Main Menu

Main Menu |

Most Favorited Images

Most Favorited Images |

Recently Uploaded Images

Recently Uploaded Images |

Most Liked Images

Most Liked Images |

Top Reviewers

Top Reviewers |

| cockalatte |

646 |

| MoneyManMatt |

490 |

| Still Looking |

399 |

| samcruz |

399 |

| Jon Bon |

396 |

| Harley Diablo |

377 |

| honest_abe |

362 |

| DFW_Ladies_Man |

313 |

| Chung Tran |

288 |

| lupegarland |

287 |

| nicemusic |

285 |

| You&Me |

281 |

| Starscream66 |

280 |

| George Spelvin |

265 |

| sharkman29 |

255 |

|

Top Posters

Top Posters |

| DallasRain | 70796 | | biomed1 | 63334 | | Yssup Rider | 61040 | | gman44 | 53297 | | LexusLover | 51038 | | offshoredrilling | 48679 | | WTF | 48267 | | pyramider | 46370 | | bambino | 42779 | | CryptKicker | 37222 | | The_Waco_Kid | 37138 | | Mokoa | 36496 | | Chung Tran | 36100 | | Still Looking | 35944 | | Mojojo | 33117 |

|

|

03-22-2024, 03:08 PM

03-22-2024, 03:08 PM

|

#1666

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,942

|

Quote:

Originally Posted by Texas Contrarian

Note: When I took a glance a few minutes ago at the below opinion piece by the excellent Daniel Henninger, I almost started a thread titled something along the lines of: "The Fiscal Follies Continue Unabated" -- but as I was just about to pull the trigger on the thread kickoff, it occurred to me that there's an already existing thread covering all the shit that no one's going to even make a pretense of paying for, so why not just post a reply to the already-existing thread? Besides, we've already discussed the ridiculousness of the proposed tax hikes which won't even cover much of the previous shit, let alone new rounds of vote-buying!

$7.3 trillion!! Try this on for a thought experiment. In FY 2000, federal government spending was about $1.8 trillion. Suppose we had passed "debt brake" legislation like the Swiss did in 2001, and (for example) had restricted the growth in federal spending to the rate of inflation plus population growth. A quick back-of-the envelope estimate then gets you to approximately the $4 trillion mark. Okay, the population is aging, so it's fair to assume that you'd need to throw in some extra to cover increased health care costs for the elderly. Let's be generous and add 10%, bringing the spending level to about $4.4 trillion. But now the proposal is that we spend $7.3 trillion, or 66% more than justified by population growth and inflation!

Does anyone seriously believe that's warranted?

Without further ado, here's the WSJ's Henninger:

Opinion | Biden’s Budget: $7.3 Trillion!!!

Daniel Henninger

5–7 minutes

After three years of this presidency, much of the public is either nodding off or checked out. But there may be a method in Joe Biden’s distracting madness. Passing quietly in and out of the news last week was Mr. Biden’s proposal that in fiscal 2025 the federal government would spend $7.3 trillion.

Seven point three trillion??!! Try to wrap your head around such a fantastic number.

Annual federal spending broke the $4 trillion barrier in the final years of Barack Obama’s presidency. In 2020 under Donald Trump, bipartisan spending rocketed to $6.8 trillion, driven by what were supposed to be one-off outlays for the Covid-19 “emergency.”

During the primaries, Nikki Haley repeatedly pointed out Mr. Trump’s role in expanding the federal chunk. Her questions about Mr. Trump’s spending plans for a second term remain largely unanswered. An implicit question raised by Gov. Haley’s complaint is whether most voters care that the federal debt held by the public is more than $27 trillion, about 98% of gross domestic product, or if mainly what they feel is helplessness. The Biden Democrats are betting the nation is numb to public spending.

One can argue in hindsight about the need for the pandemic’s $2 trillion injection, but with the release of this $7 trillion budget, it’s clear the political operatives in the Biden administration recognized Covid as a crisis opportunity for the ages. Mr. Biden is pocketing the emergency spending level and hoping to jack it higher permanently. Think $10 trillion by 2033, the level the Biden budget forecasts. Did his dad tell him to do this?

The budget is being described as a campaign document—in other words, an election-year effort to buy votes. Implicit in this strategy is the Democratic assumption that voters can be bought and are happy to stay bought.

Among the reasons Mr. Biden won’t drop out of the race despite doom-laden poll numbers is that he thinks—or so said Sen. Bernie Sanders—that he can be the most progressive president since Franklin D. Roosevelt. That ambition is important to an understanding of his $7.3 trillion whopper.

FDR’s New Deal program dates to 1933. They say times change, but not if you’re a Biden Democrat. What Mr. Biden is proposing as the U.S. heads deeper into a century defined by artificial intelligence is policy that is 90 years old. It somehow seems appropriate.

If there is one word associated with FDR’s New Deal agenda it is “projects.” Everything—housing, airports, hospitals, schools—became a project paid for with federal spending. Back then the thing common to most of the projects was cement. Today, it’s climate. The 2022 Inflation Reduction Act—accurately described by the progressive Economic Policy Institute as “essentially a climate-change bill”—spends nearly $400 billion on renewable-energy projects. The new budget proposes tens of billions more “to support clean energy workforce and infrastructure projects across the nation.”

Housing is a party perennial, so the Biden budget would spend an astounding $258 billion to subsidize it.

Despite the voguish Democratic habit of invoking Roosevelt’s memory—how this appeals to younger, history-free voters is anyone’s guess—the party’s recall of FDR ends in the 1930s.

