Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

646 |

| MoneyManMatt |

490 |

| Still Looking |

399 |

| samcruz |

399 |

| Jon Bon |

396 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| Starscream66 |

280 |

| George Spelvin |

265 |

| sharkman29 |

255 |

|

Top Posters

Top Posters |

| DallasRain | 70796 | | biomed1 | 63334 | | Yssup Rider | 61040 | | gman44 | 53297 | | LexusLover | 51038 | | offshoredrilling | 48679 | | WTF | 48267 | | pyramider | 46370 | | bambino | 42781 | | CryptKicker | 37223 | | The_Waco_Kid | 37138 | | Mokoa | 36496 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

11-26-2012, 06:55 AM

11-26-2012, 06:55 AM

|

#31

|

|

Valued Poster

Join Date: Mar 30, 2009

Location: Hwy 380 Revisited

Posts: 3,333

|

Quote:

Originally Posted by JD Barleycorn

You have to understand what payroll taxes are. They are not a normal tax that goes into the general fund. It is not a tax for the cost of doing business. The payroll tax goes to Social Security and that money is yours if you live long enough to draw it out. Despite what Obama has claimed, he is not saving you money by cutting the payroll tax, he is costing you money down the line when you retire. The average person pays about 12.4 % in payroll taxes. Your employer covers 6.2% and you cover 6.2 %. Since this is considered overhead for your employer you actually pay it all. So a person making about 50,000 dollars yearly pays about $3100 (6.2%) a year and your employer matches with money that could be yours as well for $6200 a year. About every dozen years it doubles in value until you retire. $6200 becomes $12,400 and then become $24,800 and then becomes $49,600 in 36 years. Give it another 12 years for $99,600. Now take away the 2% that Obama is so proud of; $6200 becomes $5200. After 48 years that $99,600 drops to $83,200 or a loss of $16,400 from your retirement. Pretty nice of Obama to do that for you.

This is all based on the idea of an average interest rate of 6% which doubles the balance over 12 years. (divide 72 by the interest rate to find the number of months to double your money)

Just face it, Obama screwed you and you won't know it until you retire.

|

Bought any bridges lately you ignorant slut? That is about the most worthless stretch of the imagination - even coming from you - that I have read in a long time. Get back to your mop and broom.

|

|

Quote

| 1 user liked this post |

11-26-2012, 06:55 AM

11-26-2012, 06:55 AM

|

#32

|

|

Account Disabled

Join Date: Feb 15, 2012

Location: Houston

Posts: 10,342

|

It is like when I ask the question; What is enough. It seems the savior in chief stated, "At some point you have made enough" well what is enough? Who gets to decide what is enough.

Only in a democracy can those that carry no load force those that are carrying the largest burden to carry even more. Centralizing the riders into a handful of states defeats the purpose of a true Republic.

|

|

Quote

| 1 user liked this post |

11-26-2012, 07:09 AM

11-26-2012, 07:09 AM

|

#33

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by Chica Chaser

I agree. So to reduce the deficit we must either reduce spending or increase revenue to the federal government. (for this exercise lets not get into the spending/cutting specifics) The current administration doesn't show much sign of reducing overall spending so they must increase revenue (raise taxes).

Lets try it this way; lets assume most of these rich folks are married and filing jointly. Here are their current federal income tax brackets

Married Individuals Filing Joint Returns and Surviving Spouses

10% on taxable income from $0 to $17,400

15% on taxable income over $17,400 to $70,700

25% on taxable income over $70,700 to $142,700

28% on taxable income over $142,700 to $217,450

33% on taxable income over $217,450 to $388,350

35% on taxable income over $388,350.

I keep hearing that folks making $250K and up are those rich folks and the primary target for raising their tax rates, that will affect the bottom two brackets listed. Plus many politicians have said that the rich need to pay a "little bit more". So with that in mind, the 33% and 35% rates need to go up to what? What are the numbers that will make up the rich folks fair-share?

Anyone want to take a shot at this?

|

CC, you need to pay closer attention. I have already said that the middle class need to pay more at present Defense outlays. I think we should go back to pre Bush taxes.

You do realize that we have doubled Defense spending since 2002 not including the wars. Are you ok with that?

Quote:

Originally Posted by WTF

. They are not. In fact the middle class is not paying enough for the present Defense spending that this country does. The poor do not really have shit to pay.

.

|

|

|

Quote

| 1 user liked this post |

11-26-2012, 07:16 AM

11-26-2012, 07:16 AM

|

#34

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by The2Dogs

It is like when I ask the question; What is enough. It seems the savior in chief stated, "At some point you have made enough" well what is enough? Who gets to decide what is enough.

