Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

649 |

| MoneyManMatt |

490 |

| Still Looking |

399 |

| samcruz |

399 |

| Jon Bon |

397 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| Starscream66 |

280 |

| George Spelvin |

267 |

| sharkman29 |

256 |

|

Top Posters

Top Posters |

| DallasRain | 70798 | | biomed1 | 63389 | | Yssup Rider | 61079 | | gman44 | 53297 | | LexusLover | 51038 | | offshoredrilling | 48710 | | WTF | 48267 | | pyramider | 46370 | | bambino | 42878 | | The_Waco_Kid | 37233 | | CryptKicker | 37224 | | Mokoa | 36496 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

02-25-2010, 09:16 AM

02-25-2010, 09:16 AM

|

#46

|

|

Account Disabled

Join Date: Dec 30, 2009

Posts: 2,307

|

For reasons not worth going into  I'm up close & personal with rentals and residential properties.

|

|

Quote

| 1 user liked this post |

02-25-2010, 12:14 PM

02-25-2010, 12:14 PM

|

#47

|

|

Pending Age Verification

User ID: 13797

Join Date: Feb 9, 2010

Location: Atlanta

Posts: 66

My ECCIE Reviews

|

This has been a big topic in my life as of late. What I am finding is that if you are selling a home that is 200K or less, houses are selling rather quickly, a gain may not be made but neither a huge loss.So, if you are planning "on movin on up" it is a fantastic time because higher priced homes can be found a a fantastic deal and can be a great investment for the future.Keep in mind, I specifically am speaking of my area, although my guess is that the circumstances may be similar nation wide.

Just one ladies point of view.

|

|

Quote

| 1 user liked this post |

02-25-2010, 12:51 PM

02-25-2010, 12:51 PM

|

#48

|

|

Valued Poster

Join Date: Jan 5, 2010

Location: New Orleans

Posts: 307

|

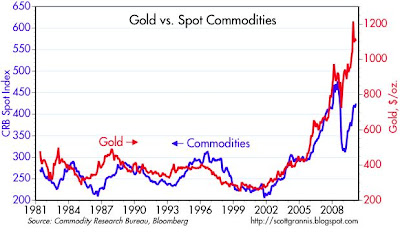

The graph above tracks the correlation between the price of gold, and the price of commodities from 1981 to present. If historical trends hold true, and continue, then either the price of gold is over valued, or the price of commodities is undervalued. The likely result is going to be some reduction in the price of gold, and an increase in the price of commodities, that increaes in the price of commodities will result in a higher level of inflation as the economy returns to a normal level of activity.

Your question on the price of homes, fixes those cost project over the next six months. Given the current level of unemployment, combined with some projected increases in home mortgage rates, the price of homes will likely not increase over the next six months. However, that may not be the case depending on your location. Prices of homes in the deep south, where Katrina self corrected an overbuilt market, that has not fully recovered, will likely see increases in home values before someplace like Michigan, which will probably not see increases to that areas workforce in the near term.

I am not an economist, but I stayed at Holiday Inn Express last night...

CG

|

|

Quote

| 1 user liked this post |

02-25-2010, 01:05 PM

02-25-2010, 01:05 PM

|

#49

|

|

Account Disabled

Join Date: Dec 30, 2009

Posts: 2,307

|

Quote:

Originally Posted by CajunGent

I am not an economist, but I stayed at Holiday Inn Express last night... CG

|

Hey, same school I went to study RE 101.

|

|

Quote

| 1 user liked this post |

02-25-2010, 07:00 PM

02-25-2010, 07:00 PM

|

#50

|

|

Valued Poster

Join Date: Dec 30, 2009

Location: Houston

Posts: 127

|

Never buy a house unless you have cash or you plan to stay there forever, the economics will never work out. Rent! You will get more for your money and your costs are fixed except for utilities.......no taxes, maintanence, insurance, repairs, etc.