With war spreading in Europe in 1939, Roosevelt led a big U.S. defense buildup. He repeatedly gave the American public his reasons for the commitment in speeches and statements that are stirring to this day. His 1940 message to Congress for defense appropriations warned of “disturbances abroad, and the need of putting our own house in order in the face of storm signals from across the seas.”

The Biden budget proposes to increase defense spending next fiscal year by 1%, a cut after inflation. It would decline in future years. China has just announced a 7.2% increase in its defense spending.

The Biden Democrats, overwhelmingly dedicated to domestic spending only, have set a low, unbreakable ceiling on budget support for national security. That explains in part why Mr. Biden slow-walked arms support for Ukraine and is now going wobbly on Israel. America’s national security is hostage to Mr. Biden’s antidefense vote in six swing states.

Since the mid-1970s, a rough political consensus has kept federal spending at about 21% of GDP and taxes at just over 17%. Mr. Biden wants spending to consume 24.8% of GDP and over a decade would “pay for” this increase by pushing taxes to more than 20% of national output. By 2030, the national debt would be bigger than GDP—as in Italy or Greece.

For nearly a century, the Democrats’ policy of tax-and-spend has worked for them. But one wonders if, like their leader, this strategy has arrived at a point of exhaustion with the U.S. public. An intriguing side story to this election is figuring out what’s on the minds of Gen Z, or younger voters. They are down on Mr. Biden and bleak about their economic prospects. The Biden bet is that promising to push public spending past an incomprehensible $7 trillion will make them feel better about the president and his party. Overstuffing Uncle Sam, however, may be doing exactly the opposite.

Write henninger@wsj.com.

Copyright ©2024 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cde b8

Appeared in the March 21, 2024, print edition as 'Biden’s Budget: $7.3 Trillion!!!'.

See @ https://www.wsj.com/articles/bidens-...ecentauth_pos1 |

WTF? Annual federal government spending during COVID was $6.8 billion. Now Biden wants to take it up to $7.3 billion? Up from $4.45 trillion in FY2019?

https://www.statista.com/statistics/...cal-year-2000/

Yeah, I know we've had inflation, but that's ridiculous.

I don't know about you and other board members, but I receive very little benefit from federal government spending compared to the federal taxes I pay. It's my state and local government that provide schools, roads, police, etc. So I don't think the $3.8 trillion that state and local governments spend annually is out of line. The feds though are spending almost twice that amount.

When you add both numbers, the $7.3 trillion to the $3.8 trillion, you get $11.1 trillion in total government spending. That's about 38% of GDP. Historically, we've been in the range of 30% to 35%. In general, those developed countries with a lower ratio of government expenditure to GDP, like Switzerland, Singapore, Hong Kong, Ireland and the USA, are more prosperous. Which makes sense, because it's the private sector (businesses), not government, that's the engine for growth and jobs. Well, unfortunately, our politicians appear intent on growing government here so it's as large as, say, France, where government expenditures are 58% of GDP. If that happens look for our standard of living (as measured by, say, per capita income) to drop by perhaps 25% over what it would be otherwise.

I know you attribute the blame to both political parties. Well, I think the Democrats are worse. Or at least the progressives and Biden are worse.

I'd be interested in our left-of-center board members' thoughts on the following from the article:

The 2022 Inflation Reduction Act—accurately described by the progressive Economic Policy Institute as “essentially a climate-change bill”—spends nearly $400 billion on renewable-energy projects. The new budget proposes tens of billions more “to support clean energy workforce and infrastructure projects across the nation.”

Housing is a party perennial, so the Biden budget would spend an astounding $258 billion to subsidize it.

Why are we flushing this kind of money down the toilet? If you want to reduce carbon emissions, institute a reasonable tax on carbon, at the point it's burned, instead of passing out climate pork for political purposes. And California's experience in subsidizing housing is instructive. When you insert Biden-style requirements, like requiring union labor and "climate friendly" construction, you raise the cost by 100%.

|

|

Quote

| 2 users liked this post |

03-22-2024, 04:12 PM

03-22-2024, 04:12 PM

|

#1667

|

|

Valued Poster

Join Date: Jan 1, 2010

Location: Austin Texas

Posts: 2,217

|

Quote:

Originally Posted by Tiny

Why are we flushing this kind of money down the toilet? If you want to reduce carbon emissions, institute a reasonable tax on carbon, at the point it's burned, instead of passing out climate pork for political purposes. And California's experience in subsidizing housing is instructive. When you insert Biden-style requirements, like requiring union labor and "climate friendly" construction, you raise the cost by 100%.

|

It’s always easier to get politicians to spend money than raise or create taxes.

There are people who block carbon taxes on both sides of the aisle. More on the Republican side than the Democratic side but a big one that stalled the issue recently is Senator Joe Manchin of West Virginia.

|

|

Quote

| 1 user liked this post |

03-22-2024, 07:52 PM

03-22-2024, 07:52 PM

|

#1668

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,942

|

Quote:

Originally Posted by txdot-guy

It’s always easier to get politicians to spend money than raise or create taxes.

There are people who block carbon taxes on both sides of the aisle. More on the Republican side than the Democratic side but a big one that stalled the issue recently is Senator Joe Manchin of West Virginia.

|

I'm surprised you remember that. I do because I owned shares in a company that would have been royally screwed if Manchin hadn't nuked the tax. This wasn't widely reported, and I don't think it made it to the floor of the House or Senate.

Yes, when Kyrsten Sinema and Joe Manchin were "obstacles" to Biden's tax plans, there was a proposal to levy a tax on oil, natural gas and coal production. Sinema signed on, but Manchin didn't go along.

The devil's in the details. Recall earlier I said any tax should be imposed at the point the carbon is burned. In other words, utilities and purchasers of gasoline and the like should bear the tax. It shouldn't be imposed on exports. The proposed tax would have been levied at the inlet of gas plants and the mouths of mines, so it would apply to all production, including exports.