Only in a democracy can those that carry no load force those that are carrying the largest burden to carry even more. Centralizing the riders into a handful of states defeats the purpose of a true Republic.

|

Nobody is forcing you to police the world. That is the cost that we are presently not paying for.

You have to tax enough to pay the bills.

The question becomes, "What are you willing to pay for our current military?"

If you do not want to pay more, then we need to cut military spending. It is quite simple really. The problem is that folks do not understand the problem. The rich are the ones with political influence, if they have to start paying for all this policing the world, they might rethink policing the world. As it has beeen, they have just taken out the SS and Medicare surplus to pay for it. It hasn't effected them one bit.

|

|

Quote

| 1 user liked this post |

11-26-2012, 07:20 AM

11-26-2012, 07:20 AM

|

#35

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Speaking of understanding how things work

Speaking of understanding how things work

Quote:

Originally Posted by JD Barleycorn

You have to understand what payroll taxes are.

Just face it, Obama screwed you and you won't know it until you retire.

|

Are you trying to say that the current payroll tax reduction means that there will be less in your SS account later? If so , you are the one that hasn't read the bill. Did they not explain that to you in your Tea Puke newsletter?

http://taxes.about.com/od/payroll/a/...g-For-2011.htm

To prevent Social Security from losing tax revenue, Congress mandated that revenues be transferred from the general fund to the Social Security trust funds to make up for the tax reduction. This is provided for in section 601 of the Tax Relief Act, which reads in part, "There are hereby appropriated to the Federal Old-Age and Survivors Trust Fund and the Federal Disability Insurance Trust Fund established under section 201 of the Social Security Act (42 U.S.C. 401) amounts equal to the reduction in revenues to the Treasury by reason of the application of subsection (a). Amounts appropriated by the preceding sentence shall be transferred from the general fund at such times and in such manner as to replicate to the extent possible the transfers which would have occurred to such Trust Fund had such amendments not been enacted."

|

|

Quote

| 1 user liked this post |

11-26-2012, 07:31 AM

11-26-2012, 07:31 AM

|

#36

|

|

Professional Tush Hog.

Join Date: Mar 27, 2009

Location: Here and there.

Posts: 8,959

|

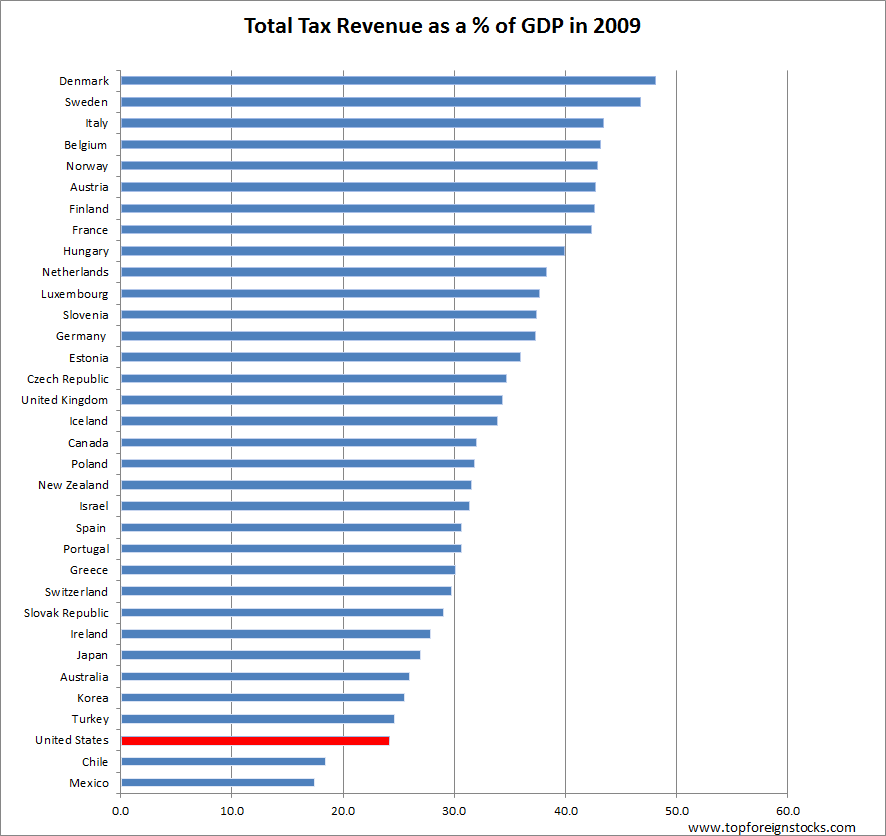

For those deluded fool who think out taxes are too high.