Concentrate building with through increasing cash flow, forget about saving and only a small percentage, <20%, of your net worth should be in long term growth or speculative ventures (those 2 terms are interchangable/ oxymoron)

CajunGent that graph is interesting but flawed.

|

|

Quote

| 1 user liked this post |

02-25-2010, 07:23 PM

02-25-2010, 07:23 PM

|

#51

|

|

Valued Poster

Join Date: Apr 5, 2009

Location: Eatin' Peaches

Posts: 2,645

|

Quote:

Originally Posted by mietk

Never buy a house unless you have cash or you plan to stay there forever, the economics will never work out. Rent! You will get more for your money and your costs are fixed except for utilities.......no taxes, maintanence, insurance, repairs, etc.

Concentrate building with through increasing cash flow, forget about saving and only a small percentage, <20%, of your net worth should be in long term growth or speculative ventures (those 2 terms are interchangable/ oxymoron)

CajunGent that graph is interesting but flawed.

|

Talk about a "homeowner scorned"   :laugh ing1:   :rant ing:

|

|

Quote

| 1 user liked this post |

02-25-2010, 09:20 PM

02-25-2010, 09:20 PM

|

#52

|

|

Account Disabled

Join Date: Dec 30, 2009

Posts: 2,307

|

This sums it up:

[ame="http://www.youtube.com/watch?v=bNmcf4Y3lGM"]YouTube- Real Estate Downfall[/ame]

|

|

Quote

| 1 user liked this post |

02-26-2010, 11:11 AM

02-26-2010, 11:11 AM

|

#53

|

|

Valued Poster

Join Date: Dec 30, 2009

Location: Houston

Posts: 127

|

Quote:

Originally Posted by atlcomedy

Talk about a "homeowner scorned"   :laugh ing1:   :rant ing: |

Not me! I have lots and lots of real estate- raw land, farm land, rentals, and my own home but I buy them right and in the case of my home I bought the land and built it myself. Always with cash, occasionally I'll leverage a property. It works for me.

|

|

Quote

| 1 user liked this post |

02-26-2010, 05:52 PM

02-26-2010, 05:52 PM

|

#54

|

|

Pending Age Verification

User ID: 6173

Join Date: Jan 6, 2010

Location: A Lost Leporid

Posts: 742

|

The reason that I have always thought that real estate is a good place to start investment wise is we all have to live somewhere.Unless everyone decides to move back home with their parents( the cat took my room) you are either going to rent , or buy.With so many people gun shy about buying now it seems like that is only going to create an over supply of renters who will eventually force the rent way up.I already live in an area where it would cost me more to rent than what I am currently paying with my mortgage/HOA/property tax combined, and I have not owned for very long.In areas like SF it is too easy to get priced out if you continue to rent.

Buying a second place to rent to others can also be a smart choice as long as you can handle the headaches, and legal problems that can come with it.I think that the days of flipping are clearly over, but as far as a long term investment goes real estate still looks like a pretty safe bet.

It is interesting to watch how my parents view their home compared to how many people in their 30s/40s relate. It looks like people who are my age are always attempting to suck the equity out of thir homes. Anytime you needed a new car/new breasts/long vacation you would just refinance.For my parents generation the goal was to one day own your home outright, so that you could one day retire. Maybe part of the problem with our economy started when people stopped looking at their home as a home, and viewed it more as a source for extra spending money.

|

|

Quote

| 1 user liked this post |

02-26-2010, 08:09 PM

02-26-2010, 08:09 PM

|

#55

|

|

Lifetime Premium Access

Join Date: Mar 31, 2009

Location: Texas

Posts: 1,206

|

Quote:

Originally Posted by Becky

Maybe part of the problem with our economy started when people stopped looking at their home as a home, and viewed it more as a source for extra spending money.

|

Word!!!

|

|

Quote

| 1 user liked this post |

02-28-2010, 04:34 PM

02-28-2010, 04:34 PM

|

#56

|

|

Valued Poster

Join Date: Feb 6, 2010

Location: Sugar Land

Posts: 176

|

Quote:

Originally Posted by Nicolette Morgandy

Do you think the value of homes will:

- or, will the value remain the same within the next 6 months?

|

Do you want an honest answer?