This was a sop to the green lobby, which wants to shut down domestic fossil fuels production. And ironically, it would have probably resulted in higher worldwide carbon emissions.

If you impose a tax on natural gas destined for export, you're kneecapping U.S. producers from competing in global markets. The taxes result in higher prices for gas. Instead of buying higher priced LNG (liquefied natural gas) from the U.S., power generators in Europe would buy instead from places like Qatar and Russia. And more importantly, they'd substitute coal for natural gas, which emits more carbon per BTU than gas when burned.

The same argument applies to a lesser extent to U.S. coal exports. Higher quality U.S. seaborn coal produces less carbon per BTU than coal from places like Indonesia.

I don't understand the logic. Either we're going to sell fossil fuels into global markets, or other countries will. So you're not reducing carbon emissions by making U.S. exports less competitive with high taxes. You just hurting companies and workers in the USA.

Not having passed a carbon tax on natural gas exports, the Biden administration is now taking a more direct approach, by suspending issuance of approvals for new LNG projects. I have no idea how the feds (instead of states and localities) are able to do that. But they are. I presume the motivation for the suspension is political and disingenuous, because stopping construction of LNG plants in the USA is not going to reduce carbon emissions.

|

|

Quote

| 1 user liked this post |

03-23-2024, 05:34 PM

03-23-2024, 05:34 PM

|

#1669

|

|

Valued Poster

Join Date: Jan 1, 2010

Location: Austin Texas

Posts: 2,217

|

Quote:

Originally Posted by Tiny

I'm surprised you remember that. I do because I owned shares in a company that would have been royally screwed if Manchin hadn't nuked the tax. This wasn't widely reported, and I don't think it made it to the floor of the House or Senate.

Yes, when Kyrsten Sinema and Joe Manchin were "obstacles" to Biden's tax plans, there was a proposal to levy a tax on oil, natural gas and coal production. Sinema signed on, but Manchin didn't go along.

The devil's in the details. Recall earlier I said any tax should be imposed at the point the carbon is burned. In other words, utilities and purchasers of gasoline and the like should bear the tax. It shouldn't be imposed on exports. The proposed tax would have been levied at the inlet of gas plants and the mouths of mines, so it would apply to all production, including exports.

This was a sop to the green lobby, which wants to shut down domestic fossil fuels production. And ironically, it would have probably resulted in higher worldwide carbon emissions.

If you impose a tax on natural gas destined for export, you're kneecapping U.S. producers from competing in global markets. The taxes result in higher prices for gas. Instead of buying higher priced LNG (liquefied natural gas) from the U.S., power generators in Europe would buy instead from places like Qatar and Russia. And more importantly, they'd substitute coal for natural gas, which emits more carbon per BTU than gas when burned.

The same argument applies to a lesser extent to U.S. coal exports. Higher quality U.S. seaborn coal produces less carbon per BTU than coal from places like Indonesia.

I don't understand the logic. Either we're going to sell fossil fuels into global markets, or other countries will. So you're not reducing carbon emissions by making U.S. exports less competitive with high taxes. You just hurting companies and workers in the USA.

Not having passed a carbon tax on natural gas exports, the Biden administration is now taking a more direct approach, by suspending issuance of approvals for new LNG projects. I have no idea how the feds (instead of states and localities) are able to do that. But they are. I presume the motivation for the suspension is political and disingenuous, because stopping construction of LNG plants in the USA is not going to reduce carbon emissions.

|

Take a look at the list of countries that have implemented a carbon tax. For a problem that is going to require everyone to pull in the same direction the result is not promising.

https://ourworldindata.org/carbon-pricing

The inaptly named Inflation Reduction Act is at least an attempt to move us to a greener economy. Global warming is in my opinion the best reason to vote for someone other than a republican. We’ll need more cooperation between global powers to accomplish anything of real change. A party that is inward looking and wants to pull away from our global partners is not the party that we should count on to foster global cooperation.

|

|

Quote

| 1 user liked this post |

03-25-2024, 11:18 PM

03-25-2024, 11:18 PM

|

#1670

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,942

|

Quote:

Originally Posted by txdot-guy

Take a look at the list of countries that have implemented a carbon tax. For a problem that is going to require everyone to pull in the same direction the result is not promising.

https://ourworldindata.org/carbon-pricing

The inaptly named Inflation Reduction Act is at least an attempt to move us to a greener economy. Global warming is in my opinion the best reason to vote for someone other than a republican. We’ll need more cooperation between global powers to accomplish anything of real change. A party that is inward looking and wants to pull away from our global partners is not the party that we should count on to foster global cooperation. |

Your map highlights the problem. What percentage of carbon emissions are from the countries highlighted in green, the ones with carbon taxes? My guess is about 25%. And what will that number be in another 30 or 40 years? I'd guess maybe 15%. China, India, Indonesia, African countries, etc. mostly don't have carbon taxes. And their consumption of fossil fuels will continue to grow. Are we supposed to tell Indians in Mumbai who live in apartment blocks baking in 120 degree heat that they can't have air conditioning? Mexicans that they can't have diesel truck?

So, whatever we do in the U.S.A. to reduce carbon emissions is going to be a drop in the bucket. For example, I read an analysis the other day that estimated replacing every passenger vehicle with an internal combustion vehicle in the USA with electric vehicles would reduce worldwide carbon emissions by 0.18%.

Like I said, I don't have a problem with a reasonable carbon tax, provided it exempts exports. You've got to tax something, and IMO a tax on carbon, or beer or cigarettes, is better than a tax on income. Especially if the carbon tax is used to reduce deficits or the income tax.