|

|

Quote

| 1 user liked this post |

11-26-2012, 07:33 AM

11-26-2012, 07:33 AM

|

#37

|

|

Lifetime Premium Access

Join Date: Jan 1, 2010

Location: houston

Posts: 48,267

|

Quote:

Originally Posted by Chica Chaser

Yes Sir, two different things no doubt, federal vs state income taxes. There is only one federal income tax while there are 50 state income tax variables. Then there are 1000's of local tax variables. Hell, its a moot point in Texas as there is no state income tax. Since most of what we discuss in here revolves around the federal aspect of it, lets stick with that.

So I throw the questions to you then

|

In Texas we tax with a sales tax , a very regressive tax. We ask our poor to pay more than their fair share!

I do find it strange that you seem to not want to pay the bill for our military spending. That is really the answer to your question.

CC ''What is fair?''

WTF '' Pay for what you bought!''

You see CC, that is really what is fair. If the rich political class wants to go to war, should they not pay for it? There sons and daughter are not the ones doing the fighting so shouldn't they at least pay? Are you ok with a tax reduction during a time of war where the rich and only the rich capture more wealth in this country? Is that fair?

|

|

Quote

| 1 user liked this post |

11-26-2012, 08:18 AM

11-26-2012, 08:18 AM

|

#38

|

|

BANNED

Join Date: Feb 9, 2015

Location: Everywhere

Posts: 11,947

|

Quote:

Originally Posted by WTF

I know simple math.

There are Three big Federal government expenses. SS, Medicare, Defense

SS and Medicare are in a surplus.

So either raise taxes or cut Defense.

Quit using SS and Medicare's surplus to pay for Defense.You then should adjust SS and Medicare to take into account that people are living longer. But you should not do what was done in 1986, which was adjust SS and Medicare and then just spend that huge surplus on Defense. If you want to police the world (rich people) do not take from SS and Medicare (poor people's saving).

|

Quote:

Originally Posted by WTF

Well I say a fair share is what pays the bills. Do you want a Caddy Defense and pay for it with a VW tax rate? That really is the question you know....How much longer do you want to keep raiding SS and Medicare to pay for Defense.

Since we are already paid up on SS and Medicare, I say we pay wtf ever we all decide we think is fair for Defense. Or do you think we should keep leaving IOU's in SS and Medicare's kitty?

Sounds like it is back to what I said. We either raise taxes or cut Defense.

What do you charge a person that wants a Caddy but only wants to pay the price of a VW? What do you think is fair in this regard? Should we get GrandMa and Pa to make up the difference out of their retirement?

|

Quote:

Originally Posted by WTF

Nobody is forcing you to police the world. That is the cost that we are presently not paying for.

You have to tax enough to pay the bills.

The question becomes, "What are you willing to pay for our current military?"

If you do not want to pay more, then we need to cut military spending. It is quite simple really. The problem is that folks do not understand the problem. The rich are the ones with political influence, if they have to start paying for all this policing the world, they might rethink policing the world. As it has beeen, they have just taken out the SS and Medicare surplus to pay for it. It hasn't effected them one bit.

|

We may not agree on Energy Policy or several Federal Social Welfare/Assistance programs. . . . but we definitely agree upon the role of U.S. Defense as World Police... the expense it incurs... it's affect upon budget deficits... and how it should be funded! It all fits in with my "Personal Responsibility / Self-Reliance" mantra!!

|

|

Quote

| 1 user liked this post |

11-26-2012, 10:52 AM

11-26-2012, 10:52 AM

|

#39

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,334

|

Opinions regarding the "fair share" of taxation for the top one percent are obviously all over the map, but I have a feeling that this subject is going to be the most-discussed public policy issue over the next few weeks, or even months.

The public at large will have a chance to render its opinion, too, since a number of pollsters are trying to guage levels of support for increased taxation of the "rich", as well as views concerning the threshold beyond which someone should be considered "rich."

Some on the left (like Paul Krugman, for instance) have said recently that we should go back to the tax structure we had in the 1950s, when the top-bracket income tax rate was as high as 91%. What they always seem to forget, though, is that hardly anyone paid an effective tax rate more than a fraction of that. Prior to the tax reform act of 1986, it was very easy to wipe out most of your tax liability with things like accelerated depreciation on highly leveraged assets.