Well as long as Obama is in office you can count on the market being highly unstable. His administrations politics cause a lot of problems in a free trade market. Once he is out of office you may be looking at a number of years before the damage is fixed.

So while most economist will only give short terms on that out to about a year or two saying it is potential to still have drops. I will say expect it to still get a lot worse unless something seriously happens to switch he balance of power in our country back to a more conservative stance.

|

|

Quote

| 1 user liked this post |

02-28-2010, 06:11 PM

02-28-2010, 06:11 PM

|

#57

|

|

Pending Age Verification

User ID: 12025

Join Date: Jan 31, 2010

Location: Manhattan

Posts: 67

My ECCIE Reviews

|

Quote:

Originally Posted by Becky

The reason that I have always thought that real estate is a good place to start investment wise is we all have to live somewhere.Unless everyone decides to move back home with their parents( the cat took my room) you are either going to rent , or buy.With so many people gun shy about buying now it seems like that is only going to create an over supply of renters who will eventually force the rent way up.I already live in an area where it would cost me more to rent than what I am currently paying with my mortgage/HOA/property tax combined, and I have not owned for very long.In areas like SF it is too easy to get priced out if you continue to rent.

Buying a second place to rent to others can also be a smart choice as long as you can handle the headaches, and legal problems that can come with it.I think that the days of flipping are clearly over, but as far as a long term investment goes real estate still looks like a pretty safe bet.

It is interesting to watch how my parents view their home compared to how many people in their 30s/40s relate. It looks like people who are my age are always attempting to suck the equity out of thir homes. Anytime you needed a new car/new breasts/long vacation you would just refinance.For my parents generation the goal was to one day own your home outright, so that you could one day retire. Maybe part of the problem with our economy started when people stopped looking at their home as a home, and viewed it more as a source for extra spending money.

|

I agree with everything you wrote. When I first moved to NYC, I couldn't believe how expensive the rent was. I'm lucky I found and a suitable place so quickly. My combined homeowner expenses - mortage / condo fees/ property tax - is a bit more than what I would pay to rent, but at the very least I'm building equity.

It seems the goal of owning your home is rare these days in my generation. Many seem to be happy spending lots of money decorating their rental apartments.

As for the housing market, I predict that the price will go down a bit more before it comes back up again. I think there are still too many inventories. The sellers will be bound to accept lower prices after more than 6 months on the market. (I'm hoping anyways - Like Becky, I'm looking for an investment unit.) I recently offered 25% below asking for a one bedroom apartment and that was the highest bid the seller got in 6 months. I didn't get the unit only because someone offered the same price, but in cash. Anyhoo....

Quote:

Originally Posted by tylorblake

This has been a big topic in my life as of late. What I am finding is that if you are selling a home that is 200K or less, houses are selling rather quickly, a gain may not be made but neither a huge loss.So, if you are planning "on movin on up" it is a fantastic time because higher priced homes can be found a a fantastic deal and can be a great investment for the future.Keep in mind, I specifically am speaking of my area, although my guess is that the circumstances may be similar nation wide.

Just one ladies point of view.

|

Whoa! A home for less than 200K? And you get the warm weather! One couldn't even get a closet for that much in NYC! I think I need to move.

|

|

Quote

| 1 user liked this post |

02-28-2010, 11:59 PM

02-28-2010, 11:59 PM

|

#58

|

|

Account Disabled

Join Date: Feb 27, 2010

Location: Los Angeles

Posts: 12

|

Real estate is local. The most expensive – by far – is in New York City and San Francisco with Los Angeles pulling up a distant third. In Los Angeles the overbuilding has been simply incredible. Prices have fallen greatly, but we still have unfinished construction projects and near-vacant buildings. The overbuilding was crazy incredible. Prices will continue to fall. Price levels will stabilize once the income derived from rentals compensates for the cost of buying.

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|