The problem is that the politicians will probably instead use the proceeds for more wasteful spending.

The, as you put it, inaptly named Inflation Reduction Act will cost $1.2 trillion according to Goldman Sachs:

https://www.wsj.com/articles/inflati...eport-5623cd29

It represents industrial policy. The problem with industrial policy in the USA is that it doesn't work. It does work in China, but that's because China is a country ruled by engineers, while the USA is ruled by lawyers. Anything funded by the federal government costs a lot more, and legal, regulatory and environmental hurdles run up the cost of manufacturing plants and mines and the like. For example, we'll undoubtedly spend much more on solar cells, battery metals and the like produced in the USA than what they'd cost if produced in other countries.

Energy policy as it relates to carbon emissions is in my opinion one of the two primary reasons NOT to vote for Democrats, especially if you're a Texan. Democratic politicians are an existential threat to the livelihood of many of my friends, family members and acquaintances, who work in the energy industry.

Having read some of Bjorn Lomborg's writings, I believe we're on a course to spend tens of trillions on reducing carbon emissions. And the benefits will not be justified by the expenditures. We could wipe out malaria, world hunger, childhood disease, etc. for a fraction of what we'll spend on reducing carbon emissions. And, again, what we do in the USA (and Europe and Japan) is not going to make a diddly squat difference compared to what developing countries do.

In the event that fusion and other technologies don't come to the rescue in the next 50 years or so, then I suspect it's going to make more sense living with higher temperatures (which will actually be beneficial for some parts of the globe), higher sea level, and somewhat more extreme weather events than going to "0" net carbon emissions. And I also suspect geoengineering, for example injecting sufur dioxide into the atmosphere, is a lot more likely to come to the rescue than going to "0" net carbon.

|

|

Quote

| 2 users liked this post |

03-26-2024, 03:38 AM

03-26-2024, 03:38 AM

|

#1671

|

|

Valued Poster

Join Date: Jan 1, 2010

Location: Austin Texas

Posts: 2,217

|

Quote:

Originally Posted by Tiny

Your map highlights the problem. What percentage of carbon emissions are from the countries highlighted in green, the ones with carbon taxes? My guess is about 25%. And what will that number be in another 30 or 40 years? I'd guess maybe 15%. China, India, Indonesia, African countries, etc. mostly don't have carbon taxes. And their consumption of fossil fuels will continue to grow. Are we supposed to tell Indians in Mumbai who live in apartment blocks baking in 120 degree heat that they can't have air conditioning? Mexicans that they can't have diesel truck?

So, whatever we do in the U.S.A. to reduce carbon emissions is going to be a drop in the bucket. For example, I read an analysis the other day that estimated replacing every passenger vehicle with an internal combustion vehicle in the USA with electric vehicles would reduce worldwide carbon emissions by 0.18%.

Like I said, I don't have a problem with a reasonable carbon tax, provided it exempts exports. You've got to tax something, and IMO a tax on carbon, or beer or cigarettes, is better than a tax on income. Especially if the carbon tax is used to reduce deficits or the income tax.

The problem is that the politicians will probably instead use the proceeds for more wasteful spending.

The, as you put it, inaptly named Inflation Reduction Act will cost $1.2 trillion according to Goldman Sachs:

https://www.wsj.com/articles/inflati...eport-5623cd29

It represents industrial policy. The problem with industrial policy in the USA is that it doesn't work. It does work in China, but that's because China is a country ruled by engineers, while the USA is ruled by lawyers. Anything funded by the federal government costs a lot more, and legal, regulatory and environmental hurdles run up the cost of manufacturing plants and mines and the like. For example, we'll undoubtedly spend much more on solar cells, battery metals and the like produced in the USA than what they'd cost if produced in other countries.

Energy policy as it relates to carbon emissions is in my opinion one of the two primary reasons NOT to vote for Democrats, especially if you're a Texan. Democratic politicians are an existential threat to the livelihood of many of my friends, family members and acquaintances, who work in the energy industry.

Having read some of Bjorn Lomborg's writings, I believe we're on a course to spend tens of trillions on reducing carbon emissions. And the benefits will not be justified by the expenditures. We could wipe out malaria, world hunger, childhood disease, etc. for a fraction of what we'll spend on reducing carbon emissions. And, again, what we do in the USA (and Europe and Japan) is not going to make a diddly squat difference compared to what developing countries do.

In the event that fusion and other technologies don't come to the rescue in the next 50 years or so, then I suspect it's going to make more sense living with higher temperatures (which will actually be beneficial for some parts of the globe), higher sea level, and somewhat more extreme weather events than going to "0" net carbon emissions. And I also suspect geoengineering, for example injecting sufur dioxide into the atmosphere, is a lot more likely to come to the rescue than going to "0" net carbon. |

So your argument is that we do nothing? The scientific consensus is that we have pumped too much carbon dioxide into the atmosphere that it is causing climate change. The solution is to remove carbon dioxide from the atmosphere while reducing or eliminating carbon dioxide emissions from our economy. This must be a world wide goal if we want to avoid disaster.

Someone has to lead by creating the industry to replace what we have now, as well as setting the standards by which the world will follow and do its part.

Industrial policy does work in the US just not in the same way as it does in China. I’m not sure what the exact policies we’re going to be implementing in the future but I do know that Drill Baby Drill isn’t the solution. That’s the policy that Trump is proposing right now.

By the way we’re producing more oil and gas today than ever.