Some people might recall reading about the discussions leading up to passage of the AMT. A few news reports of the late 1960s indicated that a number of very wealthy households paid little or no federal tax, either on income or capital gains. Responding to public outcry, congress passed legislation designed to ensure that wealthy taxpayers at least pay something, even though at a rate only a fraction of the "headline" 91%. One big problem with that was that the AMT was not indexed for inflation, so now it hits some taxpayers who aren't well off. So lawmakers are continually confronted with demands for an "AMT fix."

Now the discussion will center on whether to raise more revenue by limiting total deductions and exclusions, raising the top rate, or a combination of both. Republicans will bluster, but I think in the end will give in on the rate issue.

Another big question is what will happen with capital gains and qualified dividend rates. Many of us are beginning to expect the captal gains rate to go from 15% to 23.8%, and that there will be some sort of compromise on qualified dividends -- maybe settling somewhere around the same rate as capital gains.

None of this will raise anywhere near as much revenue as most people think, and it's obviously more about politics than economics.

The discussion involving defense spending and taxation needs to become a little more reality-based. Even during the period when Democrats held the White House and big majorities in both the House and Senate (2009-2010), there was no serious discussion of significant defense cuts -- only nibbling around the edges and cuts in previously assumed increases. But let's get real here -- even if defense spending were cut as much as Barney Frank and Ron Paul proposed, and if tax rates on the "rich" were returned to pre-Bush years, we'd still be running trillion-doallar deficits.

I believe what TexTushHog was referring to is what's referred to a the "wealth tax." It's popular in Europe and levied in countries like France. Some economists like it since wealth disparity has grown even faster than income disparity.

I came across a piece just last week elucidating the view that the wealth tax should largely replace the income tax, not just be added on top of the existing tax structure:

http://www.nytimes.com/2012/11/19/op...ot-income.html

Look for all sorts of things like this to be discussed in upcoming years.

But I don't think there's any way you can slice the pie in such a way that decidedly non-wealthy households will be spared large tax increases. Try as they may, politicians cannot supersede the laws of simple arithmetic.

American voters have decided that they want levels of social democracy that go way beyond what we had until recent years. We cannot pay for it forever with borrowed and newly-printed money.

|

|

Quote

| 1 user liked this post |

11-26-2012, 02:16 PM

11-26-2012, 02:16 PM

|

#40

|

|

Premium Access

Join Date: Dec 18, 2009

Location: Mesaba

Posts: 31,149

|

Quote:

Originally Posted by WTF

In Texas we tax with a sales tax , a very regressive tax. We ask our poor to pay more than their fair share!

I do find it strange that you seem to not want to pay the bill for our military spending. That is really the answer to your question.

CC ''What is fair?''

WTF '' Pay for what you bought!''

You see CC, that is really what is fair. If the rich political class wants to go to war, should they not pay for it? There sons and daughter are not the ones doing the fighting so shouldn't they at least pay? Are you ok with a tax reduction during a time of war where the rich and only the rich capture more wealth in this country? Is that fair?

|

WTF, most states have a sales tax on purchased goods. In addition most also have an income tax on top of that. Whats your point?

Military spending....yep, bring it down, no problem there. I think we are overstaffed with both troops and equipment. You are looking for an argument where none exists. There is no reason for us to be involved in most of these other countries issues, the cost is too high...in both lives and in money. As much as I hate to agree with Giz, I got got no problem with what either of you have said.

So, your answer to the financial problems in the US is to cut military spending? Pretty simplistic, but OK. Lets throw that out on the table.

$553 Billion....little over half trillion bucks.

So we eliminate the DoD entirely and we're half way there. Where does the other half come from?

|

|

Quote

| 1 user liked this post |

11-26-2012, 02:24 PM

11-26-2012, 02:24 PM

|

#41

|

|

Premium Access

Join Date: Dec 18, 2009

Location: Mesaba

Posts: 31,149

|

Just for reference, here is the proposal for FY2013 DoD budget

Quote:

1. FY 2013 BUDGET SUMMARY

The Fiscal Year (FY) 2013 President’s Budget develops a defense strategy to transition from emphasis on today’s wars to preparing for future challenges; protects the broad range of U.S. national security interests; advances the Department’s efforts to rebalance and reform; and supports the national security imperative of deficit reduction through reduced defense spending.

The FY 2013 Base Budget provides $525.4 billion, a reduction of $5.2 billion from the FY 2012 enacted level http://comptroller.defense.gov/defbu...rview_Book.pdf

|

They could only find $5.2B to cut?

