? Oh yeah, it was part of Ronnie Reagan's legacy - a gift to Slick Willy from winning the Cold War! So don't forget to thank Ronnie for his "huge helping hand" in producing those budget surpluses during the late 1990s!

It was the best of times for someone like myself who hates debt. You must really hate FDR then.

My man Bush rightly pointing out what an economic fraud Reagan was. Hmm... is that why Bush Sr. was such a loyal Veep for 8 years, because he thought the POTUS he served under was a "fraud"? It seems to me many voters thought Bush Sr. was a fraud when he said "read my lips - no new taxes" and then caved on his promise while in office.

Perot making debt a focal point. Perot was a fucking historical asterisk. His only "accomplishment" was to swing the 1992 election to Slick Willy by siphoning off/splitting the GOP vote.

Clinton, with a huge help from the 1994 newly elected GOP House taking debt on. Look again. The debt didn't start shrinking until Slick Willy's second term.

Alas...it was short lived. Bush was elected and the House started spending like Democrats....wait what was the member when Carter handed off to Reagan? 24%.

First you said 25%, now it's 24%. Of course, I already corrected you once above - the actual number was 26.2%. Just wanted to point out to everyone (again) what a slippery little lying weasel you are.

And folks question why I say Reagan started this whole debt mess.

|

And through your entire false and superficial "analysis", you fail to mention the most obvious take-away that jumps out at anyone taking even a cursory glance at my graph... namely, the STEEPEST CLIMBS in the debt/GDP ratio occurred under the Obama administration (2009-2016) and during the 2020-21 pandemic! But hey, let's go all the way back to the 1980s and pretend everything is Ronnie's fault!

Your modus operandi is always the same - cherry pick, ignore historical context, fudge numbers, move on to the next lie/phony narrative hoping nobody notices and calls you out. You do this shit all the time.

|

|

Quote

| 2 users liked this post |

12-06-2021, 04:54 AM

12-06-2021, 04:54 AM

|

#824

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by lustylad

And through your entire false and superficial "analysis", you fail to mention the most obvious take-away that jumps out at anyone taking even a cursory glance at my graph... namely, the STEEPEST CLIMBS in the debt/GDP ratio occurred under the Obama administration (2009-2016) and during the 2020-21 pandemic! But hey, let's go all the way back to the 1980s and pretend everything is Ronnie's fault!

Your modus operandi is always the same - cherry pick, ignore historical context, fudge numbers, move on to the next lie/phony narrative hoping nobody notices and calls you out. You do this shit all the time.

|

Because of your ignorance of history...you have left out that this country prior to Reagan paid down debt in good times.

That is no longer the case.

Take for example your new Lord and Saviour DJT (who promised to paid said debt down) even before Covid he was ringing up record debt.

Btw...I love how you brag about this not realizing you're admitting how right I am.

Caught you lying again! It works out to an increase in the ratio of 56%. That's a full 10 percentage points less than 2/3.

I've just eyeballed the numbers and you come running like a hall monitor to correct me...like a ignorant thief who corrects the cops who says he stole a 100 bucks..."I only stole 91 dollars!" shouts Lustylad unwittingly admitting he is the thief....or in this case the idiot.

|

|

Quote

| 3 users liked this post |

12-06-2021, 06:06 AM

12-06-2021, 06:06 AM

|

#825

|

|

Valued Poster

Join Date: Jan 16, 2010

Location: Texas

Posts: 51,038

|

Quote:

|

How are we going to pay for all this shit?

|

If one listened to PissLousy ... you know there won't be any "shit"!

The DumboCrats led by PissLousy won't get their "shit" to the Senate!

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|