U.S. crude oil production averaged 13.3 million barrels per day (b/d) in December 2023, following sustained productivity increases at new wells, according to our latest Petroleum Supply Monthly (PSM). U.S. crude oil production has increased to record highs since 2010 and has risen even more quickly in recent months. These record highs have come despite declining U.S. drilling activity because the new wells are more efficient.

https://www.eia.gov/todayinenergy/de...re%20efficient.

|

|

Quote

| 1 user liked this post |

03-26-2024, 01:13 PM

03-26-2024, 01:13 PM

|

#1672

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,942

|

Thanks for your thoughts Txdot. This subject, spending to lower carbon emissions, is right up there with entitlements and taxes in answering the question, "How are we going to pay for all this shit?"

Quote:

Originally Posted by txdot-guy

So your argument is that we do nothing?

|

No. We should encourage other countries to phaseout fossil fuel subsidies. Pump more money into energy RESEARCH (not subsidies and pork), like fusion and other renewables. And also research into geoengineering and climate change adaptation. Remove barriers to nuclear energy. Money spent on making sure people in developing countries have modern cooking fuels would not only lower carbon emissions, but also prevent a lot of health problems and premature deaths. Again, a reasonable carbon tax, not levied on our exports, makes sense. This is counter to Democratic politicians' arguments, but promoting natural gas as a fuel makes a lot of sense. That's why the USA has reduced its carbon emissions by 18% since 2007.

All the measures above are or possibly would be cost effective, in terms of what we pay and what we get back.

The argument of Democratic politicians is that we take away the jobs of many of my friends, family and neighbors, who work in the oil and gas industry, to get more votes. And pass out green pork to get campaign contributions and more votes.

Quote:

Originally Posted by txdot-guy

The scientific consensus is that we have pumped too much carbon dioxide into the atmosphere that it is causing climate change. The solution is to remove carbon dioxide from the atmosphere while reducing or eliminating carbon dioxide emissions from our economy.

|

This would make perfect sense, eliminating carbon dioxide emissions, if not for the cost. McKinsey estimates going to net zero by 2050 will cost $275 trillion for the physical assets alone. That's $9.4 trillion per year, and I think that's in 2019 dollars. For comparison, US GDP in 2019 was $21 trillion.

There is no way in hell people, governments and businesses are going to spend that kind of money.

https://www.mckinsey.com/capabilitie...it-could-bring

Quote:

Originally Posted by txdot-guy

This must be a world wide goal if we want to avoid disaster.

|

Disaster my butt. The earth was a lot hotter during periods of the Cretaceous. And the paleocene and eocene, which weren't that long ago in terms of geological time.

https://www.climate.gov/media/15006

No amount of carbon we emit is going to take temperatures back to those levels.

Quote:

Originally Posted by txdot-guy

Someone has to lead by creating the industry to replace what we have now, as well as setting the standards by which the world will follow and do its part.

|

India, Indonesia, China, Russia, Africa and Latin America are not going to follow.

Quote:

Originally Posted by txdot-guy

Industrial policy does work in the US just not in the same way as it does in China.

|

Here's the way it works in the USA. Politicians hand out the pork. The money gets spent inefficiently. We end up with products that cost a lot more than they would if government had never been involved.

Quote:

Originally Posted by txdot-guy

By the way we’re producing more oil and gas today than ever.

U.S. crude oil production averaged 13.3 million barrels per day (b/d) in December 2023, following sustained productivity increases at new wells, according to our latest Petroleum Supply Monthly (PSM). U.S. crude oil production has increased to record highs since 2010 and has risen even more quickly in recent months. These record highs have come despite declining U.S. drilling activity because the new wells are more efficient.

https://www.eia.gov/todayinenergy/de...re%20efficient. |

And, primarily because natural gas production has increased and substituted for coal, our carbon emissions have been on a steady downtrend since 2007.

https://www.statista.com/statistics/...ons-from-1999/

I really don't understand why many Democratic politicians, including Biden, wanted to stop issuing drilling permits in the Green River Basin, San Juan Basin, and other gas producing areas with federal leases. Or why many want to put a stop to new LNG development. It's crazy, a recipe to potentially increase carbon emissions. And to definitely take away jobs.

|

|

Quote

| 1 user liked this post |

03-30-2024, 07:18 AM

03-30-2024, 07:18 AM

|

#1673

|

|

Valued Poster

Join Date: Jul 26, 2013

Location: Railroad Tracks, other side thereof

Posts: 7,171

|

"How are we going to pay for all this shit?"

First and foremost - we ain't. It's likely to fall at the feet or our Great-Grand kids who will no longer be able to kick the can down the road. Eventually, you really do run out of Other Peoples Money.

Secondly, it will be incurred in ever increasing rents for an ever expanding roll of renters and an ever shrinking roll of individual home ownership, aka private property. I've been following buying patterns of homes recently and have seen upwards of 45% of individual home sales have been to "investors" for the last 2 years running.

Couple that with rapidly rising foreclosures and ye olde Bidenomics and you can easily see we are proper fooked. And that is not even counting the O'Biden's brilliant plan to subsidize mortgages for migrants, of the illegal variety, that is. Oh... and don't forget the meteoric rise in homelessness. That's what they are saying the math is looking like leastwise.

BIDENOMICS: Home Foreclosures Rising Nationwide – By 50 Percent or More in Some States

by Mike LaChance Mar. 21, 2024 10:00 pm

Joe Biden is admitting that nobody wants to sell their house—and he’s offering a measly incentive to fix it

Story by Sydney Lake

Homelessness In The U.S. Is Up 48 Percent Since 2015, And Americans Are Being Laid Off In Droves…

by Michael Snyder | Jan 30, 2024

Affordable? Not really...

|

|

Quote

| 1 user liked this post |

03-30-2024, 01:43 PM

03-30-2024, 01:43 PM

|

#1674

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,942

|

How are we going to pay for the houses we live in?