Quote:

The Obama administration spent $3.538 trillion in the 2012 fiscal year, 1.7 percent less than last year due to the expiration of stimulus provisions, a stronger economy, the end of military operations in Iraq and the continued drawdown in Afghanistan, the Treasury said.

Strong tax collections pushed receipts up to $2.449 trillion in 2012, up 6.4 percent from last year. http://www.foxbusiness.com/industrie...rrows-in-2012/

|

|

|

Quote

| 1 user liked this post |

11-26-2012, 02:31 PM

11-26-2012, 02:31 PM

|

#42

|

|

Valued Poster

Join Date: May 20, 2010

Location: Wichita

Posts: 28,730

|

There is not enough wealth or income to tax in the US to solve our problem. The only solution is to QUIT SPENDING SO MUCH. And replace the income tax.

|

|

Quote

| 1 user liked this post |

11-26-2012, 02:58 PM

11-26-2012, 02:58 PM

|

#43

|

|

Lifetime Premium Access

Join Date: Mar 29, 2009

Location: Texas Hill Country

Posts: 3,334

|

Quote:

Originally Posted by Chica Chaser

So we eliminate the DoD entirely and we're half way there. Where does the other half come from?

|

That's the very simple but key point that seems lost on so many people. Obviously, no one but a loon would seek to reduce defense spending to levels resembling those of the period between World War I and World War II. That left us totally unprepared in a dangerous world. But even if we reduced it to levels approximating those of the post-Cold War "peace dividend" days of the 1990s, our ballooning debt picture would not be that much better. Increased military spending is simply not the main driver of our fiscal problems.

Quote:

Originally Posted by CuteOldGuy

The only solution is to QUIT SPENDING SO MUCH...

|

That's the only good solution, but I'm afraid there's virtually no chance of it happening unless some sort of horrifically severe crisis absolutely forces it.

The alternative is just to admit that we've essentially turned the U.S. into a "lite" version of a European-style social democracy and impose a tax system designed to pay for it. That may mean adding a VAT to the existing income tax and payroll tax system, and pretty much puts the kibosh on chances of returning any time soon to the average long-term economic growth rates we enjoyed for generations.

But until something that that is forced, I think we'll just try to carry on with gargantuan quantities of borrowed and printed money until something busts. And it will.

|

|

Quote

| 1 user liked this post |

11-26-2012, 03:30 PM

11-26-2012, 03:30 PM

|

#44

|

|

Valued Poster

Join Date: Aug 20, 2010

Location: From hotel to hotel

Posts: 9,058

|

Quote:

Originally Posted by CuteOldGuy

There is not enough wealth or income to tax in the US to solve our problem. The only solution is to QUIT SPENDING SO MUCH. And replace the income tax.

|

Those two do NOT inherently go together.

Of course "quit spending so much" is the answer--the problem is getting agreement on what to cut. Everyone is perfectly willing to give up what they don't need and don't care about. There isn't anything in the budget that has no supporters.

And replacing the income tax may work, but any other gov't income source will also be inequitable to some group(s). What do you propose that doesn't put some group at a disadvantage? Every tax does.

|

|

Quote

| 1 user liked this post |

11-26-2012, 03:58 PM

11-26-2012, 03:58 PM

|

#45

|

|

Premium Access

Join Date: Aug 27, 2011

Location: san antonio

Posts: 151

|

Quote:

Originally Posted by WTF

Nobody is forcing you to police the world. That is the cost that we are presently not paying for.

You have to tax enough to pay the bills.

The question becomes, "What are you willing to pay for our current military?"

If you do not want to pay more, then we need to cut military spending. It is quite simple really. The problem is that folks do not understand the problem. The rich are the ones with political influence, if they have to start paying for all this policing the world, they might rethink policing the world. As it has beeen, they have just taken out the SS and Medicare surplus to pay for it. It hasn't effected them one bit.

|

Hey WTF I HAVE A QUESTION .. The wealthy own a great deal of the businesses in the country correct. When you tax them more what do they do, come out of their pocket OR go up in price and pass it along to their customers ! YOU, ME , and all the other folks that buy shit. Where is the money the wealthy have coming from , US ? Thats why im against raising taxes cause one way or the other im paying for it. Do you really think the top 10% or 5% are going to cash in their cds or bring back their money from Switzerland to pay more taxes.

Its kinda like the gas tax, you guys jump on here and start talking about saving the planet ( while the rest of the World could give a shit ) and all my customers are dieing a slow death, they can hardly buy grocery's and every time they fill their car up with gas it absolutely chokes em.

Its naive to think a guy driving a Bentley could give a fuck about the cost of a tank of gas let alone saving the planet.

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|