How are we going to pay for the houses we live in?

Quote:

Originally Posted by Why_Yes_I_Do

I've been following buying patterns of homes recently and have seen upwards of 45% of individual home sales have been to "investors" for the last 2 years running.

|

That's wild, the 45%.

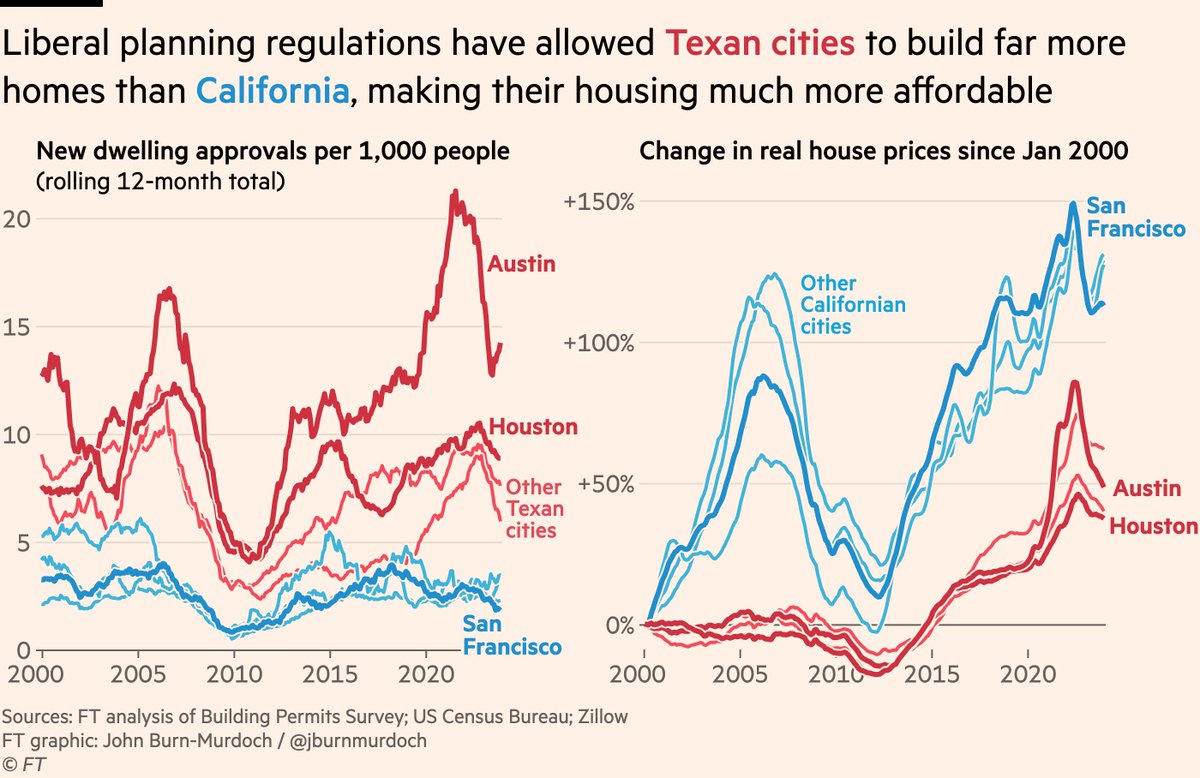

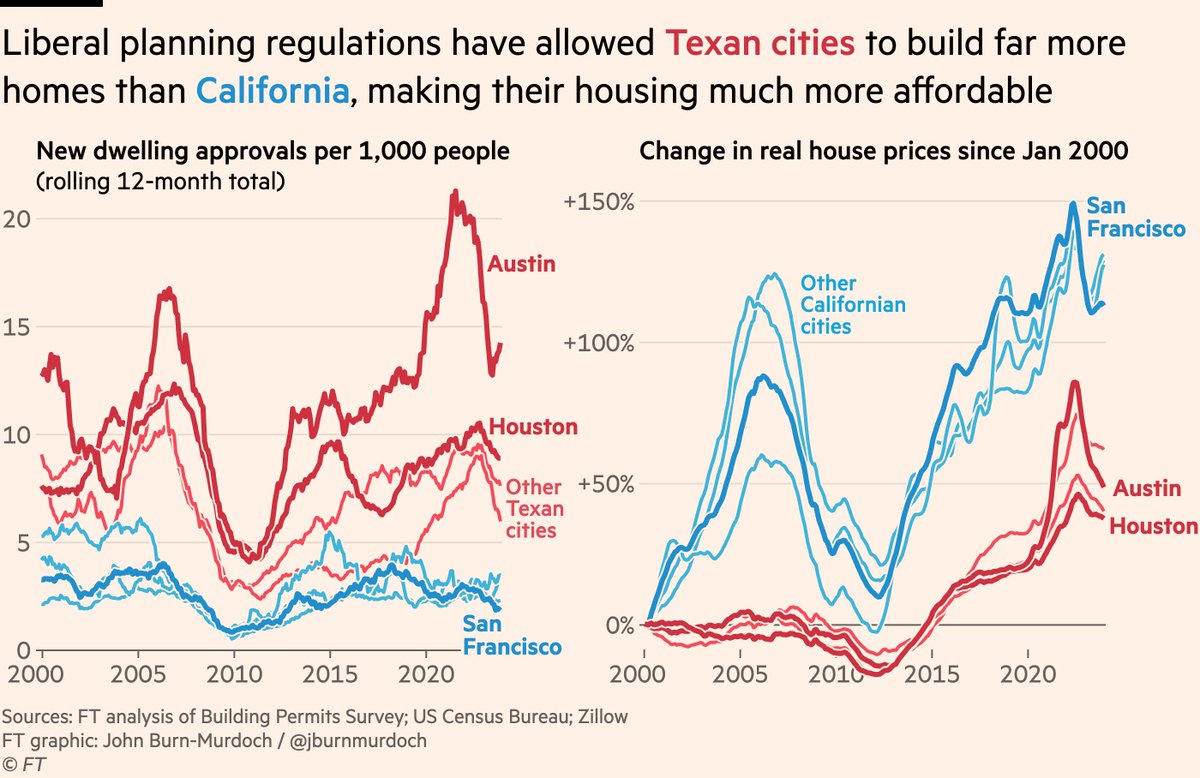

I can kind of understand why home prices are up in California cities and Austin - a shortage of land and overbearing government regulation. But Houston? Why do you think real (inflation adjusted) prices are up 40% there over 2000?

Good mass transit, subways and the like, would cost an arm and a leg, but might be worth it in some instances. For example, you could see more affordable housing built east of Austin if people living there could get to their jobs quickly.

|

|

Quote

| 1 user liked this post |

03-30-2024, 05:52 PM

03-30-2024, 05:52 PM

|

#1675

|

|

Valued Poster

Join Date: Jul 26, 2013

Location: Railroad Tracks, other side thereof

Posts: 7,171

|

Quote:

Originally Posted by Tiny

That's wild, the 45%.

I can kind of understand why home prices are up in California cities and Austin - a shortage of land and overbearing government regulation. But Houston? Why do you think real (inflation adjusted) prices are up 40% there over 2000?

Good mass transit, subways and the like, would cost an arm and a leg, but might be worth it in some instances. For example, you could see more affordable housing built east of Austin if people living there could get to their jobs quickly.

|

I know, the 45% thing caught me off guard a bit. But pay attention to the tail of those charts. The prices are coming back down in Austin and Houston exactly because they can build on the outskirts. East Austin has been having a revival (not the Baptist kind) for quite a few years and Houston is still growing outwards. Ain't gonna be seeing mass transit in either location here. They are still wiping the crap up from their foray into electric buses.

|

|

Quote

| 1 user liked this post |

03-30-2024, 06:56 PM

03-30-2024, 06:56 PM

|

#1676

|

|

Valued Poster

Join Date: Jul 26, 2013

Location: Railroad Tracks, other side thereof

Posts: 7,171

|

Quote:

Originally Posted by Why_Yes_I_Do

I know, the 45% thing caught me off guard a bit. But pay attention to the tail of those charts. The prices are coming back down in Austin and Houston exactly because they can build on the outskirts. East Austin has been having a revival (not the Baptist kind) for quite a few years and Houston is still growing outwards. Ain't gonna be seeing mass transit in either location here. They are still wiping the crap up from their foray into electric buses.

|

Sorry about that folks. I forgot to include the 45% quotation earlier. My bad:

Quote:

...Popular X account Wall Street Apes had this to say about the video clip he shared:

Private Home Ownership Is At EXTREME RISK In America

New Reports Show Economists Have Been Lying To All Of Us About The Rate Financial Firms Have Been Buying Up Single Family Homes

They said only 18-23% of homes were being purchased & by 2030 they would own 60%

That was a lie, in 2023, private equity firms purchased 44% of all of the single family homes in America, which means death for our middle class

Estimates for 2024 private equity firms are again predicted to purchase another 44% of single family homes.

“Now America has a lot of problems, but this should be a unifying problem that every single person who is not part of one of those private equity firms cares about, including current homeowners.”

“Private equity firms have been buying up all the single family homes. So up until very recently, we didn’t actually have the numbers to say just how many homes they’ve been buying up.

And most politicians across the f***** board, Democrat, Republican, whatever, have been saying, well, they’re really only buying, like, 18% of single family homes. And then economists chimed in and said that if private equity firms are buying up anywhere from 18 to 20 to 23% of single family homes in this country.

That by 2030, they would own 60% of all of the homes in America. Well, we just got the final numbers.

Um, in 2023, private equity firms purchased 44% of all of the single family homes in America, which means death for our middle class.

Our generation will not be homeowners. They will have us permanently renting from, like, 2 or 3 companies. Now America has a lot of problems, but this should be a unifying problem that every single person who is not part of one of those private equity firms cares about, including current homeowners.

They bought 44% of all of the single family homes in America last year, and they are set up to purchase an even higher percentage of them this year. Unless we have major reform, almost all of the single family homes in this country will be owned by these private equity firms in a very, very short amount of time.”...

|

|

|

Quote

| 1 user liked this post |

03-31-2024, 08:53 AM

03-31-2024, 08:53 AM

|

#1677

|

|

Valued Poster

Join Date: Dec 31, 2009

Location: Georgetown, Texas

Posts: 9,328

|

Quote:

Originally Posted by Why_Yes_I_Do

I know, the 45% thing caught me off guard a bit. But pay attention to the tail of those charts. The prices are coming back down in Austin and Houston exactly because they can build on the outskirts. East Austin has been having a revival (not the Baptist kind) for quite a few years and Houston is still growing outwards. Ain't gonna be seeing mass transit in either location here. They are still wiping the crap up from their foray into electric buses.

|

Prices have fallen in Austin but they have fallen just as much in the close-in suburbs. I sold my Cedar Park home in March of 2023 for over $100,000 less than what I would have gotten 6 months earlier. Fortunately, the home I purchased in Georgetown had also seen an equivalent drop in price. And home prices have not gone up in the last year.

https://www.mysanantonio.com/realest...t-18750615.php

|

|

Quote

| 1 user liked this post |

03-31-2024, 12:57 PM

03-31-2024, 12:57 PM

|

#1678

|

|

Valued Poster

Join Date: Jul 26, 2013

Location: Railroad Tracks, other side thereof

Posts: 7,171

|

Quote:

Originally Posted by SpeedRacerXXX

Prices have fallen in Austin but they have fallen just as much in the close-in suburbs. I sold my Cedar Park home in March of 2023 for over $100,000 less than what I would have gotten 6 months earlier. Fortunately, the home I purchased in Georgetown had also seen an equivalent drop in price. And home prices have not gone up in the last year.

https://www.mysanantonio.com/realest...t-18750615.php |

I expect prices will tick up slowly in the near-ish future. TBH: I think it may well depend on the election, where Trump=up, Biden=down. Of course, the impact from a Black Swan event is unknown, but likely very bad and many things go down.

However, until interest rates subside, investors will continue snatching them up for cash and renting them out. Real estate is a physical asset. If prices go up, sell for a profit. If rates stay the same, jack the rents, and carry on renting them out.

The big question often is: Why would you sell a mortgage at say 3% and turn around and pick one up at 7+%? And we don''t even want to talk about commercial real estate conditions right now. IMHO.

|

|

Quote

| 1 user liked this post |

04-03-2024, 01:28 PM

04-03-2024, 01:28 PM

|

#1679

|

|

Lifetime Premium Access

Join Date: Mar 4, 2010

Location: Texas

Posts: 8,942

|

WYID, I'm a babe in the woods compared to you and TC on the subject of real estate, but thought this might be of interest to you, about house prices in California. It's from this week's Economist and is relevant to both "How are we going to pay for all this shit," and "How are we going to pay for our houses."

As it stands, the overall tax burden on Californians is the fifth-highest in the country, according to the Tax Foundation, a think-tank. The one area where the state’s tax revenues are low—absurdly so—is on property because of a law, passed by popular vote in 1978, which has led to homes being assessed well below their market value. That in turn contributes to inflated housing prices in California, pushing yet more people away from the state.

The average property tax rate in Houston is 2.13% versus 0.75% in California. Say you pay $500,000 for a house and own it for 30 years, and there's no increase or decrease in property values. If it's in California, you'll pay $112,500 in property tax over the next 3 years, versus $319,500 in Houston. The total cost of acquisition plus taxes is $612,500 for California and $819,500 for Houston. So their argument is people in California can/will pay more for a house because the taxes are lower. If they're right, it goes a little of the way towards explaining your graph.

One fulcrum that could dramatically alter California’s fortunes is the property market. Housing has become more unaffordable throughout America over the past decade but California continues to claim the dubious crown as the least affordable big state. The price-to-income ratio for buying homes is 12 in San Jose and 11.3 in San Francisco, double the national median, according to researchers at Harvard University. The root cause is a lack of new housing. Mr Newsom is well aware of this and has sought to kick-start construction. Since 2017 lawmakers have passed more than 100 separate pieces of legislation to make it easier to build homes. But the results have been dismal so far. Construction permits have plateaued at about 110,000 housing units per year, far short of what California needs.

Instead, the property sector stands as an example of how California often ties itself in regulatory knots. The state has sped up its notoriously cumbersome environmental reviews for housing, especially for affordable projects. Yet to benefit from this provision, companies must demonstrate that they are using highly skilled workers at prevailing wages—a requirement that in practice compels them to hire union contractors. Alexis Gevorgian, a developer, calculates that this can increase costs by as much as 40%, turning affordable housing into a guaranteed loss-making venture. “The expedited reviews themselves are useless unless you get a subsidy from the government,” Mr Gevorgian says. One of the things on the chopping block as California looks to close its budget deficit? About $1bn of funding for affordable housing, including subsidies for developers. California is no failed state. But it certainly is a struggling one.

The rest of the article is interesting. Unemployment in California is above 5%. Unlike the rest of the country, there are more people looking for work than there are unfilled jobs. People, especially the wealthy who are fed up with the taxes, are leaving the state. Income tax collection was down 25% last year. The deficit is on track to hit $78 billion, far higher than the state's earlier $38 billion projection.

California's anti-free market policies seem to be catching up with it.

https://www.economist.com/united-sta...-easy-solution

|

|

Quote

| 1 user liked this post |

04-03-2024, 02:05 PM

04-03-2024, 02:05 PM

|

#1680

|

|

Valued Poster

Join Date: Jan 21, 2011

Location: Bonerville

Posts: 5,963

|

It was my understanding that the pricing of Real estate was part n parcel of the laws of supply and demand. So, not sure that a change in POTUS is the change that would trickle into inventory or demand, as much as a change in loan rates would have a direct impact.

I believe most borrowers and would be purchasers are waiting till rates hit a little lower> those who have to buy will likely refi- and take a small deduction on pricing, but I frankly don't see any reason for a reduction in pricing on sub 20 yr old or new home pricing. The price for builders has not changed substantially and the inventory is so low currently that pricing won't be effective till things flip flop dramatically on that front.

Problem for most municipalities on a low % of sales is that in PA, when a house is bought and sold, there is a transaction tax of 2.2% and I'm betting other states have something similar,. and of course the taxes on properties are usually based on the valuation on sales. NO sales equals no transaction tax, and the tax base stays level- and the local tax role is almost always spending more every year. YOY. I would think that level of stagnation in the market also is not expected and a problem with how local municpalities are paying for ongoing things.

On the other end, the infrastructure money has yet to really hit into the economy locally at our level of the state and local counties. Due to time and tenure for bidding processes and other dragging events.

|

|

Quote

| 1 user liked this post |

|

AMPReviews.net

AMPReviews.net |

Find Ladies

Find Ladies |

Hot Women

Hot Women |

|